40 NOBEL BIOCARE ANNUAL REPORT <strong>2003</strong>Significant accounting policies<strong>Nobel</strong> <strong>Biocare</strong> Holding AG (the Company) is a company domiciledin Switzerland. The consolidated financial statements of theCompany for the year ended 31 December <strong>2003</strong> comprise theCompany and its subsidiaries and associate (the Group). The<strong>Nobel</strong> <strong>Biocare</strong> Holding Group is an innovative, medical devicesgroup and the world leader in innovative esthetic dental solutionswith its brands Brånemark System ® , Replace ® Select (dentalimplants) and Procera ® (individualized prosthetics).Formation of a new GroupIn April 2002, the Board of Directors of <strong>Nobel</strong> <strong>Biocare</strong> AB, theformer parent company of the Group, announced a decision toundergo a change of domicile from Sweden to Switzerland. Dueto legal and tax reasons, a direct change of domicile of <strong>Nobel</strong><strong>Biocare</strong> AB to Switzerland was not feasible. Therefore, a new Swisscompany named <strong>Nobel</strong> <strong>Biocare</strong> Holding AG was incorporated inSwitzerland.In May 2002, <strong>Nobel</strong> <strong>Biocare</strong> Holding AG launched a publicoffer to the shareholders of <strong>Nobel</strong> <strong>Biocare</strong> AB. 94.6 percent of allthe shares in <strong>Nobel</strong> <strong>Biocare</strong> AB were exchanged. <strong>Nobel</strong> <strong>Biocare</strong>Holding AG acquired an additional 4.3 percent of the shares in<strong>Nobel</strong> <strong>Biocare</strong> AB during a prolonged offering period announcedin June 2002. The <strong>Nobel</strong> <strong>Biocare</strong> Holding Group intends toacquire the remaining 1.1 percent of the shares in a compulsorypurchase procedure. In June 2002, <strong>Nobel</strong> <strong>Biocare</strong> Holding AGwas listed on the SWX Swiss Exchange.<strong>Nobel</strong> <strong>Biocare</strong> Holding AG incorporated the majority of the netassets of the former <strong>Nobel</strong> <strong>Biocare</strong> AB at book value. A valuationof the net assets at book value was deemed to present a true andfair view of the transaction, as there was basically not a changein ownership or cash involved in the transaction. However, theshares that the <strong>Nobel</strong> <strong>Biocare</strong> Holding Group will acquire in thecompulsory purchase procedure will be settled in cash. Therefore,a 1.1 percent of the net assets, relating to the sharesacquired in the compulsory purchase procedure, will be recognizedat fair value.Statement of complianceThe consolidated financial statements are prepared in accordancewith International Financial <strong>Report</strong>ing Standards (IFRSs)and comply with Swiss law. IFRS was applied in full for the firsttime in the 2002 consolidated financial statements.Basis of preparationThe consolidated financial statements are presented in EUR,rounded to the nearest thousand. Although the parent companyis domiciled in Switzerland, the consolidated financial statementsare presented in EUR since the Group’s cash in-flow to a largeextent is in EUR. The subsidiaries prepare their individual financialstatements using the measurement currency in their respectivecountry. The consolidated financial statements are prepared onthe historical cost basis except that the derivative financialinstruments are stated at their fair value.Basis of consolidationSubsidiariesSubsidiaries are companies controlled by <strong>Nobel</strong> <strong>Biocare</strong> HoldingAG. Control exists when the Company has the power, directly orindirectly, to govern the financial and operating policies of acompany so as to obtain benefits from its activities. Subsidiaries areincluded in the consolidated financial statements from the date thecontrol effectively commences until the date control ceases.According to the full consolidation method, all assets andliabilities as well as income and expenses of the subsidiaries areincluded in the consolidated financial statements. The share ofminority shareholders in the net assets and results is presentedseparately as minority interests in the consolidated balancesheet and income