14 <strong>Compass</strong> <strong>Group</strong> PLC Annual Report 2007Business reviewcontinuedNorth America40.5% <strong>Group</strong> revenue (2006: 41.8%)North America continues to make excellentprogress across a broad and well balancedportfolio. We have seen good organic revenuegrowth, with a much better balance betweennew contracts and like for like growth. TheBusiness & Industry sector has been driventhrough innovation, delivering 4% like for likerevenue growth. We have had considerablesuccess in creating a multi-service business inthe Healthcare sector through cross-sellingbetween Morrison, our foodservice business,and Crothall, our support services business. Tosupport this we completed an infill acquisition,on 1 October 2007, of a company with£37 million of revenues called Propoco Inc(‘Professional Services’) whose services andbusiness model align very closely to Crothall.Healthy eating programmes and the strengthof the Chartwells brand contributed to 9%organic revenue growth in the Educationsector. Combined with good progress inLevy, our Sports & Leisure business, and inthe Canadian business, North Americadelivered 6% organic revenue growth overall.The pipeline into 2008 looks healthy.Operating profit increased by £39 million,or 18%, on a constant currency basis to£261 million (2006: £222 million on aconstant currency basis), and we have seena step change in the margin of 60 basispoints to 6.3%. Around half of the margingrowth has come from a significant one-offreduction in overheads. The remainder ofthe improvement is the result of better like forlike growth and ongoing operating efficienciesacross the businesses, both in in-unit andabove unit overheads. We have seen animprovement in margin of 40 basis points,from 6.1% in the first half to 6.5% in thesecond half.Continental Europe24.9% <strong>Group</strong> revenue (2006: 24.2%)Organic revenue growth in ContinentalEurope has doubled to 4%, with good growthopportunities for the future. In Spain, goodlike for like growth, driven by new offeringsand an increase in consumer numbers,together with strong new business in theHealthcare and Education sectors resultedin organic revenue growth of 13%. Thecontinued high activity in the oil and gasindustry in the Nordic region has contributedto 14% organic revenue growth, while thefocus on healthy eating continues to driveincreasing volumes through much of theregion. We are becoming more establishedin the Eastern European market with ourbusinesses there growing well.On a constant currency basis, growth of£31 million, or 26%, in operating profitfrom continuing operations to £151 million(2006: £120 million on a constant currencybasis) represents a margin improvementof 100 basis points. Just over half ofthis improvement is attributable to thecompletion of the turnaround of previouslyunderperforming countries such as Franceand the Netherlands. The remaining margingrowth has come from improved like forlike revenue growth, which is at a highdrop through to margin, and focus on costcontrol across all countries. It is importantto remember that the seasonality of thisbusiness, with the reduction in headcountsin the Business & Industry sector over thesummer period and the closure of schools,means that we record stronger profits andmargin in the first half, 6.5%, compared tothe second half, 5.3%. The underlying trendsin the first and second half margin in 2007are similar to 2006.UK18.8% <strong>Group</strong> revenue (2006: 18.3%)The UK business has delivered a solid resultwith, as expected, operating profits in linewith last year.Fundamentally we have a very strong businessin the UK. We have continued to work hardto fix the basics and build a solid foundationfor the future. Good progress has been madeby the new senior management team: thework to improve or exit loss-making contractsis now largely complete; we have continuedto reorganise across the business to drivefurther efficiencies; and Education, aftera difficult period, is now stabilised.Although the organisation of the business ismuch improved there is still more work to do.As such, we expect the performance of thebusiness to be broadly similar in 2008.Rest of the World15.8% <strong>Group</strong> revenue (2006: 15.7%)In the Rest of the World our two largestbusinesses, Australia and Japan, togetheraccount for 52% of revenue. Australia hascontinued to deliver strong organic revenuegrowth driven by the continued buoyancyof the extraction industries. In addition tothis, with the help of the MAP programme,Australia has made good progress indeveloping its margin.In Japan, the focus has been on drivingefficiency. By restructuring the business andincreasing the focus on cost efficiency wehave seen good improvement in the margin.There is still more to do and we need towork harder to drive revenue growth, butwe are very encouraged by the progress inthe business over the last year.Good progress has been