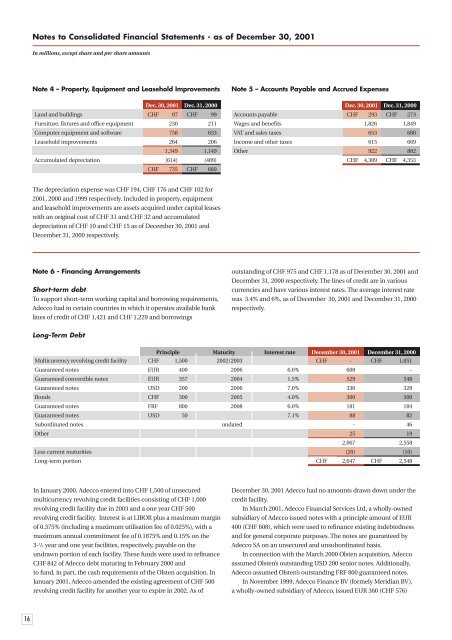

Notes to Consolidated F<strong>in</strong>ancial Statements - as of December 30, 2001In millions, except share and per share amountsNote 4 – Property, Equipment and Leasehold ImprovementsDec. 30, 2001 Dec. 31, 2000Land and build<strong>in</strong>gs CHF 97 CHF 99Furniture, fixtures and office equipment 230 211Computer equipment and software 758 633Leasehold improvements 264 2061,349 1,149Accumulated depreciation (614) (489)CHF 735 CHF 660Note 5 – Accounts Payable and Accrued ExpensesDec. 30, 2001 Dec. 31, 2000Accounts payable CHF 293 CHF 273Wages and benefits 1,826 1,849VAT and sales taxes 653 680Income and other taxes 615 669Other 922 882CHF 4,309 CHF 4,353The depreciation expense was CHF 194, CHF 176 and CHF 102 for2001, 2000 and 1999 respectively. Included <strong>in</strong> property, equipmentand leasehold improvements are assets acquired under capital leaseswith an orig<strong>in</strong>al cost of CHF 31 and CHF 32 and accumulateddepreciation of CHF 10 and CHF 15 as of December 30, 2001 andDecember 31, 2000 respectively.Note 6 - F<strong>in</strong>anc<strong>in</strong>g ArrangementsShort-term debtTo support short-term work<strong>in</strong>g capital and borrow<strong>in</strong>g requirements,Adecco had <strong>in</strong> certa<strong>in</strong> countries <strong>in</strong> which it operates available bankl<strong>in</strong>es of credit of CHF 1,421 and CHF 1,229 and borrow<strong>in</strong>gsoutstand<strong>in</strong>g of CHF 975 and CHF 1,178 as of December 30, 2001 andDecember 31, 2000 respectively. The l<strong>in</strong>es of credit are <strong>in</strong> variouscurrencies and have various <strong>in</strong>terest rates. The average <strong>in</strong>terest ratewas 3.4% and 6%, as of December 30, 2001 and December 31, 2000respectively.Long-Term DebtPr<strong>in</strong>ciple Maturity Interest rate December 30, 2001 December 31, 2000Multicurrency revolv<strong>in</strong>g credit facility CHF 1,500 2002/2003 CHF - CHF 1,051Guaranteed notes EUR 400 2006 6.0% 608 -Guaranteed convertible notes EUR 357 2004 1.5% 529 548Guaranteed notes USD 200 2006 7.0% 336 328Bonds CHF 300 2005 4.0% 300 300Guaranteed notes FRF 800 2008 6.0% 181 184Guaranteed notes USD 50 7.1% 88 82Subord<strong>in</strong>ated notes undated - 46Other 25 192,067 2,558Less current maturities (20) (10)Long-term portion CHF 2,047 CHF 2,548In January 2000, Adecco entered <strong>in</strong>to CHF 1,500 of unsecuredmulticurrency revolv<strong>in</strong>g credit facilities consist<strong>in</strong>g of CHF 1,000revolv<strong>in</strong>g credit facility due <strong>in</strong> 2003 and a one year CHF 500revolv<strong>in</strong>g credit facility. Interest is at LIBOR plus a maximum marg<strong>in</strong>of 0.375% (<strong>in</strong>clud<strong>in</strong>g a maximum utilisation fee of 0.025%), with amaximum annual commitment fee of 0.1875% and 0.15% on the3- 1 /2 year and one year facilities, respectively, payable on theundrawn portion of each facility. These funds were used to ref<strong>in</strong>anceCHF 842 of Adecco debt matur<strong>in</strong>g <strong>in</strong> February 2000 andto fund, <strong>in</strong> part, the cash requirements of the Olsten acquisition. InJanuary 2001, Adecco amended the exist<strong>in</strong>g agreement of CHF 500revolv<strong>in</strong>g credit facility for another year to expire <strong>in</strong> 2002. As ofDecember 30, 2001 Adecco had no amounts drawn down under thecredit facility.In March 2001, Adecco F<strong>in</strong>ancial Services Ltd, a wholly-ownedsubsidiary of Adecco issued notes with a pr<strong>in</strong>ciple amount of EUR400 (CHF 608), which were used to ref<strong>in</strong>ance exist<strong>in</strong>g <strong>in</strong>debtednessand for general corporate purposes. The notes are guaranteed byAdecco SA on an unsecured and unsubord<strong>in</strong>ated basis.In connection with the March 2000 Olsten acquisition, Adeccoassumed Olsten’s outstand<strong>in</strong>g USD 200 senior notes. Additionally,Adecco assumed Olsten’s outstand<strong>in</strong>g FRF 800 guaranteed notes.In November 1999, Adecco F<strong>in</strong>ance BV (formely Meridian BV),a wholly-owned subsidiary of Adecco, issued EUR 360 (CHF 576)16

