Suggested Answers of BT2 Revision Package - ASKnLearn

Suggested Answers of BT2 Revision Package - ASKnLearn

Suggested Answers of BT2 Revision Package - ASKnLearn

- No tags were found...

You also want an ePaper? Increase the reach of your titles

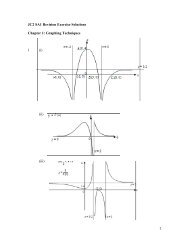

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(b)Explain how a rise in interest rate and the bursting <strong>of</strong> the UShousing bubble resulted in the economic crisis for US.The economic crisis in US is caused by subprime mortgage crisis thatresulted in lower national income in US. The subprime mortgage crisisitself is caused by higher interest rates and the bursting <strong>of</strong> the UShousing bubble as stated in Extract 4.As mentioned in Extract 4, the US central bank has increased theinterest rates from 1% to 5.25%. A rise in the interest rate will increasethe cost <strong>of</strong> borrowing as the interest cost will increase for a givenamount borrowed. Therefore consumption and investment will fall asthey are negatively related to interest rate and AD will fall resulting inlower national income in US. [1]Bursting <strong>of</strong> the US housing bubble caused prices <strong>of</strong> housing to fall.Furthermore, the increasing defaults and foreclosures have led to areduced supply <strong>of</strong> new loan as US housing mortgage companies areless willing and able to lend. Extract 4 pointed out that many housingmortgage companies are forced to shutdown. These have two effectson the US economy. First, with a fall in housing prices the wealth <strong>of</strong>house owners will decrease and hence lowering autonomousconsumption. Second, there will be less investment on housing as lessnew loans are <strong>of</strong>fered. AD will fall due to a fall in C and I henceresulting in lower national income in US. [2]Cap at [2] if there is no supporting evidence from the case orexplanation is provided only for 1 factor.[3](c)With the aid <strong>of</strong> a diagram, explain how the subprime crisis mayaffect China’s economy in the long-term.The subprime crisis would affect China’s economy in the long-termthrough its effect on trade.As stated in Extract 4, if the subprime crisis exacerbates and results insevere economic downturn in US and EU, consumption spending willfall and hence imports from China will fall. This will lead to a fall in Xand hence decreases the AD <strong>of</strong> China in the longer term. Inventorieswill increase and lead to a fall in production, output, employment andnational income through the multiplier. This can be seen in the AD-ASdiagram below.[5]