made in LatinAmerica and the UAE with a healthy mixof revenue and profit growth.Overall, the Rest of the World has hadanother very strong year, delivering £64million operating profit from continuingoperations (2006: £43 million on a constantcurrency basis), an increase of £21 million,or 49%, on a constant currency basis. Thisrepresents margin growth of 100 basis points,approximately half of which has come fromthe step change in lower margin countriessuch as Japan and the mobilisation of strongnew business, particularly in Australia andLatin America. In August, the <strong>Group</strong> sold asignificant part of its remaining high streetretail restaurants business in Japan for£26 million. The business recorded annualoperating profits of around £4 million inthe year.There remains significant opportunity tofurther develop our businesses in the Restof the World both in size and operatingperformance.Unallocated overheadsUnallocated overheads for the year were£58 million (2006: £66 million). The decreaseis largely due to the absence of non-recurringrestructuring costs last year and overheadefficiencies, partly offset by the strengtheningof central functions.Operating profitOperating profit from continuing operations,including associates, was £529 million(2006: £457 million), an increase of 16%on a reported basis. The operating profitincreased by £101 million on a constantcurrency basis, up 24%. This represents a70 basis point improvement in margin.Finance costUnderlying net finance cost, excludingrevaluation gains and losses on swaps andhedging instruments (hedge accountingineffectiveness), was £87 million(2006: £145 million). With the full yearbenefit of the Selecta disposal proceedsgoing forward, we expect the 2008 underlyingfinance charge to be around £70 million.Profit before taxProfit before tax from continuing operationswas £436 million (2006: £323 million).On an underlying basis, excludingrevaluation gains and losses on swaps andhedging instruments (hedge accountingineffectiveness), profit before tax fromcontinuing operations increased by 42%to £442 million (2006: £312 million).Income tax expenseOn an underlying basis, excluding revaluationgains and losses on swaps and hedginginstruments (hedge accounting ineffectiveness),the tax charge from continuing operations andbefore exceptional items was £126 million(2006: £101 million), an effective tax rate of29% (2006: 32%). Against the backgroundof reducing corporate tax rates in a numberof territories, we now expect the <strong>Group</strong>’seffective tax rate to average out at aroundthe 29% level for the short-term.Discontinued operationsOn 2 July 2007, the <strong>Group</strong> completed the saleof its European vending business, Selecta, fora consideration of £772 million on a debt andcash free basis. The <strong>Group</strong> has also completed

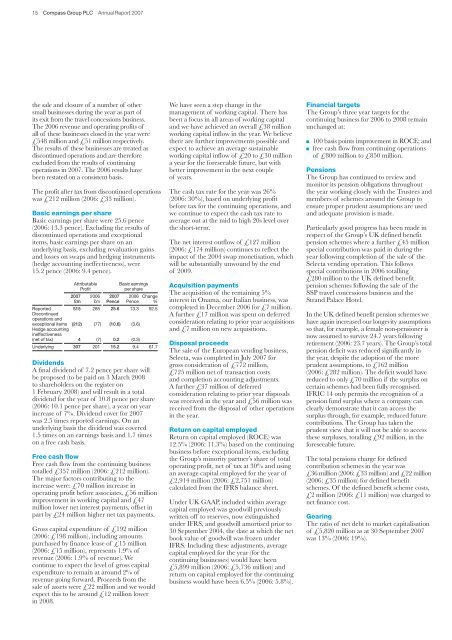

15 <strong>Compass</strong> <strong>Group</strong> PLC Annual Report 2007the sale and closure of a number of othersmall businesses during the year as part ofits exit from the travel concessions business.The 2006 revenue and operating profits ofall of these businesses closed in the year were£548 million and £51 million respectively.The results of these businesses are treated asdiscontinued operations and are thereforeexcluded from the results of continuingoperations in 2007. The 2006 results havebeen restated on a consistent basis.The profit after tax from discontinued operationswas £212 million (2006: £33 million).Basic earnings per shareBasic earnings per share were 25.6 pence(2006: 13.3 pence). Excluding the results ofdiscontinued operations and exceptionalitems, basic earnings per share on anunderlying basis, excluding revaluation gainsand losses on swaps and hedging instruments(hedge accounting ineffectiveness), were15.2 pence (2006: 9.4 pence).Attributable Basic earningsProfitper share2007 2006 2007 2006 Change£m £m Pence Pence %Reported 515 285 25.6 13.3 92.5Discontinuedoperations andexceptional items (212) (77) (10.6) (3.6)Hedge accountingineffectiveness(net of tax) 4 (7) 0.2 (0.3)Underlying 307 201 15.2 9.4 61.7DividendsA final dividend of 7.2 pence per share willbe proposed (to be paid on 3 March 2008to shareholders on the register on1 February 2008) and will result in a totaldividend for the year of 10.8 pence per share(2006: 10.1 pence per share), a year on yearincrease of 7%. Dividend cover for 2007was 2.5 times reported earnings. On anunderlying basis the dividend was covered1.5 times on an earnings basis and 1.7 timeson a free cash basis.Free cash flowFree cash flow from the continuing businesstotalled £357 million (2006: £212 million).The major factors contributing to theincrease were: £70 million increase inoperating profit before associates, £56 millionimprovement in working capital and £47million lower net interest payments, offset inpart by £24 million higher net tax payments.Gross