2568.11 kb - Compass Group

2568.11 kb - Compass Group

2568.11 kb - Compass Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

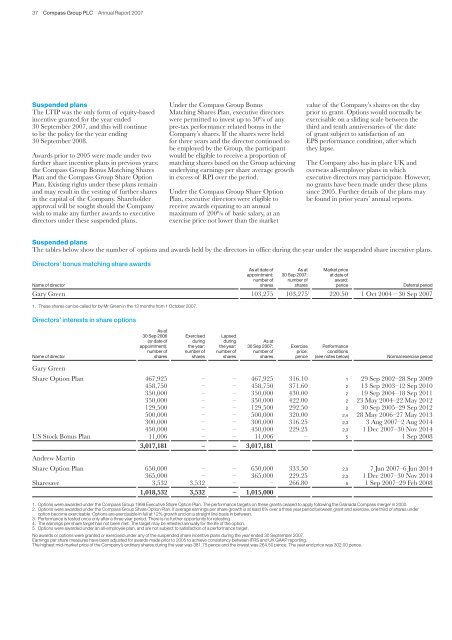

37 <strong>Compass</strong> <strong>Group</strong> PLC Annual Report 2007Suspended plansThe LTIP was the only form of equity-basedincentive granted for the year ended30 September 2007, and this will continueto be the policy for the year ending30 September 2008.Awards prior to 2005 were made under twofurther share incentive plans in previous years:the <strong>Compass</strong> <strong>Group</strong> Bonus Matching SharesPlan and the <strong>Compass</strong> <strong>Group</strong> Share OptionPlan. Existing rights under these plans remainand may result in the vesting of further sharesin the capital of the Company. Shareholderapproval will be sought should the Companywish to make any further awards to executivedirectors under these suspended plans.Under the <strong>Compass</strong> <strong>Group</strong> BonusMatching Shares Plan, executive directorswere permitted to invest up to 50% of anypre-tax performance related bonus in theCompany’s shares. If the shares were heldfor three years and the director continued tobe employed by the <strong>Group</strong>, the participantwould be eligible to receive a proportion ofmatching shares based on the <strong>Group</strong> achievingunderlying earnings per share average growthin excess of RPI over the period.Under the <strong>Compass</strong> <strong>Group</strong> Share OptionPlan, executive directors were eligible toreceive awards equating to an annualmaximum of 200% of basic salary, at anexercise price not lower than the marketvalue of the Company’s shares on the dayprior to grant. Options would normally beexercisable on a sliding scale between thethird and tenth anniversaries of the dateof grant subject to satisfaction of anEPS performance condition, after whichthey lapse.The Company also has in place UK andoverseas all-employee plans in whichexecutive directors may participate. However,no grants have been made under these planssince 2005. Further details of the plans maybe found in prior years’ annual reports.Suspended plansThe tables below show the number of options and awards held by the directors in office during the year under the suspended share incentive plans.Directors’ bonus matching share awardsAs at date of As at Market priceappointment: 30 Sep 2007: at date ofnumber of number of award:Name of director shares shares pence Deferral periodGary Green 103,275 103,275 1 220.50 1 Oct 2004 – 30 Sep 20071. These shares can be called for by Mr Green in the 12 months from 1 October 2007.Directors’ interests in share optionsAs at30 Sep 2006 Exercised Lapsed(or date of during during As atappointment): the year: the year: 30 Sep 2007: Exercise Performancenumber of number of number of number of price: conditionsName of director shares shares shares shares pence (see notes below) Normal exercise periodGary GreenShare Option Plan 467,925 – – 467,925 316.10 1 29 Sep 2002–28 Sep 2009458,750 – – 458,750 371.60 2 13 Sep 2003–12 Sep 2010350,000 – – 350,000 430.00 2 19 Sep 2004–18 Sep 2011350,000 – – 350,000 422.00 2 23 May 2004–22 May 2012129,500 – – 129,500 292.50 2 30 Sep 2005–29 Sep 2012500,000 – – 500,000 320.00 2,4 28 May 2006–27 May 2013300,000 – – 300,000 316.25 2,3 3 Aug 2007–2 Aug 2014450,000 – – 450,000 229.25 2,3 1 Dec 2007–30 Nov 2014US Stock Bonus Plan 11,006 – – 11,006 – 5 1 Sep 20083,017,181 – – 3,017,181Andrew MartinShare Option Plan 650,000 – – 650,000 333.50 2,3 7 Jun 2007–6 Jun 2014365,000 – – 365,000 229.25 2,3 1 Dec 2007–30 Nov 2014Sharesave 3,532 3,532 – – 266.80 5 1 Sep 2007–29 Feb 20081,018,532 3,532 – 1,015,0001. Options were awarded under the <strong>Compass</strong> <strong>Group</strong> 1999 Executive Share Option Plan. The performance targets on these grants ceased to apply following the Granada <strong>Compass</strong> merger in 2000.2. Options were awarded under the <strong>Compass</strong> <strong>Group</strong> Share Option Plan. If average earnings per share growth is at least 6% over a three year period between grant and exercise, one third of shares underoption become exercisable. Options are exercisable in full at 12% growth and on a straight line basis in between.3. Performance is tested once only after a three year period. There is no further opportunity for retesting.4. The earnings per share target has not been met. The target may be retested annually for the life of the option.5. Options were awarded under an all-employee plan, and are not subject to satisfaction of a performance target.No awards or options were granted or exercised under any of the suspended share incentive plans during the year ended 30 September 2007.Earnings per share measures have been adjusted for awards made prior to 2005 to achieve consistency between IFRS and UK GAAP reporting.The highest mid-market price of the Company’s ordinary shares during the year was 381.75 pence and the lowest was 264.50 pence. The year end price was 302.00 pence.