Annual Report 2012 - Lahore Stock Exchange

Annual Report 2012 - Lahore Stock Exchange

Annual Report 2012 - Lahore Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

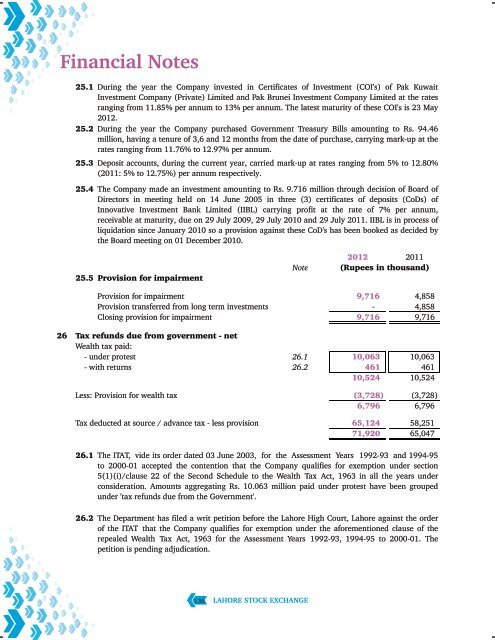

Financial Notes25.125.225.325.4During the year the Company invested in Certificates of Investment (COI's) of Pak KuwaitInvestment Company (Private) Limited and Pak Brunei Investment Company Limited at the ratesranging from 11.85% per annum to 13% per annum. The latest maturity of these COI's is 23 May<strong>2012</strong>.During the year the Company purchased Government Treasury Bills amounting to Rs. 94.46million, having a tenure of 3,6 and 12 months from the date of purchase, carrying mark-up at therates ranging from 11.76% to 12.97% per annum.Deposit accounts, during the current year, carried mark-up at rates ranging from 5% to 12.80%(2011: 5% to 12.75%) per annum respectively.The Company made an investment amounting to Rs. 9.716 million through decision of Board ofDirectors in meeting held on 14 June 2005 in three (3) certificates of deposits (CoDs) ofInnovative Investment Bank Limited (IIBL) carrying profit at the rate of 7% per annum,receivable at maturity, due on 29 July 2009, 29 July 2010 and 29 July 2011. IIBL is in process ofliquidation since January 2010 so a provision against these CoD's has been booked as decided bythe Board meeting on 01 December 2010.25.5 Provision for impairmentNote<strong>2012</strong> 2011(Rupees in thousand)Provision for impairment 9,716 4,858Provision transferred from long term investments - 4,858Closing provision for impairment 9,716 9,71626 Tax refunds due from government - netWealth tax paid:- under protest 26.1 10,063 10,063- with returns 26.2 461 46110,524 10,524Less: Provision for wealth tax (3,728) (3,728)6,796 6,796Tax deducted at source / advance tax - less provision 65,124 58,25171,920 65,04726.126.2The ITAT, vide its order dated 03 June 2003, for the Assessment Years 1992-93 and 1994-95to 2000-01 accepted the contention that the Company qualifies for exemption under section5(1)(i)/clause 22 of the Second Schedule to the Wealth Tax Act, 1963 in all the years underconsideration. Amounts aggregating Rs. 10.063 million paid under protest have been groupedunder 'tax refunds due from the Government'.The Department has filed a writ petition before the <strong>Lahore</strong> High Court, <strong>Lahore</strong> against the orderof the ITAT that the Company qualifies for exemption under the aforementioned clause of therepealed Wealth Tax Act, 1963 for the Assessment Years 1992-93, 1994-95 to 2000-01. Thepetition is pending adjudication.136LAHORE STOCK EXCHANGE