Annual Report 2012 - Lahore Stock Exchange

Annual Report 2012 - Lahore Stock Exchange

Annual Report 2012 - Lahore Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

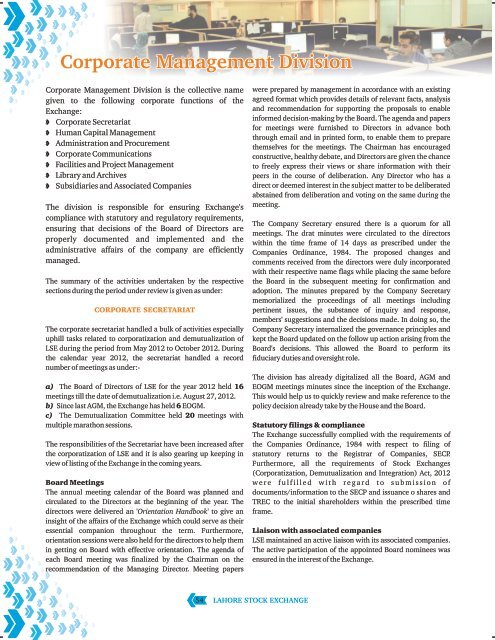

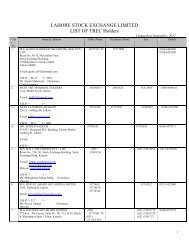

Corporate Management DivisionCorporate Management Division is the collective namegiven to the following corporate functions of the<strong>Exchange</strong>: Corporate Secretariat Human Capital Management Administration and Procurement Corporate Communications Facilities and Project Management Library and Archives Subsidiaries and Associated CompaniesThe division is responsible for ensuring <strong>Exchange</strong>'scompliance with statutory and regulatory requirements,ensuring that decisions of the Board of Directors areproperly documented and implemented and theadministrative affairs of the company are efficientlymanaged.The summary of the activities undertaken by the respectivesections during the period under review is given as under:CORPORATE SECRETARIATThe corporate secretariat handled a bulk of activities especiallyuphill tasks related to corporatization and demutualization ofLSE during the period from May <strong>2012</strong> to October <strong>2012</strong>. Duringthe calendar year <strong>2012</strong>, the secretariat handled a recordnumber of meetings as under:-a) The Board of Directors of LSE for the year <strong>2012</strong> held 16meetings till the date of demutualization i.e. August 27, <strong>2012</strong>.b) Since last AGM, the <strong>Exchange</strong> has held 6 EOGM.c) The Demutualization Committee held 20 meetings withmultiple marathon sessions.The responsibilities of the Secretariat have been increased afterthe corporatization of LSE and it is also gearing up keeping inview of listing of the <strong>Exchange</strong> in the coming years.Board MeetingsThe annual meeting calendar of the Board was planned andcirculated to the Directors at the beginning of the year. Thedirectors were delivered an 'Orientation Handbook' to give aninsight of the affairs of the <strong>Exchange</strong> which could serve as theiressential companion throughout the term. Furthermore,orientation sessions were also held for the directors to help themin getting on Board with effective orientation. The agenda ofeach Board meeting was finalized by the Chairman on therecommendation of the Managing Director. Meeting paperswere prepared by management in accordance with an existingagreed format which provides details of relevant facts, analysisand recommendation for supporting the proposals to enableinformed decision-making by the Board. The agenda and papersfor meetings were furnished to Directors in advance boththrough email and in printed form, to enable them to preparethemselves for the meetings. The Chairman has encouragedconstructive, healthy debate, and Directors are given the chanceto freely express their views or share information with theirpeers in the course of deliberation. Any Director who has adirect or deemed interest in the subject matter to be deliberatedabstained from deliberation and voting on the same during themeeting.The Company Secretary ensured there is a quorum for allmeetings. The drat minutes were circulated to the directorswithin the time frame of 14 days as prescribed under theCompanies Ordinance, 1984. The proposed changes andcomments received from the directors were duly incorporatedwith their respective name flags while placing the same beforethe Board in the subsequent meeting for confirmation andadoption. The minutes prepared by the Company Secretarymemorialized the proceedings of all meetings includingpertinent issues, the substance of inquiry and response,members' suggestions and the decisions made. In doing so, theCompany Secretary internalized the governance principles andkept the Board updated on the follow up action arising from theBoard's decisions. This allowed the Board to perform itsfiduciary duties and oversight role.The division has already digitalized all the Board, AGM andEOGM meetings minutes since the inception of the <strong>Exchange</strong>.This would help us to quickly review and make reference to thepolicy decision already take by the House and the Board.Statutory filings & complianceThe <strong>Exchange</strong> successfully complied with the requirements ofthe Companies Ordinance, 1984 with respect to filing ofstatutory returns to the Registrar of Companies, SECP.Furthermore, all the requirements of <strong>Stock</strong> <strong>Exchange</strong>s(Corporatization, Demutualization and Integration) Act, <strong>2012</strong>w e r e f u l f i l l e d w i t h r e g a r d t o s u b m i s s i o n o fdocuments/information to the SECP and issuance o shares andTREC to the initial shareholders within the prescribed timeframe.Liaison with associated companiesLSE maintained an active liaison with its associated companies.The active participation of the appointed Board nominees wasensured in the interest of the <strong>Exchange</strong>.54LAHORE STOCK EXCHANGE