Aberdeen Global - Hozam Plaza

Aberdeen Global - Hozam Plaza

Aberdeen Global - Hozam Plaza

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

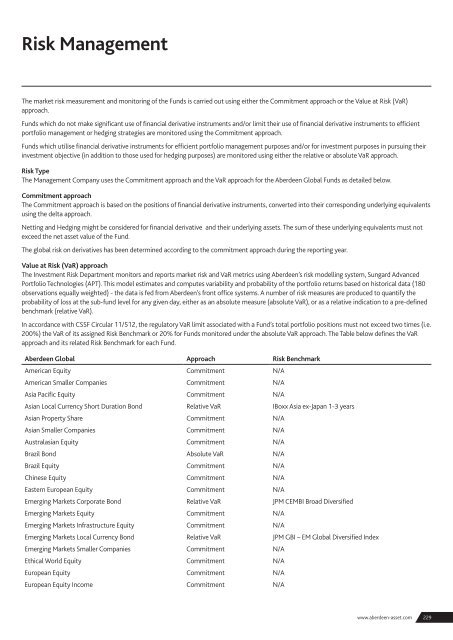

Risk ManagementThe market risk measurement and monitoring of the Funds is carried out using either the Commitment approach or the Value at Risk (VaR)approach.Funds which do not make significant use of financial derivative instruments and/or limit their use of financial derivative instruments to efficientportfolio management or hedging strategies are monitored using the Commitment approach.Funds which utilise financial derivative instruments for efficient portfolio management purposes and/or for investment purposes in pursuing theirinvestment objective (in addition to those used for hedging purposes) are monitored using either the relative or absolute VaR approach.Risk TypeThe Management Company uses the Commitment approach and the VaR approach for the <strong>Aberdeen</strong> <strong>Global</strong> Funds as detailed below.Commitment approachThe Commitment approach is based on the positions of financial derivative instruments, converted into their corresponding underlying equivalentsusing the delta approach.Netting and Hedging might be considered for financial derivative and their underlying assets. The sum of these underlying equivalents must notexceed the net asset value of the Fund.The global risk on derivatives has been determined according to the commitment approach during the reporting year.Value at Risk (VaR) approachThe Investment Risk Department monitors and reports market risk and VaR metrics using <strong>Aberdeen</strong>’s risk modelling system, Sungard AdvancedPortfolio Technologies (APT). This model estimates and computes variability and probability of the portfolio returns based on historical data (180observations equally weighted) - the data is fed from <strong>Aberdeen</strong>’s front office systems. A number of risk measures are produced to quantify theprobability of loss at the sub-fund level for any given day, either as an absolute measure (absolute VaR), or as a relative indication to a pre-definedbenchmark (relative VaR).In accordance with CSSF Circular 11/512, the regulatory VaR limit associated with a Fund’s total portfolio positions must not exceed two times (i.e.200%) the VaR of its assigned Risk Benchmark or 20% for Funds monitored under the absolute VaR approach. The Table below defines the VaRapproach and its related Risk Benchmark for each Fund.<strong>Aberdeen</strong> <strong>Global</strong> Approach Risk BenchmarkAmerican Equity Commitment N/AAmerican Smaller Companies Commitment N/AAsia Pacific Equity Commitment N/AAsian Local Currency Short Duration Bond Relative VaR IBoxx Asia ex-Japan 1-3 yearsAsian Property Share Commitment N/AAsian Smaller Companies Commitment N/AAustralasian Equity Commitment N/ABrazil Bond Absolute VaR N/ABrazil Equity Commitment N/AChinese Equity Commitment N/AEastern European Equity Commitment N/AEmerging Markets Corporate Bond Relative VaR JPM CEMBI Broad DiversifiedEmerging Markets Equity Commitment N/AEmerging Markets Infrastructure Equity Commitment N/AEmerging Markets Local Currency Bond Relative VaR JPM GBI – EM <strong>Global</strong> Diversified IndexEmerging Markets Smaller Companies Commitment N/AEthical World Equity Commitment N/AEuropean Equity Commitment N/AEuropean Equity Income Commitment N/Awww.aberdeen-asset.com229