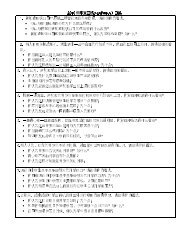

Suggested Answers of BT2 Revision Package - ASKnLearn

Suggested Answers of BT2 Revision Package - ASKnLearn

Suggested Answers of BT2 Revision Package - ASKnLearn

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(16) 2011 MI Prelim H2 Paper Q4The Monetary Authority <strong>of</strong> Singapore revalued the currency in April 2010 and said inOctober 2010 it would steepen and widen the currency’s trading band while seeking amodest and gradual appreciation.(a) Explain Singapore’s choice <strong>of</strong> using exchange rates rather than interest rates as aninstrument for its monetary policy. [10](b) Assess the impact <strong>of</strong> the revaluation and the changes made to the currency’s tradingband on the Singapore economy. [15]<strong>Suggested</strong> Answer Scheme:(a) Explain Singapore’s choice <strong>of</strong> using exchange rates rather than interest ratesas an instrument for its monetary policy. [10]Exchange rate measures the price <strong>of</strong> domestic currency in terms <strong>of</strong> another foreign currencywhereas interest rate is the cost <strong>of</strong> loans or borrowing.Changes in exchange rate can be used as an instrument for monetary policy by altering theprice <strong>of</strong> exports and imports and hence, causing changes in export revenue and importexpenditure to influence economic growth and unemployment.However, interest rate can be used as an instrument for monetary by changing the cost <strong>of</strong>borrowing. For instance, an increase in interest rate can increase the cost <strong>of</strong> borrowing andin turn, cause returns from investment to decrease and hence, lower investment. This in turninfluences AD to affect economic growth and employment.However, interest rate is ineffective as a choice <strong>of</strong> monetary policy.Singapore’s small and open economy results in a lack <strong>of</strong> monetary control and hence,interest rates would be volatile. Singapore’s vulnerable to capital flows is due to Singapore’sposition as an international financial centre. This can result in an inflow <strong>of</strong> ST capital whichwould negate any increase in interest rates and push interest rates down. Hence, interestrates would not be a useful instrument for its monetary policy in Singapore due to itsopenness to capital flows.Singapore’s GDP is mainly contributed by export growth. Hence, keeping exchange ratescompetitive in the short term would reduce price <strong>of</strong> exports and assuming Ex +Em >1 i.e.Marshall Lerner condition holds, this would result in an intended increase in AD i.e.