Suggested Answers of BT2 Revision Package - ASKnLearn

Suggested Answers of BT2 Revision Package - ASKnLearn

Suggested Answers of BT2 Revision Package - ASKnLearn

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

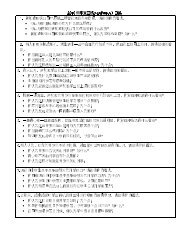

Marking SchemeL3Well developed explanation <strong>of</strong> the negative consequences <strong>of</strong> bothBOP deficit and high unemployment7-10L2Answer must also substantiate the relative importance <strong>of</strong> ahealthy BOP over unemployment from the global recessionWell developed explanation <strong>of</strong> the negative consequences <strong>of</strong>either the BOP deficitORWell developed explanation <strong>of</strong> the negative consequences <strong>of</strong> highunemploymentORUnder developed explanation <strong>of</strong> the negative consequences <strong>of</strong>BOP deficit and high unemployment5-6L1 A smattering <strong>of</strong> valid points 1-4b) The government can implement demand management policies such as fiscal policy andsupply side policies to tackle the balance <strong>of</strong> payment deficit issues and high unemploymentfrom the global recession. Fiscal policy is not the best way out <strong>of</strong> its economic problems butit can serve as a temporary support to its sluggish economy and improve the balance <strong>of</strong>trade. The U.S. will need supply side policies as a long-term solution to address its BOTdeficit and restore confidence in its economy.Explain how the policy works to address the problem <strong>of</strong> unemployment and recessionFiscal Policy: To support the economy due to the fall in AD from the recessionFiscal policy refers to the deliberate attempt by the government to adjust macroeconomicvariables by adjusting tax rates and government expenditure. The severity <strong>of</strong> the globalrecession meant the U.S. government had to act fast and increase its expenditure to supportthe economy against the recession that followed. The government can reduce both personalincome and corporate tax rates so as to encourage consumption and investment. Areduction in personal income tax would increase disposable income thus stimulatingpurchasing power and hence spending which benefits firms. A cut in corporate tax willincrease after-tax pr<strong>of</strong>its, encourage firms to invest, expand and recruit more workers. TheU.S. government can directly inject public spending into the circular flow <strong>of</strong> income to