statement, respectively.AssociatesAssociates are companies where the Group is able to exercisesignificant influence, but not control, over the financial andoperating policies.The consolidated financial statements include the Group'sshare of the total recognized gains and losses of associates on anequity accounting basis, from the date significant influencecommences until the date it ceases. When the Group’s share oflosses exceeds the carrying amount of the associate, the carryingamount is reduced to nil and recognition of further losses isdiscontinued except to the extent that the Group has incurredobligations in respect of the associate.Transactions eliminated on consolidationIntra-group balances and transactions, and any unrealized gainsand losses arising from intra-group transactions, are eliminatedin preparing the consolidated financial statements.Foreign currencyForeign currency transactionsTransactions in foreign currencies are translated at the foreignexchange rate at the date of the transaction. Monetary assetsand liabilities in foreign currencies are translated at the foreignexchange rate at the balance sheet date. Non-monetary assetsand liabilities in foreign currencies that are stated at historicalcost are translated at the foreign exchange rate at the date ofthe transaction. Non-monetary assets and liabilities in foreigncurrencies that are stated at fair value are translated at theforeign exchange rate at the date the values were determined.Foreign exchange differences arising on translation arerecognized in the income statement. Foreign exchange ratedifferences relating to financial assets and liabilities are recognizedas financial income or expenses, while foreign exchange ratedifferences relating to assets and liabilities of an operating natureare recognized in profit from operations.Financial statements of foreign operationsThe Group’s foreign operations are considered as not beingintegral to <strong>Nobel</strong> <strong>Biocare</strong> Holding AG's operations. Assets andliabilities of the foreign operations, including goodwill, are translatedat the foreign exchange rates at the balance sheet date.The revenues and expenses of foreign operations, are translatedat rates approximating the foreign exchange rates at the dates ofthe transactions.Foreign exchange differences arising on translation of foreignoperations are recognized directly in equity in the translationreserve. If a loan is made to a foreign operation and the loan insubstance forms part of the Group's investment in the foreignoperation, foreign exchange differences arising on the loan are

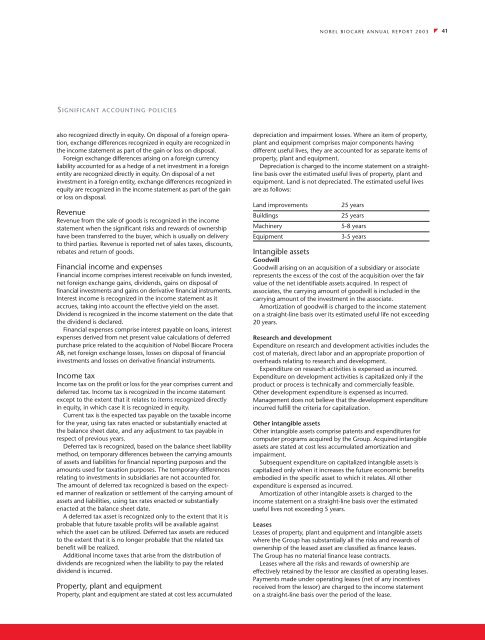

NOBEL BIOCARE ANNUAL REPORT <strong>2003</strong>41SIGNIFICANT ACCOUNTING POLICIESalso recognized directly in equity. On disposal of a foreign operation,exchange differences recognized in equity are recognized inthe income statement as part of the gain or loss on disposal.Foreign exchange differences arising on a foreign currencyliability accounted for as a hedge of a net investment in a foreignentity are recognized directly in equity. On disposal of a netinvestment in a foreign entity, exchange differences recognized inequity are recognized in the income statement as part of the gainor loss on disposal.RevenueRevenue from the sale of goods is recognized in the incomestatement when the significant risks and rewards of ownershiphave been transferred to the buyer, which is usually on deliveryto third parties. Revenue is reported net of sales taxes, discounts,rebates and return of goods.Financial income and expensesFinancial income comprises interest receivable on funds invested,net foreign exchange gains, dividends, gains on disposal offinancial investments and gains on derivative financial instruments.Interest income is recognized in the income statement as itaccrues, taking into account the effective yield on the asset.Dividend is recognized in the income statement on the date thatthe dividend is declared.Financial expenses comprise interest payable on loans, interestexpenses derived from net present value calculations of deferredpurchase price related to the acquisition of <strong>Nobel</strong> <strong>Biocare</strong> ProceraAB, net foreign exchange losses, losses