2009 - TDM Berhad

2009 - TDM Berhad

2009 - TDM Berhad

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

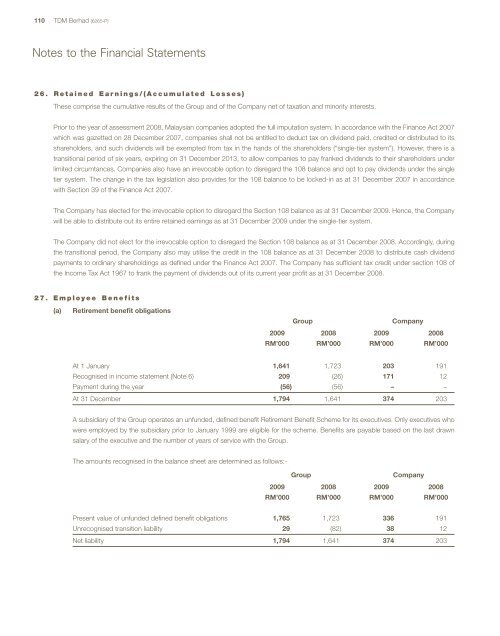

110 <strong>TDM</strong> <strong>Berhad</strong> (6265-P)Notes to the Financial Statements26. Retained Earnings/(Accumulated Losses)These comprise the cumulative results of the Group and of the Company net of taxation and minority interests.Prior to the year of assessment 2008, Malaysian companies adopted the full imputation system. In accordance with the Finance Act 2007which was gazetted on 28 December 2007, companies shall not be entitled to deduct tax on dividend paid, credited or distributed to itsshareholders, and such dividends will be exempted from tax in the hands of the shareholders (“single-tier system”). However, there is atransitional period of six years, expiring on 31 December 2013, to allow companies to pay franked dividends to their shareholders underlimited circumtances. Companies also have an irrevocable option to disregard the 108 balance and opt to pay dividends under the singletier system. The change in the tax legislation also provides for the 108 balance to be locked-in as at 31 December 2007 in accordancewith Section 39 of the Finance Act 2007.The Company has elected for the irrevocable option to disregard the Section 108 balance as at 31 December <strong>2009</strong>. Hence, the Companywill be able to distribute out its entire retained earnings as at 31 December <strong>2009</strong> under the single-tier system.The Company did not elect for the irrevocable option to disregard the Section 108 balance as at 31 December 2008. Accordingly, duringthe transitional period, the Company also may utilise the credit in the 108 balance as at 31 December 2008 to distribute cash dividendpayments to ordinary shareholdings as defi ned under the Finance Act 2007. The Company has suffi cient tax credit under section 108 ofthe Income Tax Act 1967 to frank the payment of dividends out of its current year profi t as at 31 December 2008.27. Employee Benefits(a)Retirement benefit obligationsGroupCompany<strong>2009</strong> 2008 <strong>2009</strong> 2008RM’000 RM’000 RM’000 RM’000At 1 January 1,641 1,723 203 191Recognised in income statement (Note 6) 209 (26) 171 12Payment during the year (56) (56) – –At 31 December 1,794 1,641 374 203A subsidiary of the Group operates an unfunded, defi ned benefi t Retirement Benefi t Scheme for its executives. Only executives whowere employed by the subsidiary prior to January 1999 are eligible for the scheme. Benefi ts are payable based on the last drawnsalary of the executive and the number of years of service with the Group.The amounts recognised in the balance sheet are determined as follows:-GroupCompany<strong>2009</strong> 2008 <strong>2009</strong> 2008RM’000 RM’000 RM’000 RM’000Present value of unfunded defi ned benefi t obligations 1,765 1,723 336 191Unrecognised transition liability 29 (82) 38 12Net liability 1,794 1,641 374 203