Making people successful in a changing world - Annual Report 2012

Making people successful in a changing world - Annual Report 2012

Making people successful in a changing world - Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

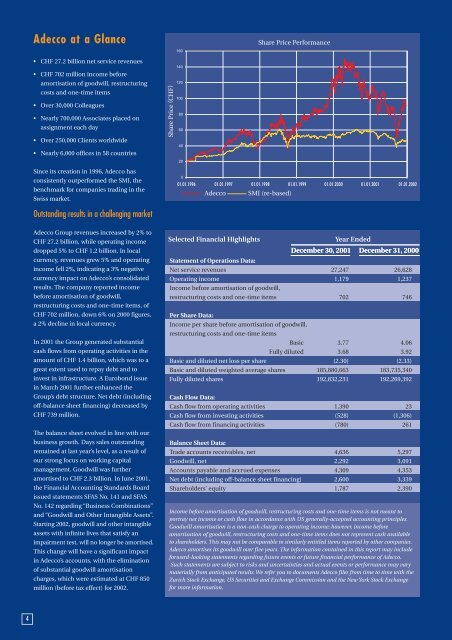

Adecco at a GlanceShare Price Performance• CHF 27.2 billion net service revenues• CHF 702 million <strong>in</strong>come beforeamortisation of goodwill, restructur<strong>in</strong>gcosts and one-time items• Over 30,000 Colleagues• Nearly 700,000 Associates placed onassignment each day• Over 250,000 Clients <strong>world</strong>wideShare Price (CHF)• Nearly 6,000 offices <strong>in</strong> 58 countriesS<strong>in</strong>ce its creation <strong>in</strong> 1996, Adecco hasconsistently outperformed the SMI, thebenchmark for companies trad<strong>in</strong>g <strong>in</strong> theSwiss market.01.01.1996 01.01.1997 01.01.1998 01.01.1999 01.01.2000 01.01.2001 01.01.2002AdeccoSMI (re-based)Outstand<strong>in</strong>g results <strong>in</strong> a challeng<strong>in</strong>g marketAdecco Group revenues <strong>in</strong>creased by 2% toCHF 27.2 billion, while operat<strong>in</strong>g <strong>in</strong>comedropped 5% to CHF 1.2 billion. In localcurrency, revenues grew 5% and operat<strong>in</strong>g<strong>in</strong>come fell 2%, <strong>in</strong>dicat<strong>in</strong>g a 3% negativecurrency impact on Adecco’s consolidatedresults. The company reported <strong>in</strong>comebefore amortisation of goodwill,restructur<strong>in</strong>g costs and one-time items, ofCHF 702 million, down 6% on 2000 figures,a 2% decl<strong>in</strong>e <strong>in</strong> local currency.In 2001 the Group generated substantialcash flows from operat<strong>in</strong>g activities <strong>in</strong> theamount of CHF 1.4 billion, which was to agreat extent used to repay debt and to<strong>in</strong>vest <strong>in</strong> <strong>in</strong>frastructure. A Eurobond issue<strong>in</strong> March 2001 further enhanced theGroup’s debt structure. Net debt (<strong>in</strong>clud<strong>in</strong>goff-balance sheet f<strong>in</strong>anc<strong>in</strong>g) decreased byCHF 739 million.The balance sheet evolved <strong>in</strong> l<strong>in</strong>e with ourbus<strong>in</strong>ess growth. Days sales outstand<strong>in</strong>grema<strong>in</strong>ed at last year’s level, as a result ofour strong focus on work<strong>in</strong>g capitalmanagement. Goodwill was furtheramortised to CHF 2.3 billion. In June 2001,the F<strong>in</strong>ancial Account<strong>in</strong>g Standards Boardissued statements SFAS No. 141 and SFASNo. 142 regard<strong>in</strong>g “Bus<strong>in</strong>ess Comb<strong>in</strong>ations”and “Goodwill and Other Intangible Assets”.Start<strong>in</strong>g 2002, goodwill and other <strong>in</strong>tangibleassets with <strong>in</strong>f<strong>in</strong>ite lives that satisfy animpairment test, will no longer be amortised.This change will have a significant impact<strong>in</strong> Adecco’s accounts, with the elim<strong>in</strong>ationof substantial goodwill amortisationcharges, which were estimated at CHF 850million (before tax effect) for 2002.Selected F<strong>in</strong>ancial HighlightsStatement of Operations Data:Year EndedDecember 30, 2001 December 31, 2000Net service revenues 27,247 26,628Operat<strong>in</strong>g <strong>in</strong>come 1,179 1,237Income before amortisation of goodwill,restructur<strong>in</strong>g costs and one-time items 702 746Per Share Data:Income per share before amortisation of goodwill,restructur<strong>in</strong>g costs and one-time itemsBasic 3.77 4.06Fully diluted 3.68 3.92Basic and diluted net loss per share (2.30) (2.33)Basic and diluted weighted average shares 185,880,663 183,735,340Fully diluted shares 192,832,231 192,269,392Cash Flow Data:Cash flow from operat<strong>in</strong>g activities 1,390 23Cash flow from <strong>in</strong>vest<strong>in</strong>g activities (528) (1,306)Cash flow from f<strong>in</strong>anc<strong>in</strong>g activities (780) 261Balance Sheet Data:Trade accounts receivables, net 4,636 5,297Goodwill, net 2,292 3,091Accounts payable and accrued expenses 4,309 4,353Net debt (<strong>in</strong>clud<strong>in</strong>g off-balance sheet f<strong>in</strong>anc<strong>in</strong>g) 2,600 3,339Shareholders’ equity 1,787 2,390Income before amortisation of goodwill, restructur<strong>in</strong>g costs and one-time items is not meant toportray net <strong>in</strong>come or cash flow <strong>in</strong> accordance with US generally-accepted account<strong>in</strong>g pr<strong>in</strong>ciples.Goodwill amortisation is a non-cash charge to operat<strong>in</strong>g <strong>in</strong>come; however, <strong>in</strong>come beforeamortisation of goodwill, restructur<strong>in</strong>g costs and one-time items does not represent cash availableto shareholders. This may not be comparable to similarly entitled items reported by other companies.Adecco amortises its goodwill over five years. The <strong>in</strong>formation conta<strong>in</strong>ed <strong>in</strong> this report may <strong>in</strong>cludeforward-look<strong>in</strong>g statements regard<strong>in</strong>g future events or future f<strong>in</strong>ancial performance of Adecco.Such statements are subject to risks and uncerta<strong>in</strong>ties and actual events or performance may varymaterially from anticipated results. We refer you to documents Adecco files from time to time with theZurich Stock Exchange, US Securities and Exchange Commission and the New York Stock Exchangefor more <strong>in</strong>formation.4