Michel Dacorogna, Tail-Dependence an Essential Factor for

Michel Dacorogna, Tail-Dependence an Essential Factor for

Michel Dacorogna, Tail-Dependence an Essential Factor for

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

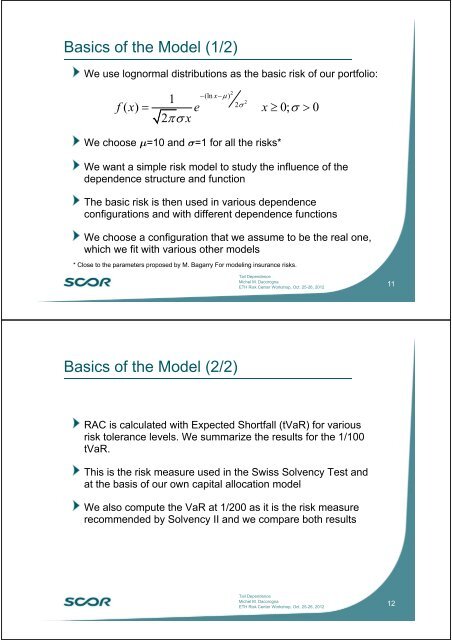

Basics of the Model (1/2)We use lognormal distributions as the basic risk of our portfolio:1f x e x2x2(ln x)22( ) 0; 0We choose m=10 <strong>an</strong>d s=1 <strong>for</strong> all the risks*We w<strong>an</strong>t a simple risk model to study the influence of thedependence structure <strong>an</strong>d functionThe basic risk is then used in various dependenceconfigurations <strong>an</strong>d with different dependence functionsWe choose a configuration that we assume to be the real one,which we fit with various other models* Close to the parameters proposed by M. Bagarry For modeling insur<strong>an</strong>ce risks.<strong>Tail</strong> <strong>Dependence</strong><strong>Michel</strong> M. <strong>Dacorogna</strong>ETH Risk Center Workshop, Oct. 25-26, 201211Basics of the Model (2/2)RAC is calculated with Expected Shortfall (tVaR) <strong>for</strong> variousrisk toler<strong>an</strong>ce levels. We summarize the results <strong>for</strong> the 1/100tVaR.This is the risk measure used in the Swiss Solvency Test <strong>an</strong>dat the basis of our own capital allocation modelWe also compute the VaR at 1/200 as it is the risk measurerecommended by Solvency II <strong>an</strong>d we compare both results<strong>Tail</strong> <strong>Dependence</strong><strong>Michel</strong> M. <strong>Dacorogna</strong>ETH Risk Center Workshop, Oct. 25-26, 201212