Suggested Answers of BT2 Revision Package - ASKnLearn

Suggested Answers of BT2 Revision Package - ASKnLearn

Suggested Answers of BT2 Revision Package - ASKnLearn

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

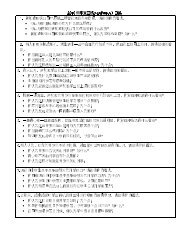

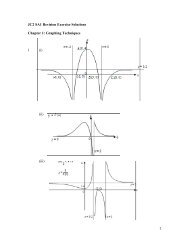

(8) 2010 RVHS Prelim H2 Paper Q4a) Explain how a change in the U.S interest rate can lead to a lower circular flow <strong>of</strong> incomeand expenditure for Singapore. [12]b) Examine whether a lower circular flow <strong>of</strong> income and expenditure necessarily mean alower standard <strong>of</strong> living. [13](a)Interest rate is the price charged for the use <strong>of</strong> money. It represents the cost <strong>of</strong> borrowing aswell as the opportunity cost <strong>of</strong> consumption. On the same note, the circular flow <strong>of</strong> incomeand expenditure depicts the expenditure on goods and services by the consumers, firms,government and the foreigners to the firms which in turn determine the income payments tothe factors <strong>of</strong> production, namely land, labour, capital and entrepreneurship. An increase ininterest rate can reduce the aggregate expenditure via its components and can reduce thecircular flow <strong>of</strong> income and expenditure.As Singapore is a small and open economy, whenever U.S interest rate increases, there willbe a hike in the Singapore’s interest rate given the huge capital flows and excessivechanges to the exchange rate <strong>of</strong> Singapore.Consumption is spending by households on goods and services, with the exception <strong>of</strong>purchases <strong>of</strong> new housing. With higher cost <strong>of</strong> borrowing due to the increase in interest rate,consumers postpone spending on consumer durables like cars, furniture and consumerelectronics. In addition, those with mortgage payments, having to fork out more to pay for theinterest, will have less disposable income to spend. Moreover, with the increase in interestrates, there is more incentive to save given the higher opportunity cost <strong>of</strong> consumption.Higher interest rate will also have negative impact on asset prices, hence households will bediscouraged to spend as they feel less wealthy. These factors will cause consumption todecrease.Investment is spending on capital equipment, inventories and structures, includinghousehold purchases <strong>of</strong> new housing. Firms <strong>of</strong>ten finance their purchases <strong>of</strong> equipment,inventories and structures through loans. With reference to Fig 1, when interest rateincreases from OR 1 to OR 2 , projects I 1 I 2 which are viable in the past becomes no longerviable, hence investment falls. In addition, the higher cost <strong>of</strong> borrowing also discourages thebuying <strong>of</strong> property, hence reduces the level <strong>of</strong> investment.