on disposal of financialinvestments and losses on derivative financial instruments.Income taxIncome tax on the profit or loss for the year comprises current anddeferred tax. Income tax is recognized in the income statementexcept to the extent that it relates to items recognized directlyin equity, in which case it is recognized in equity.Current tax is the expected tax payable on the taxable incomefor the year, using tax rates enacted or substantially enacted atthe balance sheet date, and any adjustment to tax payable inrespect of previous years.Deferred tax is recognized, based on the balance sheet liabilitymethod, on temporary differences between the carrying amountsof assets and liabilities for financial reporting purposes and theamounts used for taxation purposes. The temporary differencesrelating to investments in subsidiaries are not accounted for.The amount of deferred tax recognized is based on the expectedmanner of realization or settlement of the carrying amount ofassets and liabilities, using tax rates enacted or substantiallyenacted at the balance sheet date.A deferred tax asset is recognized only to the extent that it isprobable that future taxable profits will be available againstwhich the asset can be utilized. Deferred tax assets are reducedto the extent that it is no longer probable that the related taxbenefit will be realized.Additional income taxes that arise from the distribution ofdividends are recognized when the liability to pay the relateddividend is incurred.Property, plant and equipmentProperty, plant and equipment are stated at cost less accumulateddepreciation and impairment losses. Where an item of property,plant and equipment comprises major components havingdifferent useful lives, they are accounted for as separate items ofproperty, plant and equipment.Depreciation is charged to the income statement on a straightlinebasis over the estimated useful lives of property, plant andequipment. Land is not depreciated. The estimated useful livesare as follows:Land improvementsBuildingsMachineryEquipment25 years25 years5-8 years3-5 yearsIntangible assetsGoodwillGoodwill arising on an acquisition of a subsidiary or associaterepresents the excess of the cost of the acquisition over the fairvalue of the net identifiable assets acquired. In respect ofassociates, the carrying amount of goodwill is included in thecarrying amount of the investment in the associate.Amortization of goodwill is charged to the income statementon a straight-line basis over its estimated useful life not exceeding20 years.Research and developmentExpenditure on research and development activities includes thecost of materials, direct labor and an appropriate proportion ofoverheads relating to research and development.Expenditure on research activities is expensed as incurred.Expenditure on development activities is capitalized only if theproduct or process is technically and commercially feasible.Other development expenditure is expensed as incurred.Management does not believe that the development expenditureincurred fulfill the criteria for capitalization.Other intangible assetsOther intangible assets comprise patents and expenditures forcomputer programs acquired by the Group. Acquired intangibleassets are stated at cost less accumulated amortization andimpairment.Subsequent expenditure on capitalized intangible assets iscapitalized only when it increases the future economic benefitsembodied in the specific asset to which it relates. All otherexpenditure is expensed as incurred.Amortization of other intangible assets is charged to theincome statement on a straight-line basis over the estimateduseful lives not exceeding 5 years.LeasesLeases of property, plant and equipment and intangible assetswhere the Group has substantially all the risks and rewards ofownership of the leased asset are classified as finance leases.The Group has no material finance lease contracts.Leases where all the risks and rewards of ownership areeffectively retained by the lessor are classified as operating leases.Payments made under operating leases (net of any incentivesreceived from the lessor) are charged to the income statementon a straight-line basis over the period of the lease.