Annual Report 2012 - Lahore Stock Exchange

Annual Report 2012 - Lahore Stock Exchange

Annual Report 2012 - Lahore Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

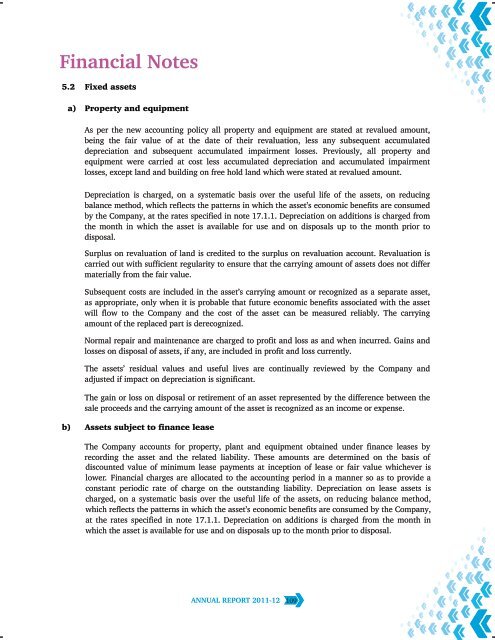

Financial Notes5.2 Fixed assetsa) Property and equipmentAs per the new accounting policy all property and equipment are stated at revalued amount,being the fair value of at the date of their revaluation, less any subsequent accumulateddepreciation and subsequent accumulated impairment losses. Previously, all property andequipment were carried at cost less accumulated depreciation and accumulated impairmentlosses, except land and building on free hold land which were stated at revalued amount.Depreciation is charged, on a systematic basis over the useful life of the assets, on reducingbalance method, which reflects the patterns in which the asset’s economic benefits are consumedby the Company, at the rates specified in note 17.1.1. Depreciation on additions is charged fromthe month in which the asset is available for use and on disposals up to the month prior todisposal.Surplus on revaluation of land is credited to the surplus on revaluation account. Revaluation iscarried out with sufficient regularity to ensure that the carrying amount of assets does not differmaterially from the fair value.Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset,as appropriate, only when it is probable that future economic benefits associated with the assetwill flow to the Company and the cost of the asset can be measured reliably. The carryingamount of the replaced part is derecognized.Normal repair and maintenance are charged to profit and loss as and when incurred. Gains andlosses on disposal of assets, if any, are included in profit and loss currently.The assets’ residual values and useful lives are continually reviewed by the Company andadjusted if impact on depreciation is significant.The gain or loss on disposal or retirement of an asset represented by the difference between thesale proceeds and the carrying amount of the asset is recognized as an income or expense.b) Assets subject to finance leaseThe Company accounts for property, plant and equipment obtained under finance leases byrecording the asset and the related liability. These amounts are determined on the basis ofdiscounted value of minimum lease payments at inception of lease or fair value whichever islower. Financial charges are allocated to the accounting period in a manner so as to provide aconstant periodic rate of charge on the outstanding liability. Depreciation on lease assets ischarged, on a systematic basis over the useful life of the assets, on reducing balance method,which reflects the patterns in which the asset’s economic benefits are consumed by the Company,at the rates specified in note 17.1.1. Depreciation on additions is charged from the month inwhich the asset is available for use and on disposals up to the month prior to disposal.ANNUAL REPORT 2011-12 109