Annual Report 2010 - Scana Industrier ASA

Annual Report 2010 - Scana Industrier ASA

Annual Report 2010 - Scana Industrier ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

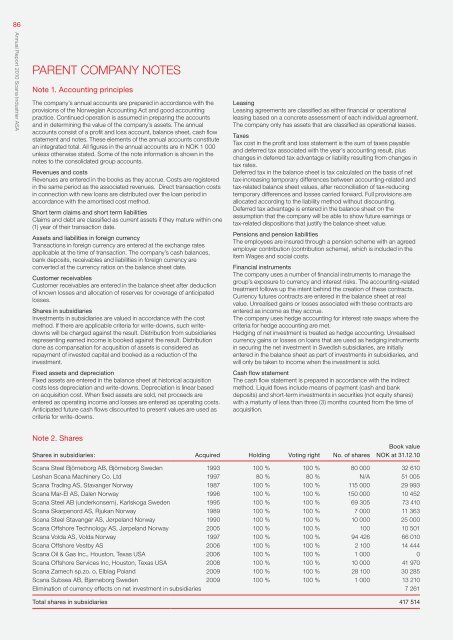

86<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>parent company NotesNote 1. Accounting principlesThe company’s annual accounts are prepared in accordance with theprovisions of the Norwegian Accounting Act and good accountingpractice. Continued operation is assumed in preparing the accountsand in determining the value of the company’s assets. The annualaccounts consist of a profit and loss account, balance sheet, cash flowstatement and notes. These elements of the annual accounts constitutean integrated total. All figures in the annual accounts are in NOK 1 000unless otherwise stated. Some of the note information is shown in thenotes to the consolidated group accounts.Revenues and costsRevenues are entered in the books as they accrue. Costs are registeredin the same period as the associated revenues. Direct transaction costsin connection with new loans are distributed over the loan period inaccordance with the amortised cost method.Short term claims and short term liabilitiesClaims and debt are classified as current assets if they mature within one(1) year of their transaction date.Assets and liabilities in foreign currencyTransactions in foreign currency are entered at the exchange ratesapplicable at the time of transaction. The company’s cash balances,bank deposits, receivables and liabilities in foreign currency areconverted at the currency ratios on the balance sheet date.Customer receivablesCustomer receivables are entered in the balance sheet after deductionof known losses and allocation of reserves for coverage of anticipatedlosses.Shares in subsidiariesInvestments in subsidiaries are valued in accordance with the costmethod. If there are applicable criteria for write-downs, such writedownswill be charged against the result. Distribution from subsidiariesrepresenting earned income is booked against the result. Distributiondone as compansation for acqusition of assets is considered asrepayment of invested capital and booked as a reduction of theinvestment.Fixed assets and depreciationFixed assets are entered in the balance sheet at historical acquisitioncosts less depreciation and write-downs. Depreciation is linear basedon acquisition cost. When fixed assets are sold, net proceeds areentered as operating income and losses are entered as operating costs.Anticipated future cash flows discounted to present values are used ascriteria for write-downs.LeasingLeasing agreements are classified as either financial or operationalleasing based on a concrete assessment of each individual agreement.The company only has assets that are classified as operational leases.TaxesTax cost in the profit and loss statement is the sum of taxes payableand deferred tax associated with the year’s accounting result, pluschanges in deferred tax advantage or liability resulting from changes intax rates.Deferred tax in the balance sheet is tax calculated on the basis of nettax-increasing temporary differences between accounting-related andtax-related balance sheet values, after reconciliation of tax-reducingtemporary differences and losses carried forward. Full provisions areallocated according to the liability method without discounting.Deferred tax advantage is entered in the balance sheet on theassumption that the company will be able to show future earnings ortax-related dispositions that justify the balance sheet value.Pensions and pension liabilitiesThe employees are insured through a pension scheme with an agreedemployer contribution (contribution scheme), which is included in theitem Wages and social costs.Financial instrumentsThe company uses a number of financial instruments to manage thegroup’s exposure to currency and interest risks. The accounting-relatedtreatment follows up the intent behind the creation of these contracts.Currency futures contracts are entered in the balance sheet at realvalue. Unrealised gains or losses associated with these contracts areentered as income as they accrue.The company uses hedge accounting for interest rate swaps where thecriteria for hedge accounting are met.Hedging of net investment is treated as hedge accounting. Unrealisedcurrency gains or losses on loans that are used as hedging instrumentsin securing the net investment in Swedish subsidiaries, are initiallyentered in the balance sheet as part of investments in subsidiaries, andwill only be taken to income when the investment is sold.Cash flow statementThe cash flow statement is prepared in accordance with the indirectmethod. Liquid flows include means of payment (cash and bankdeposits) and short-term investments in securities (not equity shares)with a maturity of less than three (3) months counted from the time ofacquisition.Note 2. SharesBook valueShares in subsidiaries: Acquired Holding Voting right No. of shares NOK at 31.12.10<strong>Scana</strong> Steel Björneborg AB, Björneborg Sweden 1993 100 % 100 % 80 000 32 610Leshan <strong>Scana</strong> Machinery Co. Ltd 1997 80 % 80 % N/A 51 005<strong>Scana</strong> Trading AS, Stavanger Norway 1987 100 % 100 % 115 000 29 993<strong>Scana</strong> Mar-El AS, Dalen Norway 1996 100 % 100 % 150 000 10 452<strong>Scana</strong> Steel AB (underkonsern), Karlskoga Sweden 1995 100 % 100 % 69 305 73 410<strong>Scana</strong> Skarpenord AS, Rjukan Norway 1989 100 % 100 % 7 000 11 363<strong>Scana</strong> Steel Stavanger AS, Jørpeland Norway 1990 100 % 100 % 10 000 25 000<strong>Scana</strong> Offshore Technology AS, Jørpeland Norway 2005 100 % 100 % 100 10 501<strong>Scana</strong> Volda AS, Volda Norway 1997 100 % 100 % 94 426 66 010<strong>Scana</strong> Offshore Vestby AS 2006 100 % 100 % 2 100 14 444<strong>Scana</strong> Oil & Gas Inc., Houston, Texas USA 2006 100 % 100 % 1 000 0<strong>Scana</strong> Offshore Services Inc, Houston, Texas USA 2008 100 % 100 % 10 000 41 970<strong>Scana</strong> Zamech sp.zo. o, Elblag Poland 2009 100 % 100 % 28 100 30 285<strong>Scana</strong> Subsea AB, Bjørneborg Sweden 2009 100 % 100 % 1 000 13 210Elimination of currency effects on net investment in subsidiaries 7 261Total shares in subsidiaries 417 514