Annual report 2008 - Comrod

Annual report 2008 - Comrod

Annual report 2008 - Comrod

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

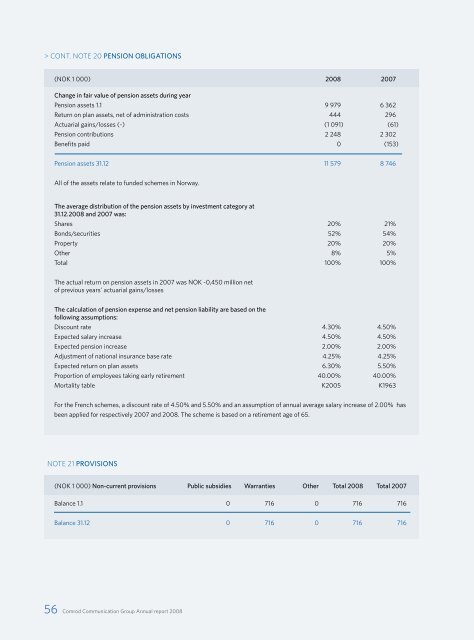

CONT. NOTE 20 PENSION OBLIGATIONS(NOK 1 000) <strong>2008</strong> 2007Change in fair value of pension assets during yearPension assets 1.1 9 979 6 362Return on plan assets, net of administration costs 444 296Actuarial gains/losses (-) (1 091) (61)Pension contributions 2 248 2 302Benefits paid 0 (153)Pension assets 31.12 11 579 8 746All of the assets relate to funded schemes in Norway.The average distribution of the pension assets by investment category at31.12.<strong>2008</strong> and 2007 was:Shares 20% 21%Bonds/securities 52% 54%Property 20% 20%Other 8% 5%Total 100% 100%The actual return on pension assets in 2007 was NOK -0,450 million netof previous years’ actuarial gains/lossesThe calculation of pension expense and net pension liability are based on thefollowing assumptions:Discount rate 4.30% 4.50%Expected salary increase 4.50% 4.50%Expected pension increase 2.00% 2.00%Adjustment of national insurance base rate 4.25% 4.25%Expected return on plan assets 6.30% 5.50%Proportion of employees taking early retirement 40.00% 40.00%Mortality table K2005 K1963For the French schemes, a discount rate of 4.50% and 5.50% and an assumption of annual average salary increase of 2.00% hasbeen applied for respectively 2007 and <strong>2008</strong>. The scheme is based on a retirement age of 65.NOTE 21 PROVISIONS(NOK 1 000) Non-current provisions Public subsidies Warranties Other Total <strong>2008</strong> Total 2007Balance 1.1 0 716 0 716 716Balance 31.12 0 716 0 716 71656 <strong>Comrod</strong> Communication Group <strong>Annual</strong> <strong>report</strong> <strong>2008</strong>