Annual report 2008 - Comrod

Annual report 2008 - Comrod

Annual report 2008 - Comrod

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

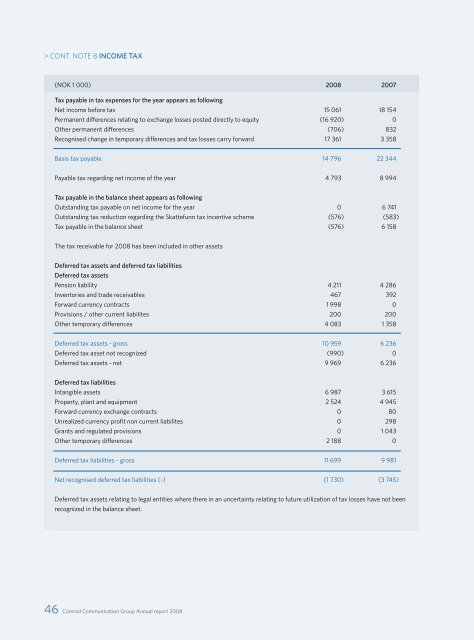

CONT. NOTE 8 INCOME TAX(NOK 1 000) <strong>2008</strong> 2007Tax payable in tax expenses for the year appears as followingNet income before tax 15 061 18 154Permanent differences relating to exchange losses posted directly to equity (16 920) 0Other permanent differences (706) 832Recognised change in temporary differences and tax losses carry forward 17 361 3 358Basis tax payable 14 796 22 344Payable tax regarding net income of the year 4 793 8 994Tax payable in the balance sheet appears as followingOutstanding tax payable on net income for the year 0 6 741Outstanding tax reduction regarding the Skattefunn tax incentive scheme (576) (583)Tax payable in the balance sheet (576) 6 158The tax receivable for <strong>2008</strong> has been included in other assetsDeferred tax assets and deferred tax liabilitiesDeferred tax assetsPension liability 4 211 4 286Inventories and trade receivables 467 392Forward currency contracts 1 998 0Provisions / other current liabilites 200 200Other temporary differences 4 083 1 358Deferred tax assets - gross 10 959 6 236Deferred tax asset not recognized (990) 0Deferred tax assets - net 9 969 6 236Deferred tax liabilitiesIntangible assets 6 987 3 615Property, plant and equipment 2 524 4 945Forward currency exchange contracts 0 80Unrealized currency profit non current liabilites 0 298Grants and regulated provisions 0 1 043Other temporary differences 2 188 0Deferred tax liabilities - gross 11 699 9 981Net recognised deferred tax liabilities (-) (1 730) (3 745)Deferred tax assets relating to legal entities where there in an uncertainty relating to future utilization of tax losses have not beenrecognized in the balance sheet.46 <strong>Comrod</strong> Communication Group <strong>Annual</strong> <strong>report</strong> <strong>2008</strong>