NEW YORK CATALOG 2012-2013 - Empire Beauty School

NEW YORK CATALOG 2012-2013 - Empire Beauty School

NEW YORK CATALOG 2012-2013 - Empire Beauty School

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

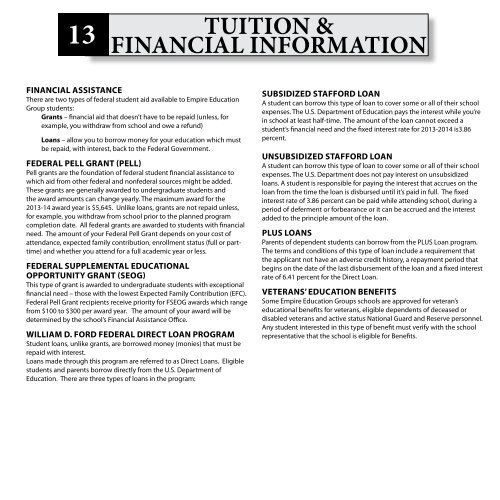

13Tuition &Financial InformationFinancial AssistanceThere are two types of federal student aid available to <strong>Empire</strong> EducationGroup students:Grants – financial aid that doesn’t have to be repaid (unless, forexample, you withdraw from school and owe a refund)Loans – allow you to borrow money for your education which mustbe repaid, with interest, back to the Federal Government.Federal Pell Grant (PELL)Pell grants are the foundation of federal student financial assistance towhich aid from other federal and nonfederal sources might be added.These grants are generally awarded to undergraduate students andthe award amounts can change yearly. The maximum award for the<strong>2013</strong>-14 award year is $5,645. Unlike loans, grants are not repaid unless,for example, you withdraw from school prior to the planned programcompletion date. All federal grants are awarded to students with financialneed. The amount of your Federal Pell Grant depends on your cost ofattendance, expected family contribution, enrollment status (full or parttime)and whether you attend for a full academic year or less.Federal Supplemental EducationalOpportunity Grant (SEOG)This type of grant is awarded to undergraduate students with exceptionalfinancial need – those with the lowest Expected Family Contribution (EFC).Federal Pell Grant recipients receive priority for FSEOG awards which rangefrom $100 to $300 per award year. The amount of your award will bedetermined by the school’s Financial Assistance Office.William D. Ford Federal Direct Loan ProgramStudent loans, unlike grants, are borrowed money (monies) that must berepaid with interest.Loans made through this program are referred to as Direct Loans. Eligiblestudents and parents borrow directly from the U.S. Department ofEducation. There are three types of loans in the program:Subsidized Stafford LoanA student can borrow this type of loan to cover some or all of their schoolexpenses. The U.S. Department of Education pays the interest while you’rein school at least half-time. The amount of the loan cannot exceed astudent’s financial need and the fixed interest rate for <strong>2013</strong>-2014 is3.86percent.Unsubsidized Stafford LoanA student can borrow this type of loan to cover some or all of their schoolexpenses. The U.S. Department does not pay interest on unsubsidizedloans. A student is responsible for paying the interest that accrues on theloan from the time the loan is disbursed until it’s paid in full. The fixedinterest rate of 3.86 percent can be paid while attending school, during aperiod of deferment or forbearance or it can be accrued and the interestadded to the principle amount of the loan.PLUS LoansParents of dependent students can borrow from the PLUS Loan program.The terms and conditions of this type of loan include a requirement thatthe applicant not have an adverse credit history, a repayment period thatbegins on the date of the last disbursement of the loan and a fixed interestrate of 6.41 percent for the Direct Loan.Veterans’ Education BenefitsSome <strong>Empire</strong> Education Groups schools are approved for veteran’seducational benefits for veterans, eligible dependents of deceased ordisabled veterans and active status National Guard and Reserve personnel.Any student interested in this type of benefit must verify with the schoolrepresentative that the school is eligible for Benefits.