Annual Report 2001 - Bohler Uddeholm materializing visions

Annual Report 2001 - Bohler Uddeholm materializing visions

Annual Report 2001 - Bohler Uddeholm materializing visions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

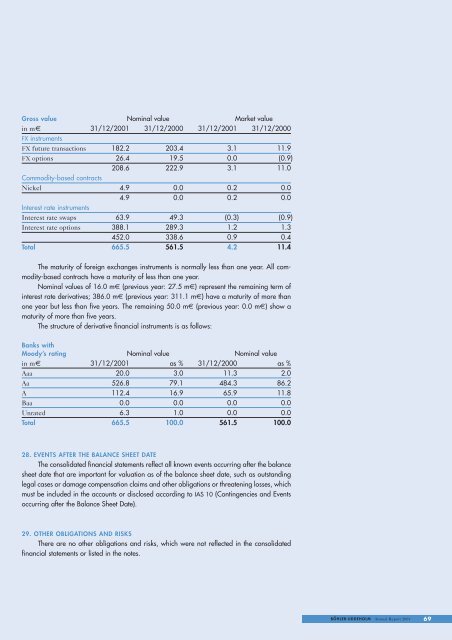

Gross value Nominal value Market value<br />

in m€ 31/12/<strong>2001</strong> 31/12/2000 31/12/<strong>2001</strong> 31/12/2000<br />

FX instruments<br />

FX future transactions 182.2 203.4 3.1 11.9<br />

FX options 26.4 19.5 0.0 (0.9)<br />

208.6 222.9 3.1 11.0<br />

Commodity-based contracts<br />

Nickel 4.9 0.0 0.2 0.0<br />

4.9 0.0 0.2 0.0<br />

Interest rate instruments<br />

Interest rate swaps 63.9 49.3 (0.3) (0.9)<br />

Interest rate options 388.1 289.3 1.2 1.3<br />

452.0 338.6 0.9 0.4<br />

Total 665.5 561.5 4.2 11.4<br />

The maturity of foreign exchanges instruments is normally less than one year. All commodity-based<br />

contracts have a maturity of less than one year.<br />

Nominal values of 16.0 m€ (previous year: 27.5 m€) represent the remaining term of<br />

interest rate derivatives; 386.0 m€ (previous year: 311.1 m€) have a maturity of more than<br />

one year but less than five years. The remaining 50.0 m€ (previous year: 0.0 m€) show a<br />

maturity of more than five years.<br />

The structure of derivative financial instruments is as follows:<br />

Banks with<br />

Moody’s rating Nominal value Nominal value<br />

in m€ 31/12/<strong>2001</strong> as % 31/12/2000 as %<br />

Aaa 20.0 3.0 11.3 2.0<br />

Aa 526.8 79.1 484.3 86.2<br />

A 112.4 16.9 65.9 11.8<br />

Baa 0.0 0.0 0.0 0.0<br />

Unrated 6.3 1.0 0.0 0.0<br />

Total 665.5 100.0 561.5 100.0<br />

28. EVENTS AFTER THE BALANCE SHEET DATE<br />

The consolidated financial statements reflect all known events occurring after the balance<br />

sheet date that are important for valuation as of the balance sheet date, such as outstanding<br />

legal cases or damage compensation claims and other obligations or threatening losses, which<br />

must be included in the accounts or disclosed according to IAS 10 (Contingencies and Events<br />

occurring after the Balance Sheet Date).<br />

29. OTHER OBLIGATIONS AND RISKS<br />

There are no other obligations and risks, which were not reflected in the consolidated<br />

financial statements or listed in the notes.<br />

BÖHLER-UDDEHOLM <strong>Annual</strong> <strong>Report</strong> <strong>2001</strong> 69