Savills plc 2012 Annual Report - (PDF) - Investor relations

Savills plc 2012 Annual Report - (PDF) - Investor relations

Savills plc 2012 Annual Report - (PDF) - Investor relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

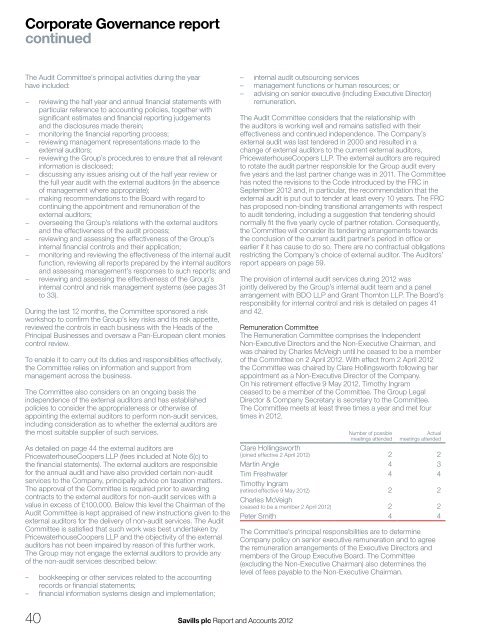

Corporate Governance reportcontinuedThe Audit Committee’s principal activities during the yearhave included:−−−−−−−−−−reviewing the half year and annual financial statements withparticular reference to accounting policies, together withsignificant estimates and financial reporting judgementsand the disclosures made therein;monitoring the financial reporting process;reviewing management representations made to theexternal auditors;reviewing the Group’s procedures to ensure that all relevantinformation is disclosed;discussing any issues arising out of the half year review orthe full year audit with the external auditors (in the absenceof management where appropriate);making recommendations to the Board with regard tocontinuing the appointment and remuneration of theexternal auditors;overseeing the Group’s <strong>relations</strong> with the external auditorsand the effectiveness of the audit process;reviewing and assessing the effectiveness of the Group’sinternal financial controls and their application;monitoring and reviewing the effectiveness of the internal auditfunction, reviewing all reports prepared by the internal auditorsand assessing management’s responses to such reports; andreviewing and assessing the effectiveness of the Group’sinternal control and risk management systems (see pages 31to 33).During the last 12 months, the Committee sponsored a riskworkshop to confirm the Group’s key risks and its risk appetite,reviewed the controls in each business with the Heads of thePrincipal Businesses and oversaw a Pan-European client moniescontrol review.To enable it to carry out its duties and responsibilities effectively,the Committee relies on information and support frommanagement across the business.The Committee also considers on an ongoing basis theindependence of the external auditors and has establishedpolicies to consider the appropriateness or otherwise ofappointing the external auditors to perform non-audit services,including consideration as to whether the external auditors arethe most suitable supplier of such services.As detailed on page 44 the external auditors arePricewaterhouseCoopers LLP (fees included at Note 6(c) tothe financial statements). The external auditors are responsiblefor the annual audit and have also provided certain non-auditservices to the Company, principally advice on taxation matters.The approval of the Committee is required prior to awardingcontracts to the external auditors for non-audit services with avalue in excess of £100,000. Below this level the Chairman of theAudit Committee is kept appraised of new instructions given to theexternal auditors for the delivery of non-audit services. The AuditCommittee is satisfied that such work was best undertaken byPricewaterhouseCoopers LLP and the objectivity of the externalauditors has not been impaired by reason of this further work.The Group may not engage the external auditors to provide anyof the non-audit services described below:– bookkeeping or other services related to the accountingrecords or financial statements;– financial information systems design and implementation;– internal audit outsourcing services– management functions or human resources; or– advising on senior executive (including Executive Director)remuneration.The Audit Committee considers that the <strong>relations</strong>hip withthe auditors is working well and remains satisfied with theireffectiveness and continued independence. The Company’sexternal audit was last tendered in 2000 and resulted in achange of external auditors to the current external auditors,PricewaterhouseCoopers LLP. The external auditors are requiredto rotate the audit partner responsible for the Group audit everyfive years and the last partner change was in 2011. The Committeehas noted the revisions to the Code introduced by the FRC inSeptember <strong>2012</strong> and, in particular, the recommendation that theexternal audit is put out to tender at least every 10 years. The FRChas proposed non-binding transitional arrangements with respectto audit tendering, including a suggestion that tendering shouldnormally fit the five yearly cycle of partner rotation. Consequently,the Committee will consider its tendering arrangements towardsthe conclusion of the current audit partner’s period in office orearlier if it has cause to do so. There are no contractual obligationsrestricting the Company’s choice of external auditor. The Auditors’report appears on page 59.The provision of internal audit services during <strong>2012</strong> wasjointly delivered by the Group’s internal audit team and a panelarrangement with BDO LLP and Grant Thornton LLP. The Board’sresponsibility for internal control and risk is detailed on pages 41and 42.Remuneration CommitteeThe Remuneration Committee comprises the IndependentNon-Executive Directors and the Non-Executive Chairman, andwas chaired by Charles McVeigh until he ceased to be a memberof the Committee on 2 April <strong>2012</strong>. With effect from 2 April <strong>2012</strong>the Committee was chaired by Clare Hollingsworth following herappointment as a Non-Executive Director of the Company.On his retirement effective 9 May <strong>2012</strong>, Timothy Ingramceased to be a member of the Committee. The Group LegalDirector & Company Secretary is secretary to the Committee.The Committee meets at least three times a year and met fourtimes in <strong>2012</strong>.Number of possiblemeetings attendedActualmeetings attendedClare Hollingsworth(joined effective 2 April <strong>2012</strong>) 2 2Martin Angle 4 3Tim Freshwater 4 4Timothy Ingram(retired effective 9 May <strong>2012</strong>) 2 2Charles McVeigh(ceased to be a member 2 April <strong>2012</strong>) 2 2Peter Smith 4 4The Committee’s principal responsibilities are to determineCompany policy on senior executive remuneration and to agreethe remuneration arrangements of the Executive Directors andmembers of the Group Executive Board. The Committee(excluding the Non-Executive Chairman) also determines thelevel of fees payable to the Non-Executive Chairman.40 <strong>Savills</strong> <strong>plc</strong> <strong>Report</strong> and Accounts <strong>2012</strong>