Download Annual Report, 2.44 MB - Xyratex

Download Annual Report, 2.44 MB - Xyratex

Download Annual Report, 2.44 MB - Xyratex

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

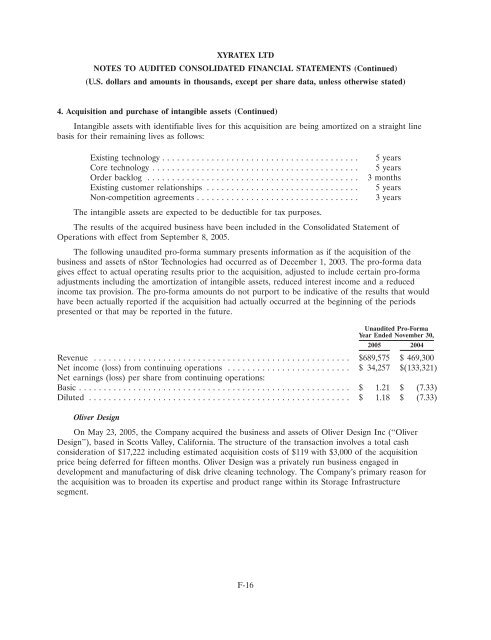

XYRATEX LTDNOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)(U.S. dollars and amounts in thousands, except per share data, unless otherwise stated)4. Acquisition and purchase of intangible assets (Continued)Intangible assets with identifiable lives for this acquisition are being amortized on a straight linebasis for their remaining lives as follows:Existing technology ........................................ 5 yearsCore technology .......................................... 5 yearsOrder backlog ........................................... 3 monthsExisting customer relationships ............................... 5 yearsNon-competition agreements ................................. 3 yearsThe intangible assets are expected to be deductible for tax purposes.The results of the acquired business have been included in the Consolidated Statement ofOperations with effect from September 8, 2005.The following unaudited pro-forma summary presents information as if the acquisition of thebusiness and assets of nStor Technologies had occurred as of December 1, 2003. The pro-forma datagives effect to actual operating results prior to the acquisition, adjusted to include certain pro-formaadjustments including the amortization of intangible assets, reduced interest income and a reducedincome tax provision. The pro-forma amounts do not purport to be indicative of the results that wouldhave been actually reported if the acquisition had actually occurred at the beginning of the periodspresented or that may be reported in the future.Unaudited Pro-FormaYear Ended November 30,2005 2004Revenue .................................................... $689,575 $ 469,300Net income (loss) from continuing operations ......................... $ 34,257 $(133,321)Net earnings (loss) per share from continuing operations:Basic ....................................................... $ 1.21 $ (7.33)Diluted ..................................................... $ 1.18 $ (7.33)Oliver DesignOn May 23, 2005, the Company acquired the business and assets of Oliver Design Inc (‘‘OliverDesign’’), based in Scotts Valley, California. The structure of the transaction involves a total cashconsideration of $17,222 including estimated acquisition costs of $119 with $3,000 of the acquisitionprice being deferred for fifteen months. Oliver Design was a privately run business engaged indevelopment and manufacturing of disk drive cleaning technology. The Company’s primary reason forthe acquisition was to broaden its expertise and product range within its Storage Infrastructuresegment.F-16