Michel Dacorogna, Tail-Dependence an Essential Factor for

Michel Dacorogna, Tail-Dependence an Essential Factor for

Michel Dacorogna, Tail-Dependence an Essential Factor for

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

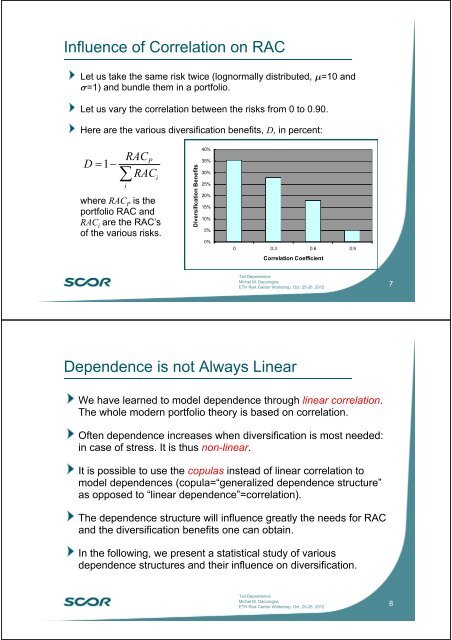

Influence of Correlation on RACLet us take the same risk twice (lognormally distributed, m=10 <strong>an</strong>ds=1) <strong>an</strong>d bundle them in a portfolio.Let us vary the correlation between the risks from 0 to 0.90.Here are the various diversification benefits, D, in percent:RACPD 1 RACwhere RAC P is theportfolio RAC <strong>an</strong>dRAC i are the RAC’sof the various risks.iiDiversification Benefits40%35%30%25%20%15%10%5%0%0 0.3 0.6 0.9Correlation Coefficient<strong>Tail</strong> <strong>Dependence</strong><strong>Michel</strong> M. <strong>Dacorogna</strong>ETH Risk Center Workshop, Oct. 25-26, 20127<strong>Dependence</strong> is not Always LinearWe have learned to model dependence through linear correlation.The whole modern portfolio theory is based on correlation.Often dependence increases when diversification is most needed:in case of stress. It is thus non-linear.It is possible to use the copulas instead of linear correlation tomodel dependences (copula=“generalized dependence structure”as opposed to “linear dependence”=correlation).The dependence structure will influence greatly the needs <strong>for</strong> RAC<strong>an</strong>d the diversification benefits one c<strong>an</strong> obtain.In the following, we present a statistical study of variousdependence structures <strong>an</strong>d their influence on diversification.<strong>Tail</strong> <strong>Dependence</strong><strong>Michel</strong> M. <strong>Dacorogna</strong>ETH Risk Center Workshop, Oct. 25-26, 20128