Annual Report 2001 - Bohler Uddeholm materializing visions

Annual Report 2001 - Bohler Uddeholm materializing visions

Annual Report 2001 - Bohler Uddeholm materializing visions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements <strong>2001</strong><br />

56 BÖHLER-UDDEHOLM <strong>Annual</strong> <strong>Report</strong> <strong>2001</strong><br />

The BÖHLER-UDDEHOLM Group has different pension plans for its employees, which are<br />

determined by the legal, economic and tax conditions of the individual countries. In part, pension<br />

obligations are financed via external funds. A significant proportion of current pension obligations<br />

and entitlements to future pensions is covered by pro<strong>visions</strong>. The obligations of our companies<br />

are determined on the basis of the “protected-unit-credit method” in accordance with<br />

IAS 19 (Employee Benefits — revised 2000). In the BÖHLER-UDDEHOLM Group, unexpected gains<br />

or losses on assets held by external funds (actuarial gains or losses) are distributed uniformly<br />

over the average remaining working period in accordance with the “corridor regulation” set<br />

forth in IAS 19.92.<br />

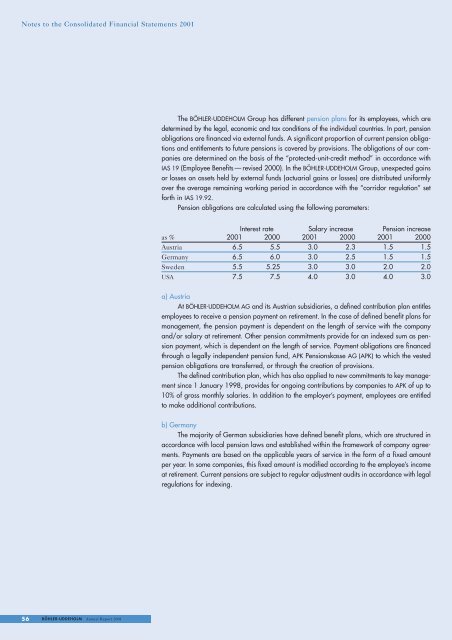

Pension obligations are calculated using the following parameters:<br />

Interest rate Salary increase Pension increase<br />

as % <strong>2001</strong> 2000 <strong>2001</strong> 2000 <strong>2001</strong> 2000<br />

Austria 6.5 5.5 3.0 2.3 1.5 1.5<br />

Germany 6.5 6.0 3.0 2.5 1.5 1.5<br />

Sweden 5.5 5.25 3.0 3.0 2.0 2.0<br />

USA 7.5 7.5 4.0 3.0 4.0 3.0<br />

a) Austria<br />

At BÖHLER-UDDEHOLM AG and its Austrian subsidiaries, a defined contribution plan entitles<br />

employees to receive a pension payment on retirement. In the case of defined benefit plans for<br />

management, the pension payment is dependent on the length of service with the company<br />

and/or salary at retirement. Other pension commitments provide for an indexed sum as pension<br />

payment, which is dependent on the length of service. Payment obligations are financed<br />

through a legally independent pension fund, APK Pensionskasse AG (APK) to which the vested<br />

pension obligations are transferred, or through the creation of pro<strong>visions</strong>.<br />

The defined contribution plan, which has also applied to new commitments to key management<br />

since 1 January 1998, provides for ongoing contributions by companies to APK of up to<br />

10% of gross monthly salaries. In addition to the employer’s payment, employees are entitled<br />

to make additional contributions.<br />

b) Germany<br />

The majority of German subsidiaries have defined benefit plans, which are structured in<br />

accordance with local pension laws and established within the framework of company agreements.<br />

Payments are based on the applicable years of service in the form of a fixed amount<br />

per year. In some companies, this fixed amount is modified according to the employee’s income<br />

at retirement. Current pensions are subject to regular adjustment audits in accordance with legal<br />

regulations for indexing.