48 NOBEL BIOCARE ANNUAL REPORT <strong>2003</strong>NOTESContributions for pension insurance insured with Alecta (only theSwedish entities) amount to EUR 456 K, of which EUR 439 K pertainsto retirement pension and family pension, and is included among“Personnel expenses” in the income statement. The Group is of theopinion that current premiums should cover current commitmentsbut, however, there is a certain premium shortfall pertaining topremiums for past periods due to changes in salaries.The obligations for defined benefit plans in the Netherlands, Japanand Italy are not material, see Significant accounting policies page43, why the detailed disclosures required by IAS 19 are not given.NOTE 21 Deferred tax assets and liabilitiesDeferred tax assets and liabilities are attributable to the following items:in EUR'000 Assets Liabilities Net<strong>2003</strong> 2002 <strong>2003</strong> 2002 <strong>2003</strong> 2002Inventories 4 732 4 396 - - 4 732 4 396Tax losses carriedforward - 262 - - - 262Other temporarydifferences 4 422 1 194 7 396 2 648 -2 974 -1 454Tax assets/liabilities 9 154 5 852 7 396 2 648 1 758 3 204Net tax assets 1 758 3 204The Group has not recognized deferred tax assets in respect of thefollowing items:in EUR'000 <strong>2003</strong> 2002Tax losses carried forward 1 820 2 660Total unrecognized deferred tax assets 1 820 2 660The unrecognized deferred tax assets will expire during the years2004–2007.For <strong>2003</strong>, current tax of EUR 166 K related to fair value changeson cash flow hedging instruments included in the hedging reserve isbooked directly in equity.NOTE 22 Trade payablesin EUR'000 <strong>2003</strong> 2002Trade payables– to third parties 9 057 13 761Total trade payables 9 057 13 761NOTE 23 Accrued expenses anddeferred incomein EUR'000 <strong>2003</strong> 2002Personnel-related costs 15 571 14 645Accrued selling expenses 3 072 2 365Accrued legal expenses 1 004 1 075Accrued royalties 828 752Derivative liabilities 425 230Accrued R&D expenses 177 226Accrued interest expenses 33 1 337Other items 1 739 1 723Total accrued expenses and deferred income 22 849 22 353NOTE 24 Operating leasesNon-cancellable operating lease rentals are payable as follows:in EUR'000 <strong>2003</strong> 2002Less than one year 5 443 4 454Between one and five years 8 630 7 437More than five years 1 429 899Total operating lease liabilities 15 502 12 790During the year ended 31 December <strong>2003</strong>, EUR 6 388 K wasexpensed in the income statement in respect of operating leases(2002: EUR 5 790 K).NOTE 25 ContingenciesPledged assetsin EUR'000 <strong>2003</strong> 2002Cash and cash equivalents 20 238 1 618Total pledged assets 20 238 1 618Contingent liabilitiesin EUR'000 <strong>2003</strong> 2002Contingent liabilities 254 792Total contingent liabilities 254 792Ongoing disputesThere are a few minor ongoing lawsuits and claims arising from theordinary business of the Group pending against companies of the<strong>Nobel</strong> <strong>Biocare</strong> Holding Group. In the opinion of the management,and based on current information, the handling, settlement or outcomeof these law suits and claims will have no adverse material effectupon the consolidated financial position or operation of the Group.During December <strong>2003</strong>, <strong>Nobel</strong> <strong>Biocare</strong> settled its patent litigationagainst VP Intellectual Properties with a one-time worldwide settlementamount. During <strong>2003</strong>, <strong>Nobel</strong> <strong>Biocare</strong> also settled the lawsuit inGermany with a one-time settlement amount.On 3 March 2004, <strong>Nobel</strong> <strong>Biocare</strong> received a positive ruling on thearbitration in the US of a patent concerning internal connections. Thearbiters ruled that none of the <strong>Nobel</strong> <strong>Biocare</strong> products with an internalconnection infringes the patent owned by Zimmer, Inc. (formerlyCenterpulse Dental).In previous decisions the arbiters ruled that <strong>Nobel</strong> <strong>Biocare</strong> may not,for contractual reasons, challenge the validity of the patent, however,had decided that the Brånemark System Stargrip implant does notinfringe the patent. The final hearing of the arbitration was limited todetermine if the Replace Select implant infringes the patent, which thepanel now has ruled it does not.The ruling of the arbiters is final and binding. The only remainingdecision from the panel relates to the legal fees to be awarded to<strong>Nobel</strong> <strong>Biocare</strong>.In the matter of the compulsory redemption proceedings for the 1.1%minority in <strong>Nobel</strong> <strong>Biocare</strong> AB, the arbitration panel has recently issueda ruling for the immediate ownership of the minority shares againsta bank guarantee. The arbitration will continue and, unless the partiescan agree on an amicable solution, is expected to take anadditional 1–2 years before the final purchase price is decided uponby the panel.

