Annual Report 2001 - Bohler Uddeholm materializing visions

Annual Report 2001 - Bohler Uddeholm materializing visions

Annual Report 2001 - Bohler Uddeholm materializing visions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

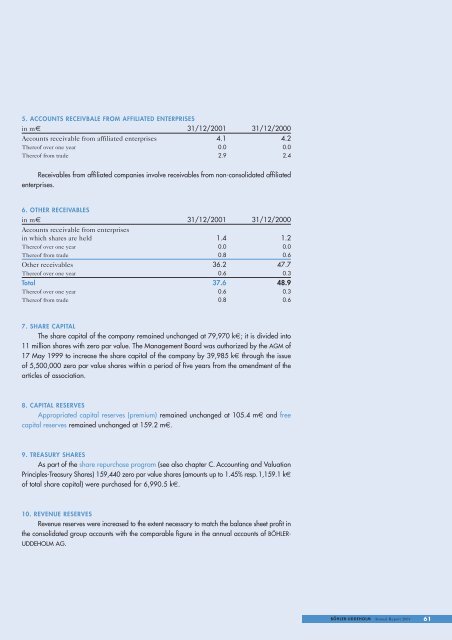

5. ACCOUNTS RECEIVBALE FROM AFFILIATED ENTERPRISES<br />

in m€ 31/12/<strong>2001</strong> 31/12/2000<br />

Accounts receivable from affiliated enterprises 4.1 4.2<br />

Thereof over one year 0.0 0.0<br />

Thereof from trade 2.9 2.4<br />

Receivables from affiliated companies involve receivables from non-consolidated affiliated<br />

enterprises.<br />

6. OTHER RECEIVABLES<br />

in m€<br />

Accounts receivable from enterprises<br />

31/12/<strong>2001</strong> 31/12/2000<br />

in which shares are held 1.4 1.2<br />

Thereof over one year 0.0 0.0<br />

Thereof from trade 0.8 0.6<br />

Other receivables 36.2 47.7<br />

Thereof over one year 0.6 0.3<br />

Total 37.6 48.9<br />

Thereof over one year 0.6 0.3<br />

Thereof from trade 0.8 0.6<br />

7. SHARE CAPITAL<br />

The share capital of the company remained unchanged at 79,970 k€; it is divided into<br />

11 million shares with zero par value. The Management Board was authorized by the AGM of<br />

17 May 1999 to increase the share capital of the company by 39,985 k€ through the issue<br />

of 5,500,000 zero par value shares within a period of five years from the amendment of the<br />

articles of association.<br />

8. CAPITAL RESERVES<br />

Appropriated capital reserves (premium) remained unchanged at 105.4 m€ and free<br />

capital reserves remained unchanged at 159.2 m€.<br />

9. TREASURY SHARES<br />

As part of the share repurchase program (see also chapter C. Accounting and Valuation<br />

Principles-Treasury Shares) 159,440 zero par value shares (amounts up to 1.45% resp.1,159.1 k€<br />

of total share capital) were purchased for 6,990.5 k€.<br />

10. REVENUE RESERVES<br />

Revenue reserves were increased to the extent necessary to match the balance sheet profit in<br />

the consolidated group accounts with the comparable figure in the annual accounts of BÖHLER-<br />

UDDEHOLM AG.<br />

BÖHLER-UDDEHOLM <strong>Annual</strong> <strong>Report</strong> <strong>2001</strong> 61