Annual Report 2012 - Lahore Stock Exchange

Annual Report 2012 - Lahore Stock Exchange

Annual Report 2012 - Lahore Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

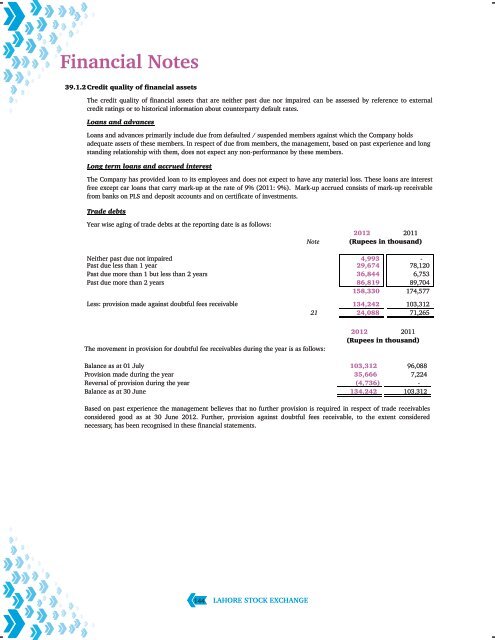

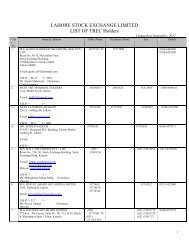

Financial Notes39.1.2 Credit quality of financial assetsThe credit quality of financial assets that are neither past due nor impaired can be assessed by reference to externalcredit ratings or to historical information about counterparty default rates.Loans and advancesLoans and advances primarily include due from defaulted / suspended members against which the Company holdsadequate assets of these members. In respect of due from members, the management, based on past experience and longstanding relationship with them, does not expect any non-performance by these members.Long term loans and accrued interestThe Company has provided loan to its employees and does not expect to have any material loss. These loans are interestfree except car loans that carry mark-up at the rate of 9% (2011: 9%). Mark-up accrued consists of mark-up receivablefrom banks on PLS and deposit accounts and on certificate of investments.Trade debtsYear wise aging of trade debts at the reporting date is as follows:Note<strong>2012</strong> 2011(Rupees in thousand)Neither past due not impaired 4,993 -Past due less than 1 year 29,674 78,120Past due more than 1 but less than 2 years 36,844 6,753Past due more than 2 years 86,819 89,704158,330 174,577Less: provision made against doubtful fees receivable 134,242 103,31221 24,088 71,265The movement in provision for doubtful fee receivables during the year is as follows:<strong>2012</strong> 2011(Rupees in thousand)Balance as at 01 July 103,312 96,088Provision made during the year 35,666 7,224Reversal of provision during the year (4,736) -Balance as at 30 June 134,242 103,312Based on past experience the management believes that no further provision is required in respect of trade receivablesconsidered good as at 30 June <strong>2012</strong>. Further, provision against doubtful fees receivable, to the extent considerednecessary, has been recognised in these financial statements.144LAHORE STOCK EXCHANGE