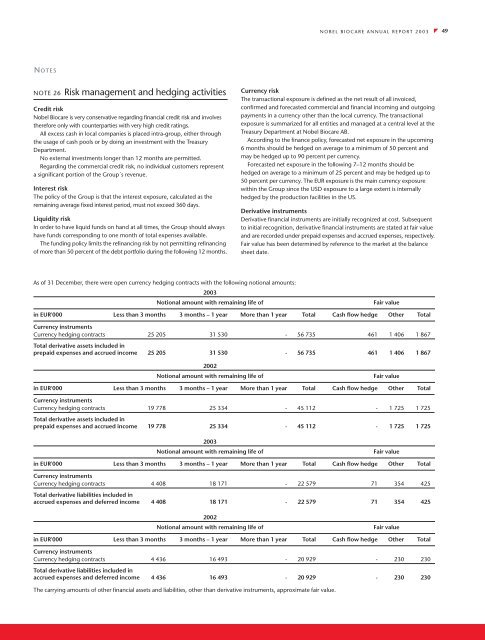

NOBEL BIOCARE ANNUAL REPORT <strong>2003</strong>49NOTESNOTE 26 Risk management and hedging activitiesCredit risk<strong>Nobel</strong> <strong>Biocare</strong> is very conservative regarding financial credit risk and involvestherefore only with counterparties with very high credit ratings.All excess cash in local companies is placed intra-group, either throughthe usage of cash pools or by doing an investment with the TreasuryDepartment.No external investments longer than 12 months are permitted.Regarding the commercial credit risk, no individual customers representa significant portion of the Group´s revenue.Interest riskThe policy of the Group is that the interest exposure, calculated as theremaining average fixed interest period, must not exceed 360 days.Liquidity riskIn order to have liquid funds on hand at all times, the Group should alwayshave funds corresponding to one month of total expenses available.The funding policy limits the refinancing risk by not permitting refinancingof more than 50 percent of the debt portfolio during the following 12 months.Currency riskThe transactional exposure is defined as the net result of all invoiced,confirmed and forecasted commercial and financial incoming and outgoingpayments in a currency other than the local currency. The transactionalexposure is summarized for all entities and managed at a central level at theTreasury Department at <strong>Nobel</strong> <strong>Biocare</strong> AB.According to the finance policy, forecasted net exposure in the upcoming6 months should be hedged on average to a minimum of 50 percent andmay be hedged up to 90 percent per currency.Forecasted net exposure in the following 7–12 months should behedged on average to a minimum of 25 percent and may be hedged up to50 percent per currency. The EUR exposure is the main currency exposurewithin the Group since the USD exposure to a large extent is internallyhedged by the production facilities in the US.Derivative instrumentsDerivative financial instruments are initially recognized at cost. Subsequentto initial recognition, derivative financial instruments are stated at fair valueand are recorded under prepaid expenses and accrued expenses, respectively.Fair value has been determined by reference to the market at the balancesheet date.As of 31 December, there were open currency hedging contracts with the following notional amounts:<strong>2003</strong>Notional amount with remaining life ofFair valuein EUR'000 Less than 3 months 3 months – 1 year More than 1 year Total Cash flow hedge Other TotalCurrency instrumentsCurrency hedging contracts 25 205 31 530 - 56 735 461 1 406 1 867Total derivative assets included inprepaid expenses and accrued income 25 205 31 530 - 56 735 461 1 406 1 8672002Notional amount with remaining life ofFair valuein EUR'000 Less than 3 months 3 months – 1 year More than 1 year Total Cash flow hedge Other TotalCurrency instrumentsCurrency hedging contracts 19 778 25 334 - 45 112 - 1 725 1 725Total derivative assets included inprepaid expenses and accrued income 19 778 25 334 - 45 112 - 1 725 1 725<strong>2003</strong>Notional amount with remaining life ofFair valuein EUR'000 Less than 3 months 3 months – 1 year More than 1 year Total Cash flow hedge Other TotalCurrency instrumentsCurrency hedging contracts 4 408 18 171 - 22 579 71 354 425Total derivative liabilities included inaccrued expenses and deferred income 4 408 18 171 - 22 579 71 354 4252002Notional amount with remaining life ofFair valuein EUR'000 Less than 3 months 3 months – 1 year More than 1 year Total Cash flow hedge Other TotalCurrency instrumentsCurrency hedging contracts 4 436 16 493 - 20 929 - 230 230Total derivative liabilities included inaccrued expenses and deferred income 4 436 16 493 - 20 929 - 230 230The carrying amounts of other financial assets and liabilities, other than derivative instruments, approximate fair value.