Savills plc 2012 Annual Report - (PDF) - Investor relations

Savills plc 2012 Annual Report - (PDF) - Investor relations

Savills plc 2012 Annual Report - (PDF) - Investor relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

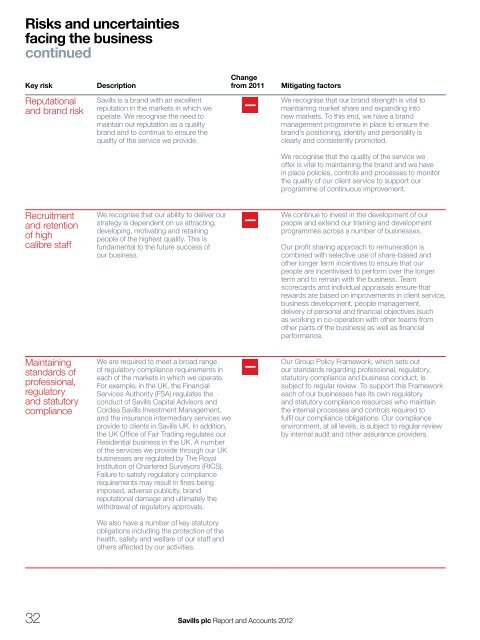

Risks and uncertaintiesfacing the businesscontinuedKey riskDescriptionChangefrom 2011Mitigating factorsReputationaland brand risk<strong>Savills</strong> is a brand with an excellentreputation in the markets in which weoperate. We recognise the need tomaintain our reputation as a qualitybrand and to continue to ensure thequality of the service we provide.We recognise that our brand strength is vital tomaintaining market share and expanding intonew markets. To this end, we have a brandmanagement programme in place to ensure thebrand’s positioning, identity and personality isclearly and consistently promoted.We recognise that the quality of the service weoffer is vital to maintaining the brand and we havein place policies, controls and processes to monitorthe quality of our client service to support ourprogramme of continuous improvement.Recruitmentand retentionof highcalibre staffWe recognise that our ability to deliver ourstrategy is dependent on us attracting,developing, motivating and retainingpeople of the highest quality. This isfundamental to the future success ofour business.We continue to invest in the development of ourpeople and extend our training and developmentprogrammes across a number of businesses.Our profit sharing approach to remuneration iscombined with selective use of share-based andother longer term incentives to ensure that ourpeople are incentivised to perform over the longerterm and to remain with the business. Teamscorecards and individual appraisals ensure thatrewards are based on improvements in client service,business development, people management,delivery of personal and financial objectives (suchas working in co-operation with other teams fromother parts of the business) as well as financialperformance.Maintainingstandards ofprofessional,regulatoryand statutorycomplianceWe are required to meet a broad rangeof regulatory compliance requirements ineach of the markets in which we operate.For example, in the UK, the FinancialServices Authority (FSA) regulates theconduct of <strong>Savills</strong> Capital Advisors andCordea <strong>Savills</strong> Investment Management,and the insurance intermediary services weprovide to clients in <strong>Savills</strong> UK. In addition,the UK Office of Fair Trading regulates ourResidential business in the UK. A numberof the services we provide through our UKbusinesses are regulated by The RoyalInstitution of Chartered Surveyors (RICS).Failure to satisfy regulatory compliancerequirements may result in fines beingimposed, adverse publicity, brandreputational damage and ultimately thewithdrawal of regulatory approvals.We also have a number of key statutoryobligations including the protection of thehealth, safety and welfare of our staff andothers affected by our activities.Our Group Policy Framework, which sets outour standards regarding professional, regulatory,statutory compliance and business conduct, issubject to regular review. To support this Frameworkeach of our businesses has its own regulatoryand statutory compliance resources who maintainthe internal processes and controls required tofulfil our compliance obligations. Our complianceenvironment, at all levels, is subject to regular reviewby internal audit and other assurance providers.32 <strong>Savills</strong> <strong>plc</strong> <strong>Report</strong> and Accounts <strong>2012</strong>