Annual report 2008 - Comrod

Annual report 2008 - Comrod

Annual report 2008 - Comrod

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

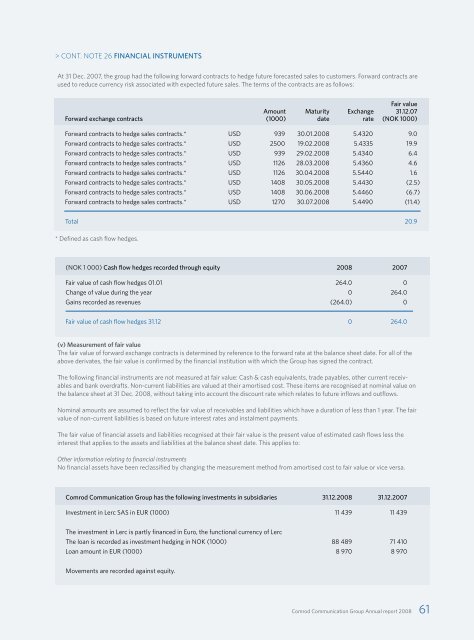

CONT. NOTE 26 FINANCIAL INSTRUMENTSAt 31 Dec. 2007, the group had the following forward contracts to hedge future forecasted sales to customers. Forward contracts areused to reduce currency risk associated with expected future sales. The terms of the contracts are as follows:Fair valueAmount Maturity Exchange 31.12.07Forward exchange contracts (1000) date rate (NOK 1000)Forward contracts to hedge sales contracts.* USD 939 30.01.<strong>2008</strong> 5.4320 9.0Forward contracts to hedge sales contracts.* USD 2500 19.02.<strong>2008</strong> 5.4335 19.9Forward contracts to hedge sales contracts.* USD 939 29.02.<strong>2008</strong> 5.4340 6.4Forward contracts to hedge sales contracts.* USD 1126 28.03.<strong>2008</strong> 5.4360 4.6Forward contracts to hedge sales contracts.* USD 1126 30.04.<strong>2008</strong> 5.5440 1.6Forward contracts to hedge sales contracts.* USD 1408 30.05.<strong>2008</strong> 5.4430 (2.5)Forward contracts to hedge sales contracts.* USD 1408 30.06.<strong>2008</strong> 5.4460 (6.7)Forward contracts to hedge sales contracts.* USD 1270 30.07.<strong>2008</strong> 5.4490 (11.4)Total 20.9* Defined as cash flow hedges.(NOK 1 000) Cash flow hedges recorded through equity <strong>2008</strong> 2007Fair value of cash flow hedges 01.01 264.0 0Change of value during the year 0 264.0Gains recorded as revenues (264.0) 0Fair value of cash flow hedges 31.12 0 264.0(v) Measurement of fair valueThe fair value of forward exchange contracts is determined by reference to the forward rate at the balance sheet date. For all of theabove derivates, the fair value is confirmed by the financial institution with which the Group has signed the contract.The following financial instruments are not measured at fair value: Cash & cash equivalents, trade payables, other current receivablesand bank overdrafts. Non-current liabilities are valued at their amortised cost. These items are recognised at nominal value onthe balance sheet at 31 Dec. <strong>2008</strong>, without taking into account the discount rate which relates to future inflows and outflows.Nominal amounts are assumed to reflect the fair value of receivables and liabilities which have a duration of less than 1 year. The fairvalue of non-current liabilities is based on future interest rates and instalment payments.The fair value of financial assets and liabilities recognised at their fair value is the present value of estimated cash flows less theinterest that applies to the assets and liabilities at the balance sheet date. This applies to:Other information relating to financial instrumentsNo financial assets have been reclassified by changing the measurement method from amortised cost to fair value or vice versa.<strong>Comrod</strong> Communication Group has the following investments in subsidiaries 31.12.<strong>2008</strong> 31.12.2007Investment in Lerc SAS in EUR (1000) 11 439 11 439The investment in Lerc is partly financed in Euro, the functional currency of LercThe loan is recorded as investment hedging in NOK (1000) 88 489 71 410Loan amount in EUR (1000) 8 970 8 970Movements are recorded against equity.<strong>Comrod</strong> Communication Group <strong>Annual</strong> <strong>report</strong> <strong>2008</strong> 61