2568.11 kb - Compass Group

2568.11 kb - Compass Group

2568.11 kb - Compass Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

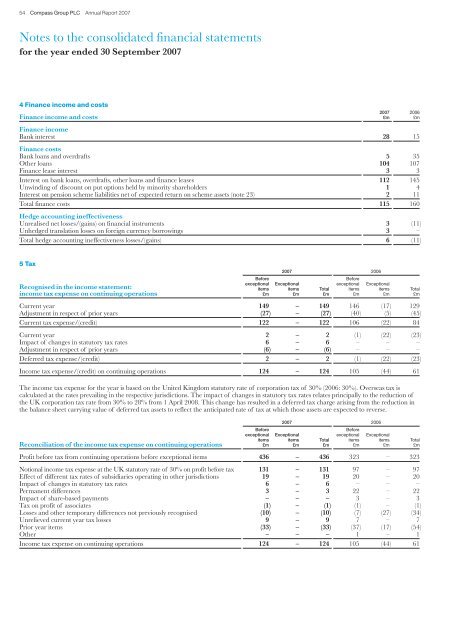

54 <strong>Compass</strong> <strong>Group</strong> PLC Annual Report 2007Notes to the consolidated financial statementsfor the year ended 30 September 20074 Finance income and costs2007 2006Finance income and costs £m £mFinance incomeBank interest 28 15Finance costsBank loans and overdrafts 5 35Other loans 104 107Finance lease interest 3 3Interest on bank loans, overdrafts, other loans and finance leases 112 145Unwinding of discount on put options held by minority shareholders 1 4Interest on pension scheme liabilities net of expected return on scheme assets (note 23) 2 11Total finance costs 115 160Hedge accounting ineffectivenessUnrealised net losses/(gains) on financial instruments 3 (11)Unhedged translation losses on foreign currency borrowings 3 –Total hedge accounting ineffectiveness losses/(gains) 6 (11)5 Tax2007 2006BeforeBeforeexceptional Exceptional exceptional ExceptionalRecognised in the income statement: items items Total items items Totalincome tax expense on continuing operations £m £m £m £m £m £mCurrent year 149 – 149 146 (17) 129Adjustment in respect of prior years (27) – (27) (40) (5) (45)Current tax expense/(credit) 122 – 122 106 (22) 84Current year 2 – 2 (1) (22) (23)Impact of changes in statutory tax rates 6 – 6 – – –Adjustment in respect of prior years (6) – (6) – – –Deferred tax expense/(credit) 2 – 2 (1) (22) (23)Income tax expense/(credit) on continuing operations 124 – 124 105 (44) 61The income tax expense for the year is based on the United Kingdom statutory rate of corporation tax of 30% (2006: 30%). Overseas tax iscalculated at the rates prevailing in the respective jurisdictions. The impact of changes in statutory tax rates relates principally to the reduction ofthe UK corporation tax rate from 30% to 28% from 1 April 2008. This change has resulted in a deferred tax charge arising from the reduction inthe balance sheet carrying value of deferred tax assets to reflect the anticipated rate of tax at which those assets are expected to reverse.Before2007 2006exceptional Exceptional exceptional Exceptionalitems items Total items items TotalReconciliation of the income tax expense on continuing operations £m £m £m £m £m £mProfit before tax from continuing operations before exceptional items 436 – 436 323 – 323Notional income tax expense at the UK statutory rate of 30% on profit before tax 131 – 131 97 – 97Effect of different tax rates of subsidiaries operating in other jurisdictions 19 – 19 20 – 20Impact of changes in statutory tax rates 6 – 6 – – –Permanent differences 3 – 3 22 – 22Impact of share-based payments – – – 3 – 3Tax on profit of associates (1) – (1) (1) – (1)Losses and other temporary differences not previously recognised (10) – (10) (7) (27) (34)Unrelieved current year tax losses 9 – 9 7 – 7Prior year items (33) – (33) (37) (17) (54)Other – – – 1 – 1Income tax expense on continuing operations 124 – 124 105 (44) 61Before