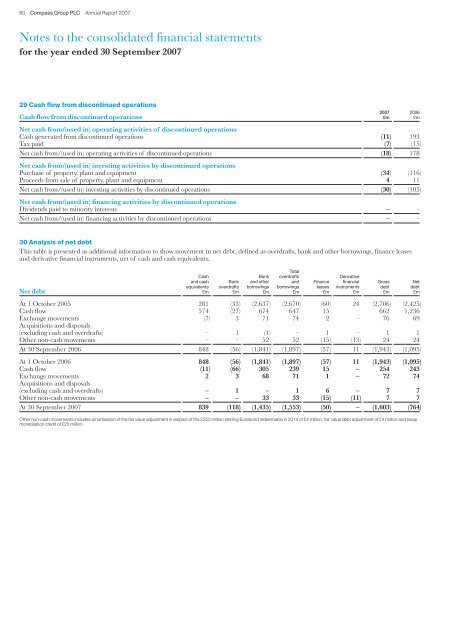

80 <strong>Compass</strong> <strong>Group</strong> PLC Annual Report 2007Notes to the consolidated financial statementsfor the year ended 30 September 200729 Cash flow from discontinued operations2007 2006Cash flow from discontinued operations £m £mNet cash from/(used in) operating activities of discontinued operationsCash generated from discontinued operations (11) 193Tax paid (7) (15)Net cash from/(used in) operating activities of discontinued operations (18) 178Net cash from/(used in) investing activities by discontinued operationsPurchase of property, plant and equipment (34) (116)Proceeds from sale of property, plant and equipment 4 11Net cash from/(used in) investing activities by discontinued operations (30) (105)Net cash from/(used in) financing activities by discontinued operationsDividends paid to minority interests – –Net cash from/(used in) financing activities by discontinued operations – –30 Analysis of net debtThis table is presented as additional information to show movement in net debt, defined as overdrafts, bank and other borrowings, finance leasesand derivative financial instruments, net of cash and cash equivalents.TotalCash Bank overdrafts Derivativeand cash Bank and other and Finance financial Gross NetNet debtequivalents overdrafts borrowings borrowings leases instruments debt debt£m £m £m £m £m £m £m £mAt 1 October 2005 281 (33) (2,637) (2,670) (60) 24 (2,706) (2,425)Cash flow 574 (27) 674 647 15 – 662 1,236Exchange movements (7) 3 71 74 2 – 76 69Acquisitions and disposals(excluding cash and overdrafts) – 1 (1) – 1 – 1 1Other non-cash movements – – 52 52 (15) (13) 24 24At 30 September 2006 848 (56) (1,841) (1,897) (57) 11 (1,943) (1,095)At 1 October 2006 848 (56) (1,841) (1,897) (57) 11 (1,943) (1,095)Cash flow (11) (66) 305 239 15 – 254 243Exchange movements 2 3 68 71 1 – 72 74Acquisitions and disposals(excluding cash and overdrafts) – 1 – 1 6 – 7 7Other non-cash movements – – 33 33 (15) (11) 7 7At 30 September 2007 839 (118) (1,435) (1,553) (50) – (1,603) (764)Other non-cash movements includes amortisation of the fair value adjustment in respect of the £250 million sterling Eurobond redeemable in 2014 of £4 million, fair value debt adjustment of £4 million and swapmonetisation credit of £25 million.

81 <strong>Compass</strong> <strong>Group</strong> PLC Annual Report 200731 Contingent liabilities2007 2006Contingent liabilities £m £mPerformance bonds, guarantees and indemnities (including those of associated undertakings) 227 203On 21 October 2005, the Company announced that it had instructed Freshfields Bruckhaus Deringer to conduct an investigation into therelationships between Eurest Support Services (‘ESS’) (a member of the <strong>Group</strong>), IHC Services Inc. (‘IHC’) and the United Nations (‘UN’). Ernst& Young assisted Freshfields Bruckhaus Deringer in this investigation. On 1 February 2006, it was announced that the investigation had concluded.The investigation established serious irregularities in connection with contracts awarded to ESS by the UN. The work undertaken by FreshfieldsBruckhaus Deringer and Ernst & Young gave no reason to believe that these issues extended beyond a few individuals within ESS to other partsof ESS or the wider <strong>Compass</strong> <strong>Group</strong> of companies.The <strong>Group</strong> settled all outstanding civil litigation against it, in relation to this matter, in October 2006 but litigation continues between competitorsof ESS, IHC and other parties involved in UN procurement.IHC’s relationship with the UN and ESS was part of a wider investigation into UN procurement activity being conducted by the United StatesAttorney’s Office for the Southern District of New York, and with which the <strong>Group</strong> cooperated fully. The current status of that investigation isuncertain and a matter for the US authorities. Those investigators could have had access to sources unavailable to the <strong>Group</strong>, FreshfieldsBruckhaus Deringer or Ernst & Young, and further information may yet emerge which is inconsistent with, or additional to, the findings of theFreshfields Bruckhaus Deringer investigation, which could have an adverse impact on the <strong>Group</strong>. The <strong>Group</strong> has however not been contacted by,or received further requests for information from, the United States Attorney’s Office for the Southern District of New York in connection withthese matters since January 2006. The <strong>Group</strong> has cooperated fully with the UN throughout.In February 2007, the <strong>Group</strong>’s Portuguese business, Eurest (Portugal) Sociedade Europeia Restaurantes LDA, was visited by the PortugueseCompetition Authority (‘PCA’) as part of an investigation into possible past breaches of competition law by the <strong>Group</strong> and other caterers in thesector. The PCA investigation relates to a part of the Portuguese catering business which services mainly public sector contracts. The <strong>Group</strong>is cooperating fully with the PCA’s ongoing investigation. Revenues of the Portuguese business for the year ended 30 September 2007 were£90 million (r134 million). It is likely that the investigation will take several months to complete and its outcome cannot be predicted at this point.It is not currently possible to quantify any potential liability which may arise in respect of these matters. The directors currently have no reasonto believe that any potential liability that may arise would be material to the financial position of the <strong>Group</strong>.The <strong>Group</strong>, through a number of its subsidiary undertakings, is, from time to time, party to various other legal proceedings or claims arising fromits normal business. Provisions are made as appropriate. None of these proceedings is regarded as material litigation.The <strong>Group</strong> has provided a guarantee to one of its joint venture partners over the level of profits which will accrue to them in future periods.The maximum amount payable under this guarantee is £35 million, which would be payable in respect of the period from 1 July 2007 to31 December 2010. Based on the latest management projections, no liability is expected to arise in relation to this guarantee and accordingly,no provision has been recorded at 30 September 2007 (2006: £nil).32 Capital commitments2007 2006Capital commitments £m £mContracted for but not provided for 23 3033 Operating lease and concessions commitmentsThe <strong>Group</strong> leases offices and other premises under non-cancellable operating leases. The leases have varying terms, purchase options, escalationclauses and renewal rights. The <strong>Group</strong> has some leases that include revenue-related rental payments that are contingent on future levels of revenue.Future minimum rentals payable under non-cancellable operating leases and concessions agreements are as follows:Operating leases2007 2006OtherOperating leasesLand and Other occupancy Land and Other occupancybuildings assets rentals buildings assets rentalsOperating lease and concessions commitments £m £m £m £m £m £mFalling due within 1 year 40 41 26 47 46 43Falling due between 2 and 5 years 111 54 61 111 51 104Falling due in more than 5 years 71 5 33 106 6 71Total 222 100 120 264 103 218Other