Annual Report 2003 - Nobel Biocare Corporate

Annual Report 2003 - Nobel Biocare Corporate

Annual Report 2003 - Nobel Biocare Corporate

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

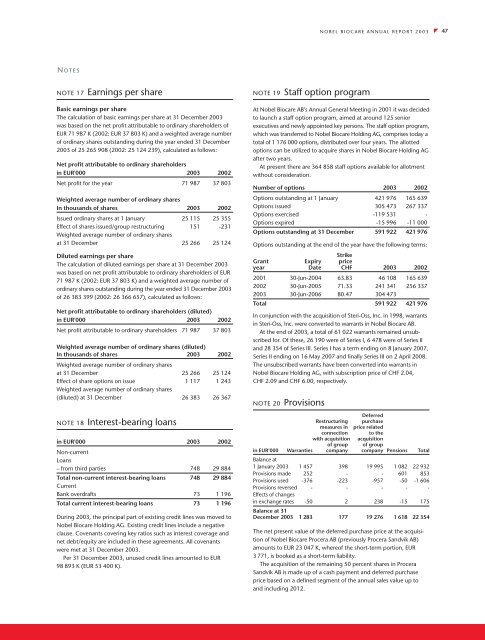

NOBEL BIOCARE ANNUAL REPORT <strong>2003</strong>47NOTESNOTE 17 Earnings per shareBasic earnings per shareThe calculation of basic earnings per share at 31 December <strong>2003</strong>was based on the net profit attributable to ordinary shareholders ofEUR 71 987 K (2002: EUR 37 803 K) and a weighted average numberof ordinary shares outstanding during the year ended 31 December<strong>2003</strong> of 25 265 908 (2002: 25 124 239), calculated as follows:Net profit attributable to ordinary shareholdersin EUR'000 <strong>2003</strong> 2002Net profit for the year 71 987 37 803Weighted average number of ordinary sharesIn thousands of shares <strong>2003</strong> 2002Issued ordinary shares at 1 January 25 115 25 355Effect of shares issued/group restructuring 151 -231Weighted average number of ordinary sharesat 31 December 25 266 25 124Diluted earnings per shareThe calculation of diluted earnings per share at 31 December <strong>2003</strong>was based on net profit attributable to ordinary shareholders of EUR71 987 K (2002: EUR 37 803 K) and a weighted average number ofordinary shares outstanding during the year ended 31 December <strong>2003</strong>of 26 383 399 (2002: 26 366 657), calculated as follows:Net profit attributable to ordinary shareholders (diluted)in EUR'000 <strong>2003</strong> 2002Net profit attributable to ordinary shareholders 71 987 37 803Weighted average number of ordinary shares (diluted)In thousands of shares <strong>2003</strong> 2002Weighted average number of ordinary sharesat 31 December 25 266 25 124Effect of share options on issue 1 117 1 243Weighted average number of ordinary shares(diluted) at 31 December 26 383 26 367NOTE 18 Interest-bearing loansin EUR'000 <strong>2003</strong> 2002Non-currentLoans– from third parties 748 29 884Total non-current interest-bearing loans 748 29 884CurrentBank overdrafts 73 1 196Total current interest-bearing loans 73 1 196During <strong>2003</strong>, the principal part of existing credit lines was moved to<strong>Nobel</strong> <strong>Biocare</strong> Holding AG. Existing credit lines include a negativeclause. Covenants covering key ratios such as interest coverage andnet debt/equity are included in these agreements. All covenantswere met at 31 December <strong>2003</strong>.Per 31 December <strong>2003</strong>, unused credit lines amounted to EUR98 893 K (EUR 53 400 K).NOTE 19 Staff option programAt <strong>Nobel</strong> <strong>Biocare</strong> AB’s <strong>Annual</strong> General Meeting in 2001 it was decidedto launch a staff option program, aimed at around 125 seniorexecutives and newly appointed key persons. The staff option program,which was transferred to <strong>Nobel</strong> <strong>Biocare</strong> Holding AG, comprises today atotal of 1 176 000 options, distributed over four years. The allottedoptions can be utilized to acquire shares in <strong>Nobel</strong> <strong>Biocare</strong> Holding AGafter two years.At present there are 364 858 staff options available for allotmentwithout consideration.Number of options <strong>2003</strong> 2002Options outstanding at 1 January 421 976 165 639Options issued 305 473 267 337Options exercised -119 531 -Options expired -15 996 -11 000Options outstanding at 31 December 591 922 421 976Options outstanding at the end of the year have the following terms:StrikeGrant Expiry priceyear Date CHF <strong>2003</strong> 20022001 30-Jun-2004 63.83 46 108 165 6392002 30-Jun-2005 71.33 241 341 256 337<strong>2003</strong> 30-Jun-2006 80.47 304 473Total 591 922 421 976In conjunction with the acquisition of Steri-Oss, Inc. in 1998, warrantsin Steri-Oss, Inc. were converted to warrants in <strong>Nobel</strong> <strong>Biocare</strong> AB.At the end of <strong>2003</strong>, a total of 61 022 warrants remained unsubscribedfor. Of these, 26 190 were of Series I, 6 478 were of Series IIand 28 354 of Series III. Series I has a term ending on 8 January 2007,Series II ending on 16 May 2007 and finally Series III on 2 April 2008.The unsubscribed warrants have been converted into warrants in<strong>Nobel</strong> <strong>Biocare</strong> Holding AG, with subscription price of CHF 2.04,CHF 2.09 and CHF 6.00, respectively.NOTE 20 ProvisionsDeferredRestructuring purchasemeasures in price relatedconnection to thewith acquisition acquisitionof group of groupin EUR’000 Warranties company company Pensions TotalBalance at1 January <strong>2003</strong> 1 457 398 19 995 1 082 22 932Provisions made 252 - - 601 853Provisions used -376 -223 -957 -50 -1 606Provisions reversed - - - - -Effects of changesin exchange rates -50 2 238 -15 175Balance at 31December <strong>2003</strong> 1 283 177 19 276 1 618 22 354The net present value of the deferred purchase price at the acquisitionof <strong>Nobel</strong> <strong>Biocare</strong> Procera AB (previously Procera Sandvik AB)amounts to EUR 23 047 K, whereof the short-term portion, EUR3 771, is booked as a short-term liability.The acquisition of the remaining 50 percent shares in ProceraSandvik AB is made up of a cash payment and deferred purchaseprice based on a defined segment of the annual sales value up toand including 2012.