capital expenditure of £192 million(2006: £198 million), including amountspurchased by finance lease of £15 million(2006: £15 million), represents 1.9% ofrevenue (2006: 1.9% of revenue). Wecontinue to expect the level of gross capitalexpenditure to remain at around 2% ofrevenue going forward. Proceeds from thesale of assets were £22 million and we wouldexpect this to be around £12 million lowerin 2008.We have seen a step change in themanagement of working capital. There hasbeen a focus in all areas of working capitaland we have achieved an overall £38 millionworking capital inflow in the year. We believethere are further improvements possible andexpect to achieve an average sustainableworking capital inflow of £20 to £30 milliona year for the foreseeable future, but withbetter improvement in the next coupleof years.The cash tax rate for the year was 26%(2006: 30%), based on underlying profitbefore tax for the continuing operations, andwe continue to expect the cash tax rate toaverage out at the mid to high 20s level overthe short-term.The net interest outflow of £127 million(2006: £174 million) continues to reflect theimpact of the 2004 swap monetisation, whichwill be substantially unwound by the endof 2009.Acquisition paymentsThe acquisition of the remaining 5%interest in Onama, our Italian business, wascompleted in December 2006 for £7 million.A further £17 million was spent on deferredconsideration relating to prior year acquisitionsand £7 million on new acquisitions.Disposal proceedsThe sale of the European vending business,Selecta, was completed in July 2007 forgross consideration of £772 million,£725 million net of transaction costsand completion accounting adjustments.A further £37 million of deferredconsideration relating to prior year disposalswas received in the year and £56 million wasreceived from the disposal of other operationsin the year.Return on capital employedReturn on capital employed (ROCE) was12.5% (2006: 11.3%) based on the continuingbusiness before exceptional items, excludingthe <strong>Group</strong>’s minority partner’s share of totaloperating profit, net of tax at 30% and usingan average capital employed for the year of£2,914 million (2006: £2,751 million)calculated from the IFRS balance sheet.Under UK GAAP, included within averagecapital employed was goodwill previouslywritten off to reserves, now extinguishedunder IFRS, and goodwill amortised prior to30 September 2004, the date at which the netbook value of goodwill was frozen underIFRS. Including these adjustments, averagecapital employed for the year (for thecontinuing businesses) would have been£5,899 million (2006: £5,736 million) andreturn on capital employed for the continuingbusiness would have been 6.5% (2006: 5.8%).Financial targetsThe <strong>Group</strong>’s three year targets for thecontinuing business for 2006 to 2008 remainunchanged at:100 basis points improvement in ROCE; andfree cash flow from continuing operationsof £800 million to £850 million.PensionsThe <strong>Group</strong> has continued to review andmonitor its pension obligations throughoutthe year working closely with the Trustees andmembers of schemes around the <strong>Group</strong> toensure proper prudent assumptions are usedand adequate provision is made.Particularly good progress has been made inrespect of the <strong>Group</strong>’s UK defined benefitpension schemes where a further £45 millionspecial contribution was paid in during theyear following completion of the sale of theSelecta vending operation. This followsspecial contributions in 2006 totalling£280 million to the UK defined benefitpension schemes following the sale of theSSP travel concessions business and theStrand Palace Hotel.In the UK defined benefit pension schemes wehave again increased our longevity assumptionsso that, for example, a female non-pensioner isnow assumed to survive 24.7 years followingretirement (2006: 23.7 years). The <strong>Group</strong>’s totalpension deficit was reduced significantly inthe year, despite the adoption of the moreprudent assumptions, to £162 million(2006: £282 million). The deficit would havereduced to only £70 million if the surplus oncertain schemes had been fully recognised.IFRIC 14 only permits the recognition of apension fund surplus where a company canclearly demonstrate that it can access thesurplus through, for example, reduced futurecontributions. The <strong>Group</strong> has taken theprudent view that it will not be able to accessthese surpluses, totalling £92 million, in theforeseeable future.The total pensions charge for definedcontribution schemes in the year was£36 million (2006: £33 million) and £22 million(2006: £35 million) for defined benefitschemes. Of the defined benefit scheme costs,£2 million (2006: £11 million) was charged tonet finance cost.GearingThe ratio of net debt to market capitalisationof £5,820 million as at 30 September 2007was 13% (2006: 19%).