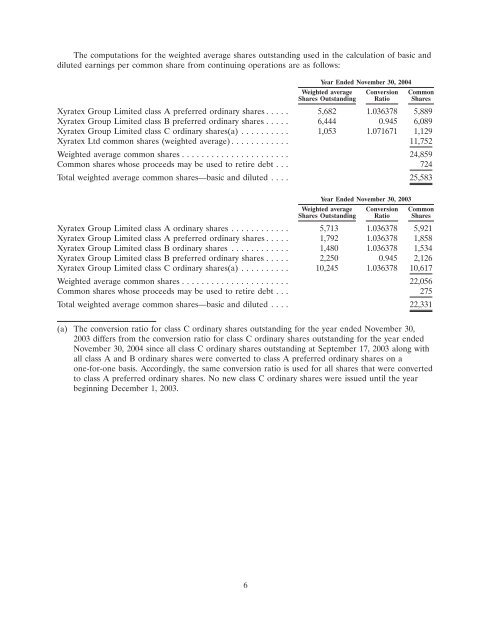

The computations for the weighted average shares outstanding used in the calculation of basic anddiluted earnings per common share from continuing operations are as follows:Year Ended November 30, 2004Weighted average Conversion CommonShares Outstanding Ratio Shares<strong>Xyratex</strong> Group Limited class A preferred ordinary shares ..... 5,682 1.036378 5,889<strong>Xyratex</strong> Group Limited class B preferred ordinary shares ..... 6,444 0.945 6,089<strong>Xyratex</strong> Group Limited class C ordinary shares(a) .......... 1,053 1.071671 1,129<strong>Xyratex</strong> Ltd common shares (weighted average) ............ 11,752Weighted average common shares ...................... 24,859Common shares whose proceeds may be used to retire debt . . . 724Total weighted average common shares—basic and diluted .... 25,583Year Ended November 30, 2003Weighted average Conversion CommonShares Outstanding Ratio Shares<strong>Xyratex</strong> Group Limited class A ordinary shares ............ 5,713 1.036378 5,921<strong>Xyratex</strong> Group Limited class A preferred ordinary shares ..... 1,792 1.036378 1,858<strong>Xyratex</strong> Group Limited class B ordinary shares ............ 1,480 1.036378 1,534<strong>Xyratex</strong> Group Limited class B preferred ordinary shares ..... 2,250 0.945 2,126<strong>Xyratex</strong> Group Limited class C ordinary shares(a) .......... 10,245 1.036378 10,617Weighted average common shares ...................... 22,056Common shares whose proceeds may be used to retire debt . . . 275Total weighted average common shares—basic and diluted .... 22,331(a) The conversion ratio for class C ordinary shares outstanding for the year ended November 30,2003 differs from the conversion ratio for class C ordinary shares outstanding for the year endedNovember 30, 2004 since all class C ordinary shares outstanding at September 17, 2003 along withall class A and B ordinary shares were converted to class A preferred ordinary shares on aone-for-one basis. Accordingly, the same conversion ratio is used for all shares that were convertedto class A preferred ordinary shares. No new class C ordinary shares were issued until the yearbeginning December 1, 2003.6

As of November 30,2005 2004 2003 2002 2001(U.S. dollars in thousands)Consolidated Balance Sheet Data:Cash and cash equivalents ................. $ 41,240 $ 63,495 $ 2,008 $ 455 $ 694Working capital ......................... 74,284 90,847 14,275 7,351 5,880Total assets ............................ 301,290 205,242 111,271 76,663 64,739Short-term borrowings and current portionacquisition note payable ................. 7,000 6,000 4,133 4,763 5,081Long-term debt and acquisition note payable, netof current portion ..................... 7,000 11,000 15,000 7,850 7,112Total debt ............................. 14,000 17,000 19,133 12,613 12,193Total shareholders’ equity .................. $161,382 $116,701 $ 19,001 $ 8,962 $ 8,636Number of shares issued and outstanding:Common shares ......................... 28,437 28,043 — — —Class B preferred ordinary shares ............ — — 11,099 — —Class A preferred ordinary shares ............ — — 8,845 — —Class A ordinary shares ................... — — — 7,166 7,579Class B ordinary shares ................... — — — 1,856 1,856Class C ordinary shares ................... — — — 12,850 13,479Item 3B: Capitalization and IndebtednessNot applicable.Item 3C: Reason for the Offer and Use of ProceedsNot applicable.Item 3D: Risk FactorsThe key risks relating to our business and industry are included below. Additional risks of whichwe are presently not aware or that we currently deem immaterial may also impair our business.Sales to a small number of customers represent a substantial portion of our revenues. The loss of anymajor customers could significantly harm our financial condition.We derive a substantial portion of our revenues from a relatively small number of customers. Ourtop customers by revenue are Network Appliance, Seagate Technology and Western Digital. In our2005 fiscal year, sales to these customers accounted for 48%, 30% and 7% of our revenues,respectively. In our 2004 fiscal year these customers accounted for 53%, 24% and 5% of our revenues,respectively. It is likely that a small number of customers will continue to account for a substantialportion of our revenues in the future. If we were to lose one of our major customers, experience anymaterial reduction in orders from any of these customers or experience a deterioration in ourrelationships with these customers, our financial condition could be significantly harmed.Our customers operate in an industry that experiences frequent volatility. If any of our topcustomers were to suffer financial difficulties, whether as a result of downturns in the markets in whichthey operate or otherwise, our financial condition could be significantly harmed.7

