Suggested Answers of BT2 Revision Package - ASKnLearn

Suggested Answers of BT2 Revision Package - ASKnLearn

Suggested Answers of BT2 Revision Package - ASKnLearn

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

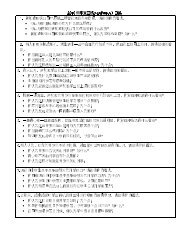

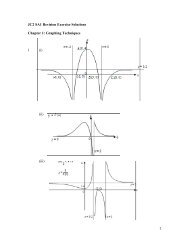

(15) 2011 MI Prelim H1 Paper Q4“Policymakers have said recently that they will use a stronger Singaporean dollar to combatinflation, but don’t want to strengthen the currency too much because that could underminethe city-state’s export competitiveness.”Taipei Time, 15 Apr 2011a) Explain how exchange rate <strong>of</strong> a country is determined.[10]• The external value a currency refers to the price <strong>of</strong> one currency in terms <strong>of</strong> anothercurrency.• The market forces – D & S – helps to determine the exchange rate : Demand factorssuchrising/falling demand for foreign goods & services, higher investment opportunitiesin foreign countries; Supply factors – favourable government policies attracts foreigninvestment into the country or preference for S’pore produced goods & services byforeigners. These factors causes the exchange rates to change eitherfavourable/unfavourable to the country.• Explain that the S$ is weighted against a basket <strong>of</strong> currencies, under a managed floatexchange rate system.• Diagram required.Level 1 Superficial definitions or vague linkages or explanation. 1-3Level 2 Clear explanation <strong>of</strong> how exchange rates are determined. 4-7Level 3 Clear explanation <strong>of</strong> how Singapore determines its exchange rate. 8-10b) Discuss whether this policy alone was adequate to resolve inflation in Singapore.[15]• Define inflation• Recognise that the increase in GPL (inflation) is due to the rise in price <strong>of</strong> essential rawmaterials – oil, food items etc, which accounted for the more expensive imported goods=> cost push inflation.• As Singapore is highly dependent on imports both for local consumption as well as forproducing exports, the S$ cannot be too weak or strong. In this case, what MAS did wasto strengthen the S$, making its currency relatively more expensive against a basket <strong>of</strong>currencies. When the S$ is strengthened, its imports, bought with S$ will now berelatively cheaper. The price <strong>of</strong> imports has fallen. Price <strong>of</strong> exports is now relatively moreexpensive, hence X may fall. Hence (X-M) may fall à fall in AD à lower growth, higherunemployment but keeping prices down and checking inflation.