Annual report 2008 - Comrod

Annual report 2008 - Comrod

Annual report 2008 - Comrod

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

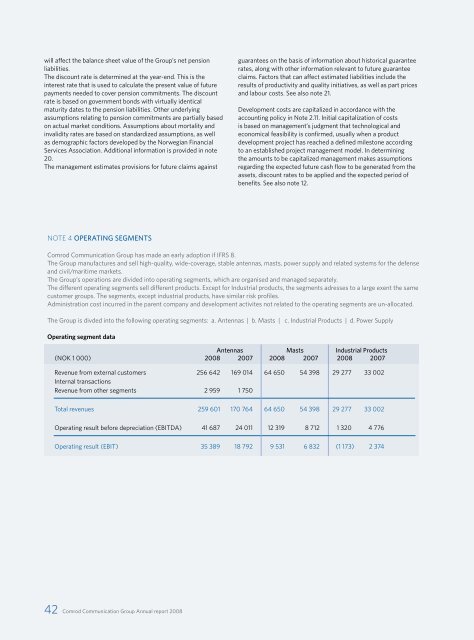

will affect the balance sheet value of the Group’s net pensionliabilities.The discount rate is determined at the year-end. This is theinterest rate that is used to calculate the present value of futurepayments needed to cover pension commitments. The discountrate is based on government bonds with virtually identicalmaturity dates to the pension liabilities. Other underlyingassumptions relating to pension commitments are partially basedon actual market conditions. Assumptions about mortality andinvalidity rates are based on standardized assumptions, as wellas demographic factors developed by the Norwegian FinancialServices Association. Additional information is provided in note20.The management estimates provisions for future claims againstguarantees on the basis of information about historical guaranteerates, along with other information relevant to future guaranteeclaims. Factors that can affect estimated liabilities include theresults of productivity and quality initiatives, as well as part pricesand labour costs. See also note 21.Development costs are capitalized in accordance with theaccounting policy in Note 2.11. Initial capitalization of costsis based on management’s judgment that technological andeconomical feasibility is confirmed, usually when a productdevelopment project has reached a defined milestone accordingto an established project management model. In determiningthe amounts to be capitalized management makes assumptionsregarding the expected future cash flow to be generated from theassets, discount rates to be applied and the expected period ofbenefits. See also note 12.NOTE 4 OPERATING SEGMENTS<strong>Comrod</strong> Communication Group has made an early adoption if IFRS 8.The Group manufactures and sell high-quality, wide-coverage, stable antennas, masts, power supply and related systems for the defenseand civil/maritime markets.The Group’s operations are divided into operating segments, which are organised and managed separately.The different operating segments sell different products. Except for Industrial products, the segments adresses to a large exent the samecustomer groups. The segments, except industrial products, have similar risk profiles.Administration cost incurred in the parent company and development activites not related to the operating segments are un-allocated.The Group is divded into the following operating segments: a. Antennas | b. Masts | c. Industrial Products | d. Power SupplyOperating segment dataAntennas Masts Industrial Products(NOK 1 000) <strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007Revenue from external customers 256 642 169 014 64 650 54 398 29 277 33 002Internal transactionsRevenue from other segments 2 959 1 750Total revenues 259 601 170 764 64 650 54 398 29 277 33 002Operating result before depreciation (EBITDA) 41 687 24 011 12 319 8 712 1 320 4 776Operating result (EBIT) 35 389 18 792 9 531 6 832 (1 173) 2 37442 <strong>Comrod</strong> Communication Group <strong>Annual</strong> <strong>report</strong> <strong>2008</strong>