Savills plc 2012 Annual Report - (PDF) - Investor relations

Savills plc 2012 Annual Report - (PDF) - Investor relations

Savills plc 2012 Annual Report - (PDF) - Investor relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

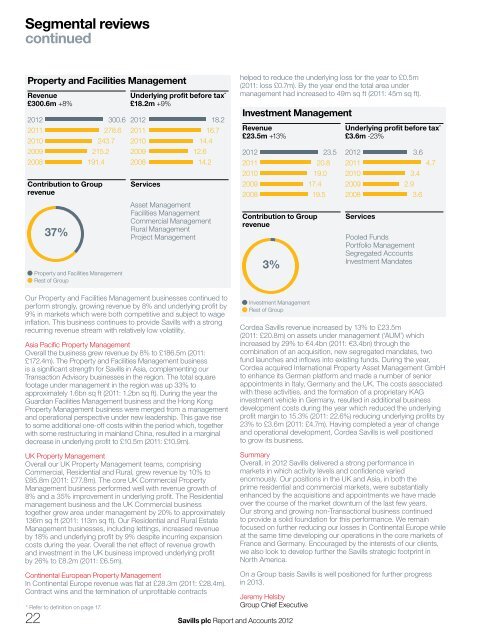

Segmental reviewscontinuedProperty and Facilities ManagementRevenue£300.6m +8%<strong>2012</strong>2011201020092008Contribution to Grouprevenue37%300.6 <strong>2012</strong>278.6 2011243.7 2010215.2 2009191.4 2008Property and Facilities ManagementRest of GroupUnderlying profit before tax *£18.2m +9%Services18.216.714.412.614.2Asset ManagementFacilities ManagementCommercial ManagementRural ManagementProject ManagementOur Property and Facilities Management businesses continued toperform strongly, growing revenue by 8% and underlying profit by9% in markets which were both competitive and subject to wageinflation. This business continues to provide <strong>Savills</strong> with a strongrecurring revenue stream with relatively low volatility.Asia Pacific Property ManagementOverall the business grew revenue by 8% to £186.5m (2011:£172.4m). The Property and Facilities Management businessis a significant strength for <strong>Savills</strong> in Asia, complementing ourTransaction Advisory businesses in the region. The total squarefootage under management in the region was up 33% toapproximately 1.6bn sq ft (2011: 1.2bn sq ft). During the year theGuardian Facilities Management business and the Hong KongProperty Management business were merged from a managementand operational perspective under new leadership. This gave riseto some additional one-off costs within the period which, togetherwith some restructuring in mainland China, resulted in a marginaldecrease in underlying profit to £10.5m (2011: £10.9m).UK Property ManagementOverall our UK Property Management teams, comprisingCommercial, Residential and Rural, grew revenue by 10% to£85.8m (2011: £77.8m). The core UK Commercial PropertyManagement business performed well with revenue growth of8% and a 35% improvement in underlying profit. The Residentialmanagement business and the UK Commercial businesstogether grew area under management by 20% to approximately136m sq ft (2011: 113m sq ft). Our Residential and Rural EstateManagement businesses, including lettings, increased revenueby 18% and underlying profit by 9% despite incurring expansioncosts during the year. Overall the net effect of revenue growthand investment in the UK business improved underlying profitby 26% to £8.2m (2011: £6.5m).Continental European Property ManagementIn Continental Europe revenue was flat at £28.3m (2011: £28.4m).Contract wins and the termination of unprofitable contracts* Refer to definition on page 17.helped to reduce the underlying loss for the year to £0.5m(2011: loss £0.7m). By the year end the total area undermanagement had increased to 49m sq ft (2011: 45m sq ft).Investment ManagementRevenue£23.5m +13%<strong>2012</strong>2011201020092008Contribution to Grouprevenue3%Investment ManagementRest of Group23.520.819.017.419.5Underlying profit before tax *£3.6m -23%<strong>2012</strong>2011201020092008ServicesPooled FundsPortfolio ManagementSegregated AccountsInvestment Mandates3.64.73.42.93.6Cordea <strong>Savills</strong> revenue increased by 13% to £23.5m(2011: £20.8m) on assets under management (‘AUM’) whichincreased by 29% to €4.4bn (2011: €3.4bn) through thecombination of an acquisition, new segregated mandates, twofund launches and inflows into existing funds. During the year,Cordea acquired International Property Asset Management GmbHto enhance its German platform and made a number of seniorappointments in Italy, Germany and the UK. The costs associatedwith these activities, and the formation of a proprietary KAGinvestment vehicle in Germany, resulted in additional businessdevelopment costs during the year which reduced the underlyingprofit margin to 15.3% (2011: 22.6%) reducing underlying profits by23% to £3.6m (2011: £4.7m). Having completed a year of changeand operational development, Cordea <strong>Savills</strong> is well positionedto grow its business.SummaryOverall, in <strong>2012</strong> <strong>Savills</strong> delivered a strong performance inmarkets in which activity levels and confidence variedenormously. Our positions in the UK and Asia, in both theprime residential and commercial markets, were substantiallyenhanced by the acquisitions and appointments we have madeover the course of the market downturn of the last few years.Our strong and growing non-Transactional business continuedto provide a solid foundation for this performance. We remainfocused on further reducing our losses in Continental Europe whileat the same time developing our operations in the core markets ofFrance and Germany. Encouraged by the interests of our clients,we also look to develop further the <strong>Savills</strong> strategic footprint inNorth America.On a Group basis <strong>Savills</strong> is well positioned for further progressin 2013.Jeremy HelsbyGroup Chief Executive22 <strong>Savills</strong> <strong>plc</strong> <strong>Report</strong> and Accounts <strong>2012</strong>