- Page 3: XYRATEX LTDANNUAL REPORT FOR THE YE

- Page 6 and 7: INTRODUCTIONWe are incorporated und

- Page 8 and 9: Year Ended November 30,2005 2004 20

- Page 12 and 13: The markets in which we operate are

- Page 14 and 15: technological capabilities. This co

- Page 16 and 17: may cease production of components,

- Page 18 and 19: • potentially adverse tax consequ

- Page 20 and 21: We could incur substantial costs, i

- Page 22 and 23: influence by voting at a meeting of

- Page 24 and 25: Xyratex Ltd to the former sharehold

- Page 26 and 27: In addition to the rapid growth of

- Page 28 and 29: RAID controller technology is proje

- Page 30 and 31: Our Competitive StrengthsDisk drive

- Page 32 and 33: the storage subsystem and disk driv

- Page 34 and 35: Our storage subsystems are internal

- Page 36 and 37: systems are capable of testing a fu

- Page 38 and 39: Research and DevelopmentWe have ove

- Page 40 and 41: • sets forth procedures for the p

- Page 42 and 43: Item 4C: Organization StructureXyra

- Page 44 and 45: ecame the parent company of our bus

- Page 46 and 47: Foreign Exchange Rate FluctuationsT

- Page 48 and 49: we recorded in the year ended Novem

- Page 50 and 51: Fiscal Year Ended November 30, 2005

- Page 52 and 53: Research and Development—otherThe

- Page 54 and 55: Fiscal Year Ended November 30, 2004

- Page 56 and 57: Selling, General and Administrative

- Page 58 and 59: Quarterly Results of OperationsThe

- Page 60 and 61:

sales growth. The increase in defer

- Page 62 and 63:

choose to make or alliances we have

- Page 64 and 65:

compete. Identifiable intangible as

- Page 66 and 67:

ITEM 6: DIRECTORS, SENIOR MANAGEMEN

- Page 68 and 69:

Ernest Sampias has served as a dire

- Page 70 and 71:

Audit CommitteeOur Audit Committee

- Page 72 and 73:

Employee Benefit/Share Option Plans

- Page 74 and 75:

The maximum amount that any partici

- Page 76 and 77:

Restricted StockRestricted stock aw

- Page 78 and 79:

the options, warrants or rights, bu

- Page 80 and 81:

Quarterly high and low market price

- Page 82 and 83:

whose functional currency is not th

- Page 84 and 85:

on the Nasdaq National Market and,

- Page 86 and 87:

Interest RatesWe had cash and cash

- Page 88 and 89:

aggregate in any fiscal year and th

- Page 90 and 91:

(This page has been left blank inte

- Page 92 and 93:

XYRATEX LTDAUDITED CONSOLIDATED BAL

- Page 94 and 95:

F-4XYRATEX LTDAUDITED CONSOLIDATED

- Page 96 and 97:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 98 and 99:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 100 and 101:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 102 and 103:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 104 and 105:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 106 and 107:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 108 and 109:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 110 and 111:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 112 and 113:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 114 and 115:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 116 and 117:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 118 and 119:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 120 and 121:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 122 and 123:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 124 and 125:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 126 and 127:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 128 and 129:

XYRATEX LTDNOTES TO AUDITED CONSOLI

- Page 130:

(This page has been left blank inte