Annual report 2008 - Comrod

Annual report 2008 - Comrod

Annual report 2008 - Comrod

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

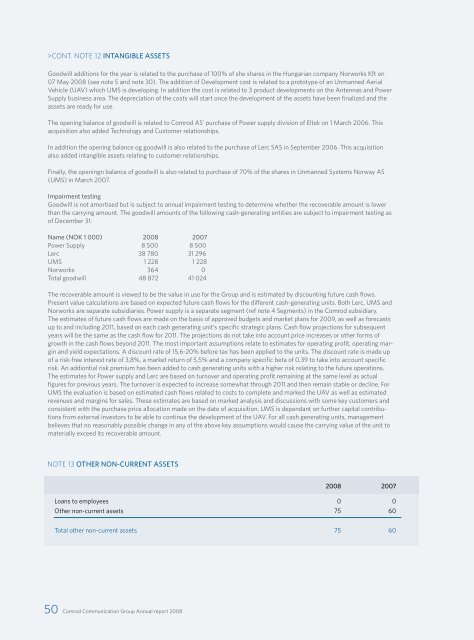

CONT. NOTE 12 INTANGIBLE ASSETSGoodwill additions for the year is related to the purchase of 100% of she shares in the Hungarian company Norworks Kft on07 May <strong>2008</strong> (see note 5 and note 30). The addition of Development cost is related to a prototype of an Unmanned AerialVehicle (UAV) which UMS is developing. In addition the cost is related to 3 product developments on the Antennas and PowerSupply business area. The depreciation of the costs will start once the development of the assets have been finalized and theassets are ready for use.The opening balance of goodwill is related to <strong>Comrod</strong> AS’ purchase of Power supply division of Eltek on 1 March 2006. Thisacquisition also added Technology and Customer relationships.In addition the opening balance og goodwill is also related to the purchase of Lerc SAS in September 2006. This acquisitionalso added intangible assets relating to customer relationships.Finally, the openingn balance of goodwill is also related to purchase of 70% of the shares in Unmanned Systems Norway AS(UMS) in March 2007.Impairment testingGoodwill is not amortised but is subject to annual impairment testing to determine whether the recoverable amount is lowerthan the carrying amount. The goodwill amounts of the following cash-generating entities are subject to impairment testing asof December 31:Name (NOK 1 000) <strong>2008</strong> 2007Power Supply 8 500 8 500Lerc 38 780 31 296UMS 1 228 1 228Norworks 364 0Total goodwill 48 872 41 024The recoverable amount is viewed to be the value in use for the Group and is estimated by discounting future cash flows.Present value calculations are based on expected future cash flows for the different cash-generating units. Both Lerc, UMS andNorworks are separate subsidiaries. Power supply is a separate segment (ref note 4 Segments) in the <strong>Comrod</strong> subsidiary.The estimates of future cash flows are made on the basis of approved budgets and market plans for 2009, as well as forecastsup to and including 2011, based on each cash generating unit’s specific strategic plans. Cash flow projections for subsequentyears will be the same as the cash flow for 2011. The projections do not take into account price increases or other forms ofgrowth in the cash flows beyond 2011. The most important assumptions relate to estimates for operating profit, operating marginand yield expectations. A discount rate of 15,6-20% before tax has been applied to the units. The discount rate is made upof a risk-free interest rate of 3,8%, a market return of 5,5% and a company specific beta of 0,39 to take into account specificrisk. An addiontial risk premium has been added to cash generating units with a higher risk relating to the future operations.The estimates for Power supply and Lerc are based on turnover and operating profit remaining at the same level as actualfigures for previous years. The turnover is expected to increase somewhat through 2011 and then remain stable or decline. ForUMS the evaluation is based on estimated cash flows related to costs to complete and marked the UAV as well as estimatedrevenues and margins for sales. These estimates are based on marked analysis and discussions with some key customers andconsistent with the purchase price allocation made on the date of acquisition. UMS is dependant on further capital contributionsfrom external investors to be able to continue the development of the UAV. For all cash generating units, managementbelieves that no reasonably possible change in any of the above key assumptions would cause the carrying value of the unit tomaterially exceed its recoverable amount.NOTE 13 OTHER NON-CURRENT ASSETS<strong>2008</strong> 2007Loans to employees 0 0Other non-current assets 75 60Total other non-current assets 75 6050 <strong>Comrod</strong> Communication Group <strong>Annual</strong> <strong>report</strong> <strong>2008</strong>