Annual Report 2012 - Lahore Stock Exchange

Annual Report 2012 - Lahore Stock Exchange

Annual Report 2012 - Lahore Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

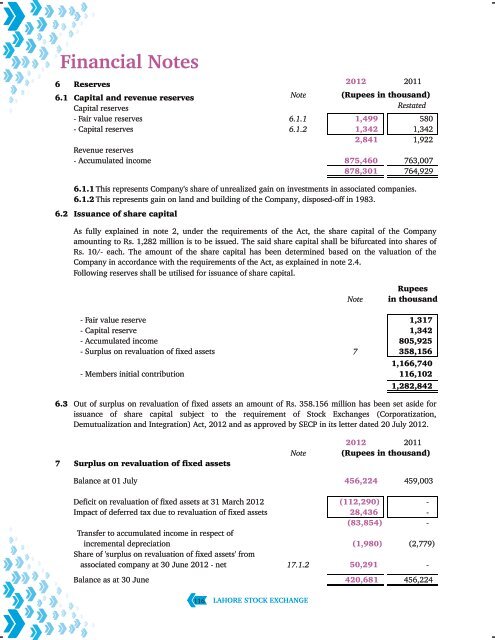

Financial Notes6 Reserves6.1 Capital and revenue reservesCapital reservesNote<strong>2012</strong> 2011(Rupees in thousand)Restated- Fair value reserves 6.1.1 1,499 580- Capital reserves 6.1.2 1,342 1,3422,841 1,922Revenue reserves- Accumulated income 875,460 763,007878,301 764,9296.1.1 This represents Company's share of unrealized gain on investments in associated companies.6.1.2 This represents gain on land and building of the Company, disposed-off in 1983.6.2 Issuance of share capitalAs fully explained in note 2, under the requirements of the Act, the share capital of the Companyamounting to Rs. 1,282 million is to be issued. The said share capital shall be bifurcated into shares ofRs. 10/- each. The amount of the share capital has been determined based on the valuation of theCompany in accordance with the requirements of the Act, as explained in note 2.4.Following reserves shall be utilised for issuance of share capital.NoteRupeesin thousand- Fair value reserve 1,317- Capital reserve 1,342- Accumulated income 805,925- Surplus on revaluation of fixed assets 7 358,1561,166,740- Members initial contribution 116,1021,282,8426.3Out of surplus on revaluation of fixed assets an amount of Rs. 358.156 million has been set aside forissuance of share capital subject to the requirement of <strong>Stock</strong> <strong>Exchange</strong>s (Corporatization,Demutualization and Integration) Act, <strong>2012</strong> and as approved by SECP in its letter dated 20 July <strong>2012</strong>.7 Surplus on revaluation of fixed assetsNote<strong>2012</strong> 2011(Rupees in thousand)Balance at 01 July 456,224 459,003Deficit on revaluation of fixed assets at 31 March <strong>2012</strong> (112,290) -Impact of deferred tax due to revaluation of fixed assets 28,436 -(83,854) -Transfer to accumulated income in respect ofincremental depreciation (1,980) (2,779)Share of 'surplus on revaluation of fixed assets' fromassociated company at 30 June <strong>2012</strong> - net 17.1.2 50,291 -Balance as at 30 June 420,681 456,224116LAHORE STOCK EXCHANGE