Aberdeen Global - Hozam Plaza

Aberdeen Global - Hozam Plaza

Aberdeen Global - Hozam Plaza

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

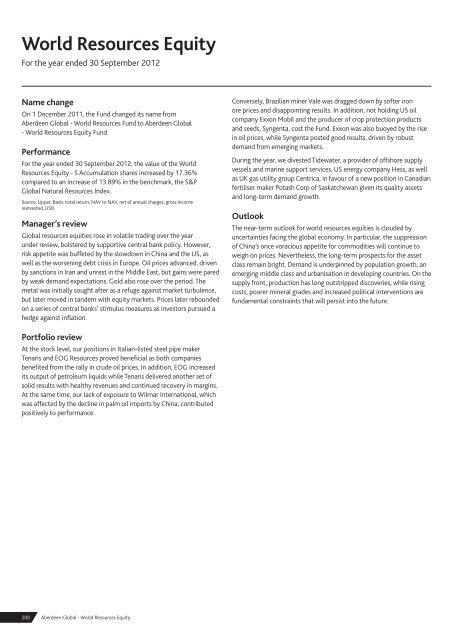

World Resources EquityFor the year ended 30 September 2012Name changeOn 1 December 2011, the Fund changed its name from<strong>Aberdeen</strong> <strong>Global</strong> - World Resources Fund to <strong>Aberdeen</strong> <strong>Global</strong>- World Resources Equity Fund.PerformanceFor the year ended 30 September 2012, the value of the WorldResources Equity - S Accumulation shares increased by 17.36%compared to an increase of 13.89% in the benchmark, the S&P<strong>Global</strong> Natural Resources Index.Source: Lipper, Basis: total return, NAV to NAV, net of annual charges, gross incomereinvested, USD.Manager’s review<strong>Global</strong> resources equities rose in volatile trading over the yearunder review, bolstered by supportive central bank policy. However,risk appetite was buffeted by the slowdown in China and the US, aswell as the worsening debt crisis in Europe. Oil prices advanced, drivenby sanctions in Iran and unrest in the Middle East, but gains were paredby weak demand expectations. Gold also rose over the period. Themetal was initially sought after as a refuge against market turbulence,but later moved in tandem with equity markets. Prices later reboundedon a series of central banks’ stimulus measures as investors pursued ahedge against inflation.Conversely, Brazilian miner Vale was dragged down by softer ironore prices and disappointing results. In addition, not holding US oilcompany Exxon Mobil and the producer of crop protection productsand seeds, Syngenta, cost the Fund. Exxon was also buoyed by the risein oil prices, while Syngenta posted good results, driven by robustdemand from emerging markets.During the year, we divested Tidewater, a provider of offshore supplyvessels and marine support services, US energy company Hess, as wellas UK gas utility group Centrica, in favour of a new position in Canadianfertiliser maker Potash Corp of Saskatchewan given its quality assetsand long-term demand growth.OutlookThe near-term outlook for world resources equities is clouded byuncertainties facing the global economy. In particular, the suppressionof China’s once voracious appetite for commodities will continue toweigh on prices. Nevertheless, the long-term prospects for the assetclass remain bright. Demand is underpinned by population growth, anemerging middle class and urbanisation in developing countries. On thesupply front, production has long outstripped discoveries, while risingcosts, poorer mineral grades and increased political interventions arefundamental constraints that will persist into the future.Portfolio reviewAt the stock level, our positions in Italian-listed steel pipe makerTenaris and EOG Resources proved beneficial as both companiesbenefited from the rally in crude oil prices. In addition, EOG increasedits output of petroleum liquids while Tenaris delivered another set ofsolid results with healthy revenues and continued recovery in margins.At the same time, our lack of exposure to Wilmar International, whichwas affected by the decline in palm oil imports by China, contributedpositively to performance.200 <strong>Aberdeen</strong> <strong>Global</strong> - World Resources Equity