Notes to Consolidated F<strong>in</strong>ancial Statements - as of December 30, 2001In millions, except share and per share amountsconvertible notes. The notes were redeemable for the pr<strong>in</strong>cipalamount together with accrued <strong>in</strong>terest at the option of the noteholder only on November 25, 2001. Certa<strong>in</strong> of the note holdersexercised their redemption right on their notes for the pr<strong>in</strong>cipalamount totall<strong>in</strong>g EUR 3. The notes are convertible <strong>in</strong>to Adeccoshares assum<strong>in</strong>g a share price of CHF 107.24 and an exchange rateof CHF 1.6084 per Euro. The rema<strong>in</strong><strong>in</strong>g balance of the notes isconvertible <strong>in</strong>to 5,361,150 shares of Adecco SA.In connection with the 1999 Delphi acquisition, Adecco assumedDelphi’s outstand<strong>in</strong>g USD 50 guaranteed senior note. Interest on thenote is payable semi-annually and the pr<strong>in</strong>cipal amount of the noteis repayable <strong>in</strong> six equal annual <strong>in</strong>stalments commenc<strong>in</strong>g June 2002.Upon adoption of SFAS No. 133 as of January 1, 2001 “Account<strong>in</strong>gfor Derivative Instruments and Hedg<strong>in</strong>g Activities”, subord<strong>in</strong>atedundated notes of CHF 72 have been reclassified from debt to otherliabilities. (see Note 13).Under the terms of the various short and long-term creditagreements, Adecco is subject to covenants requir<strong>in</strong>g, among otherth<strong>in</strong>gs, compliance with certa<strong>in</strong> f<strong>in</strong>ancial tests and ratios. As ofDecember 30, 2001, Adecco was <strong>in</strong> compliance with all f<strong>in</strong>ancialcovenants.Payments of long-term debt are due as follows:Fiscal year2002 CHF 202003 222004 5502005 6542006 624Thereafter 197CHF 2,067Note 7 – Shareholders’ EquityAdecco’s shareholders’ equity consists of common shares andparticipation certificates, each with par value CHF 1.00.Participation certificates entitle the holder to receive dividends,other distributions and liquidation proceeds to the extent suchpayments are made to the holders of common stock. Participationcertificates are non-vot<strong>in</strong>g.Included <strong>in</strong> treasury stock are common shares of 129,558 and133,410 and participation certificates of 43,260 and 42,020 as ofDecember 30, 2001 and December 31, 2000 respectively. Treasurystock is generally reserved to support option exercises under stockoption plans.On May 2, 2001, the annual general meet<strong>in</strong>g of shareholdersapproved the changes of authorised and conditional capital(authorised but not issued shares).As of December 30, 2001 19,000,000 common shares werereserved for issuance <strong>in</strong> case of special capital market transactions,such as acquisitions.Adecco had 7,082,612 and 5,267,760 common shares reserved forissuance of common shares to employees and directors upon theexercise of stock options as of December 30, 2001 and December 31,2000 respectively. Additionally, 5,399,880 and 7,000,000 commonshares were reserved for issuance for f<strong>in</strong>ancial <strong>in</strong>struments, such asconvertible bonds as of December 30, 2001 and December 31, 2000.On May 2, 2001, the annual general meet<strong>in</strong>g of shareholdersapproved the split of all common shares by 10 for 1 and allparticipation certificates by 2 for 1, effective May 14, 2001. The parvalue of common shares was reduced from CHF 10.00 to CHF 1.00and the par value of the participation certificates was reduced fromCHF 2.00 to CHF 1.00.Adecco may only pay dividends out of unappropriated reta<strong>in</strong>edearn<strong>in</strong>gs disclosed <strong>in</strong> the annual f<strong>in</strong>ancial statements of Adecco SA(“Hold<strong>in</strong>g Company”), prepared <strong>in</strong> accordance with Swiss law and asapproved at the annual general meet<strong>in</strong>g of shareholders. TheseHold<strong>in</strong>g Company f<strong>in</strong>ancial statements present unappropriatedreta<strong>in</strong>ed earn<strong>in</strong>gs of CHF 1,433 as of December 31, 2001.Note 8 – Stock Option PlansAs of December 30, 2001, Adecco had options outstand<strong>in</strong>g relat<strong>in</strong>g toits common shares under several exist<strong>in</strong>g plans and plans assumed<strong>in</strong> the Olsten acquisition. Under these plans, options vest andbecome exercisable <strong>in</strong> <strong>in</strong>stalments, generally on a ratable basis overtwo to five years beg<strong>in</strong>n<strong>in</strong>g on the day of the grant or one year afterthe date of grant, and have a contractual life of three to ten years.Adecco applies APB Op<strong>in</strong>ion No. 25 “Account<strong>in</strong>g for Stock Issuedto Employees” and related <strong>in</strong>terpretations <strong>in</strong> account<strong>in</strong>g for its plans.No compensation cost has been recognised for its stock optionplans. Had compensation cost for Adecco’s stock-basedcompensation plans been determ<strong>in</strong>ed based on the fair value atthe grant dates for awards under those plans consistent withSFAS No. 123, “Account<strong>in</strong>g for Stock-Based Compensation”, Adecco’snet loss and loss per share would have <strong>in</strong>creased to the pro formaamounts <strong>in</strong>dicated <strong>in</strong> the follow<strong>in</strong>g table:17