Annual report 2008 - Comrod

Annual report 2008 - Comrod

Annual report 2008 - Comrod

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

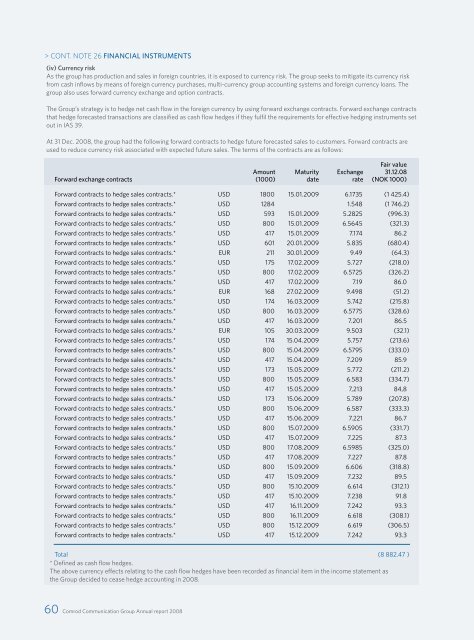

CONT. NOTE 26 FINANCIAL INSTRUMENTS(iv) Currency riskAs the group has production and sales in foreign countries, it is exposed to currency risk. The group seeks to mitigate its currency riskfrom cash inflows by means of foreign currency purchases, multi-currency group accounting systems and foreign currency loans. Thegroup also uses forward currency exchange and option contracts.The Group’s strategy is to hedge net cash flow in the foreign currency by using forward exchange contracts. Forward exchange contractsthat hedge forecasted transactions are classified as cash flow hedges if they fulfil the requirements for effective hedging instruments setout in IAS 39.At 31 Dec. <strong>2008</strong>, the group had the following forward contracts to hedge future forecasted sales to customers. Forward contracts areused to reduce currency risk associated with expected future sales. The terms of the contracts are as follows:Fair valueAmount Maturity Exchange 31.12.08Forward exchange contracts (1000) date rate (NOK 1000)Forward contracts to hedge sales contracts.* USD 1800 15.01.2009 6.1735 (1 425.4)Forward contracts to hedge sales contracts.* USD 1284 1.548 (1 746.2)Forward contracts to hedge sales contracts.* USD 593 15.01.2009 5.2825 (996.3)Forward contracts to hedge sales contracts.* USD 800 15.01.2009 6.5645 (321.3)Forward contracts to hedge sales contracts.* USD 417 15.01.2009 7.174 86.2Forward contracts to hedge sales contracts.* USD 601 20.01.2009 5.835 (680.4)Forward contracts to hedge sales contracts.* EUR 211 30.01.2009 9.49 (64.3)Forward contracts to hedge sales contracts.* USD 175 17.02.2009 5.727 (218.0)Forward contracts to hedge sales contracts.* USD 800 17.02.2009 6.5725 (326.2)Forward contracts to hedge sales contracts.* USD 417 17.02.2009 7.19 86.0Forward contracts to hedge sales contracts.* EUR 168 27.02.2009 9.498 (51.2)Forward contracts to hedge sales contracts.* USD 174 16.03.2009 5.742 (215.8)Forward contracts to hedge sales contracts.* USD 800 16.03.2009 6.5775 (328.6)Forward contracts to hedge sales contracts.* USD 417 16.03.2009 7.201 86.5Forward contracts to hedge sales contracts.* EUR 105 30.03.2009 9.503 (32.1)Forward contracts to hedge sales contracts.* USD 174 15.04.2009 5.757 (213.6)Forward contracts to hedge sales contracts.* USD 800 15.04.2009 6.5795 (333.0)Forward contracts to hedge sales contracts.* USD 417 15.04.2009 7.209 85.9Forward contracts to hedge sales contracts.* USD 173 15.05.2009 5.772 (211.2)Forward contracts to hedge sales contracts.* USD 800 15.05.2009 6.583 (334.7)Forward contracts to hedge sales contracts.* USD 417 15.05.2009 7,213 84,8Forward contracts to hedge sales contracts.* USD 173 15.06.2009 5.789 (207.8)Forward contracts to hedge sales contracts.* USD 800 15.06.2009 6.587 (333.3)Forward contracts to hedge sales contracts.* USD 417 15.06.2009 7.221 86.7Forward contracts to hedge sales contracts.* USD 800 15.07.2009 6.5905 (331.7)Forward contracts to hedge sales contracts.* USD 417 15.07.2009 7.225 87.3Forward contracts to hedge sales contracts.* USD 800 17.08.2009 6.5985 (325.0)Forward contracts to hedge sales contracts.* USD 417 17.08.2009 7.227 87.8Forward contracts to hedge sales contracts.* USD 800 15.09.2009 6.606 (318.8)Forward contracts to hedge sales contracts.* USD 417 15.09.2009 7.232 89.5Forward contracts to hedge sales contracts.* USD 800 15.10.2009 6.614 (312.1)Forward contracts to hedge sales contracts.* USD 417 15.10.2009 7.238 91.8Forward contracts to hedge sales contracts.* USD 417 16.11.2009 7.242 93.3Forward contracts to hedge sales contracts.* USD 800 16.11.2009 6.618 (308.1)Forward contracts to hedge sales contracts.* USD 800 15.12.2009 6.619 (306.5)Forward contracts to hedge sales contracts.* USD 417 15.12.2009 7.242 93.3Total (8 882.47 )* Defined as cash flow hedges.The above currency effects relating to the cash flow hedges have been recorded as financial item in the income statement asthe Group decided to cease hedge accounting in <strong>2008</strong>.60 <strong>Comrod</strong> Communication Group <strong>Annual</strong> <strong>report</strong> <strong>2008</strong>