Annual report 2008 - Comrod

Annual report 2008 - Comrod

Annual report 2008 - Comrod

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

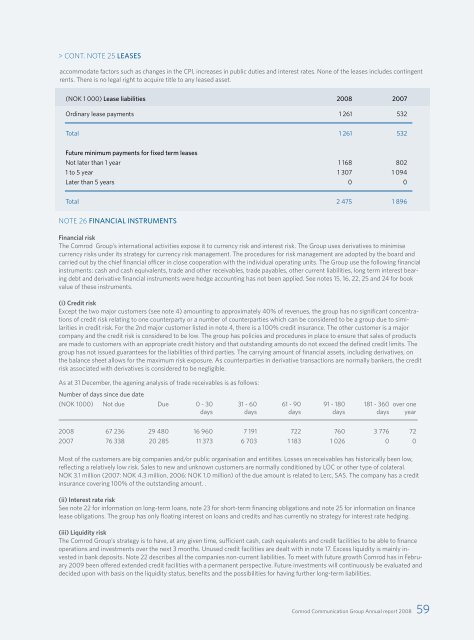

CONT. NOTE 25 LEASESaccommodate factors such as changes in the CPI, increases in public duties and interest rates. None of the leases includes contingentrents. There is no legal right to acquire title to any leased asset.(NOK 1 000) Lease liabilities <strong>2008</strong> 2007Ordinary lease payments 1 261 532Total 1 261 532Future minimum payments for fixed term leasesNot later than 1 year 1 168 8021 to 5 year 1 307 1 094Later than 5 years 0 0Total 2 475 1 896NOTE 26 FINANCIAL INSTRUMENTSFinancial riskThe <strong>Comrod</strong> Group’s international activities expose it to currency risk and interest risk. The Group uses derivatives to minimisecurrency risks under its strategy for currency risk management. The procedures for risk management are adopted by the board andcarried out by the chief financial officer in close cooperation with the individual operating units. The Group use the following financialinstruments: cash and cash equivalents, trade and other receivables, trade payables, other current liabilities, long term interest bearingdebt and derivative financial instruments were hedge accounting has not been applied. See notes 15, 16, 22, 25 and 24 for bookvalue of these instruments.(i) Credit riskExcept the two major customers (see note 4) amounting to approximately 40% of revenues, the group has no significant concentrationsof credit risk relating to one counterparty or a number of counterparties which can be considered to be a group due to similaritiesin credit risk. For the 2nd major customer listed in note 4, there is a 100% credit insurance. The other customer is a majorcompany and the credit risk is considered to be low. The group has policies and procedures in place to ensure that sales of productsare made to customers with an appropriate credit history and that outstanding amounts do not exceed the defined credit limits. Thegroup has not issued guarantees for the liabilities of third parties. The carrying amount of financial assets, including derivatives, onthe balance sheet allows for the maximum risk exposure. As counterparties in derivative transactions are normally bankers, the creditrisk associated with derivatives is considered to be negligible.As at 31 December, the agening analysis of trade receivables is as follows:Number of days since due date(NOK 1000) Not due Due 0 - 30 31 - 60 61 - 90 91 - 180 181 - 360 over onedays days days days days year<strong>2008</strong> 67 236 29 480 16 960 7 191 722 760 3 776 722007 76 338 20 285 11 373 6 703 1 183 1 026 0 0Most of the customers are big companies and/or public organisation and entitites. Losses on receivables has historically been low,reflecting a relatively low risk. Sales to new and unknown customers are normally conditioned by LOC or other type of colateral.NOK 3.1 million (2007: NOK 4.3 million, 2006: NOK 1.0 million) of the due amount is related to Lerc, SAS. The company has a creditinsurance covering 100% of the outstanding amount. .(ii) Interest rate riskSee note 22 for information on long-term loans, note 23 for short-term financing obligations and note 25 for information on financelease obligations. The group has only floating interest on loans and credits and has currently no strategy for interest rate hedging.(iii) Liquidity riskThe <strong>Comrod</strong> Group’s strategy is to have, at any given time, sufficient cash, cash equivalents and credit facilities to be able to financeoperations and investments over the next 3 months. Unused credit facilities are dealt with in note 17. Excess liquidity is mainly investedin bank deposits. Note 22 describes all the companies non-current liabilities. To meet with future growth <strong>Comrod</strong> has in February2009 been offered extended credit facilities with a permanent perspective. Future investments will continuously be evaluated anddecided upon with basis on the liquidity status, benefits and the possibilities for having further long-term liabilities.<strong>Comrod</strong> Communication Group <strong>Annual</strong> <strong>report</strong> <strong>2008</strong> 59