Annual Report 2001 - Bohler Uddeholm materializing visions

Annual Report 2001 - Bohler Uddeholm materializing visions

Annual Report 2001 - Bohler Uddeholm materializing visions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group valuation rules reflect the principle of consistent balance sheet preparation and<br />

valuation. Compliance with these uniform valuation principles is verified and attested by the<br />

auditors of the individual company financial statements. Data from companies consolidated<br />

using the equity method are not adjusted to conform to Group valuation methods.<br />

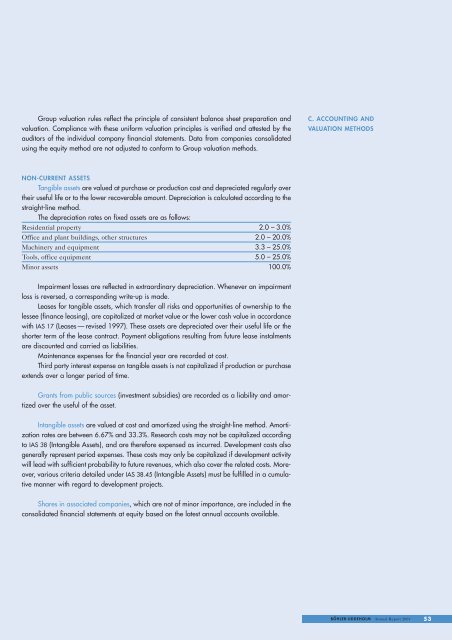

NON-CURRENT ASSETS<br />

Tangible assets are valued at purchase or production cost and depreciated regularly over<br />

their useful life or to the lower recoverable amount. Depreciation is calculated according to the<br />

straight-line method.<br />

The depreciation rates on fixed assets are as follows:<br />

Residential property 2.0 – 3.0%<br />

Office and plant buildings, other structures 2.0 – 20.0%<br />

Machinery and equipment 3.3 – 25.0%<br />

Tools, office equipment 5.0 – 25.0%<br />

Minor assets 100.0%<br />

Impairment losses are reflected in extraordinary depreciation. Whenever an impairment<br />

loss is reversed, a corresponding write-up is made.<br />

Leases for tangible assets, which transfer all risks and opportunities of ownership to the<br />

lessee (finance leasing), are capitalized at market value or the lower cash value in accordance<br />

with IAS 17 (Leases — revised 1997). These assets are depreciated over their useful life or the<br />

shorter term of the lease contract. Payment obligations resulting from future lease instalments<br />

are discounted and carried as liabilities.<br />

Maintenance expenses for the financial year are recorded at cost.<br />

Third party interest expense on tangible assets is not capitalized if production or purchase<br />

extends over a longer period of time.<br />

Grants from public sources (investment subsidies) are recorded as a liability and amortized<br />

over the useful of the asset.<br />

Intangible assets are valued at cost and amortized using the straight-line method. Amortization<br />

rates are between 6.67% and 33.3%. Research costs may not be capitalized according<br />

to IAS 38 (Intangible Assets), and are therefore expensed as incurred. Development costs also<br />

generally represent period expenses. These costs may only be capitalized if development activity<br />

will lead with sufficient probability to future revenues, which also cover the related costs. Moreover,<br />

various criteria detailed under IAS 38.45 (Intangible Assets) must be fulfilled in a cumulative<br />

manner with regard to development projects.<br />

Shares in associated companies, which are not of minor importance, are included in the<br />

consolidated financial statements at equity based on the latest annual accounts available.<br />

C. ACCOUNTING AND<br />

VALUATION METHODS<br />

BÖHLER-UDDEHOLM <strong>Annual</strong> <strong>Report</strong> <strong>2001</strong> 53