2568.11 kb - Compass Group

2568.11 kb - Compass Group

2568.11 kb - Compass Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

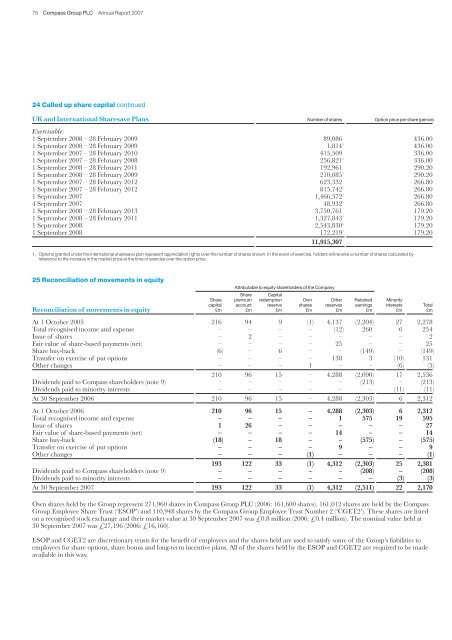

75 <strong>Compass</strong> <strong>Group</strong> PLC Annual Report 200724 Called up share capital continuedUK and International Sharesave Plans Number of shares Option price per share (pence)Exercisable:1 September 2008 – 28 February 2009 89,086 436.001 September 2008 – 28 February 2009 1,814 1 436.001 September 2007 – 28 February 2010 415,509 336.001 September 2007 – 28 February 2008 256,821 1 336.001 September 2008 – 28 February 2011 192,961 290.201 September 2008 – 28 February 2009 210,085 1 290.201 September 2007 – 28 February 2012 623,332 266.801 September 2007 – 28 February 2012 815,742 1 266.801 September 2007 1,466,372 1 266.804 September 2007 48,932 1 266.801 September 2008 – 28 February 2013 3,750,761 179.201 September 2008 – 28 February 2011 1,327,843 1 179.201 September 2008 2,543,830 1 179.201 September 2008 172,219 1 179.2011,915,3071. Options granted under the international sharesave plan represent appreciation rights over the number of shares shown. In the event of exercise, holders will receive a number of shares calculated byreference to the increase in the market price at the time of exercise over the option price.25 Reconciliation of movements in equityAttributable to equity shareholders of the CompanyShare CapitalShare premium redemption Own Other Retained Minoritycapital account reserve shares reserves earnings interests TotalReconciliation of movements in equity £m £m £m £m £m £m £m £mAt 1 October 2005 216 94 9 (1) 4,137 (2,204) 27 2,278Total recognised income and expense – – – – (12) 260 6 254Issue of shares – 2 – – – – – 2Fair value of share-based payments (net) – – – – 25 – – 25Share buy-back (6) – 6 – – (149) – (149)Transfer on exercise of put options – – – – 138 3 (10) 131Other changes – – – 1 – – (6) (5)210 96 15 – 4,288 (2,090) 17 2,536Dividends paid to <strong>Compass</strong> shareholders (note 9) – – – – – (213) – (213)Dividends paid to minority interests – – – – – – (11) (11)At 30 September 2006 210 96 15 – 4,288 (2,303) 6 2,312At 1 October 2006 210 96 15 – 4,288 (2,303) 6 2,312Total recognised income and expense – – – – 1 575 19 595Issue of shares 1 26 – – – – – 27Fair value of share-based payments (net) – – – – 14 – – 14Share buy-back (18) – 18 – – (575) – (575)Transfer on exercise of put options – – – – 9 – – 9Other changes – – – (1) – – – (1)193 122 33 (1) 4,312 (2,303) 25 2,381Dividends paid to <strong>Compass</strong> shareholders (note 9) – – – – – (208) – (208)Dividends paid to minority interests – – – – – – (3) (3)At 30 September 2007 193 122 33 (1) 4,312 (2,511) 22 2,170Own shares held by the <strong>Group</strong> represent 271,960 shares in <strong>Compass</strong> <strong>Group</strong> PLC (2006: 161,600 shares). 161,012 shares are held by the <strong>Compass</strong><strong>Group</strong> Employee Share Trust (‘ESOP’) and 110,948 shares by the <strong>Compass</strong> <strong>Group</strong> Employee Trust Number 2 (‘CGET2’). These shares are listedon a recognised stock exchange and their market value at 30 September 2007 was £0.8 million (2006: £0.4 million). The nominal value held at30 September 2007 was £27,196 (2006: £16,160).ESOP and CGET2 are discretionary trusts for the benefit of employees and the shares held are used to satisfy some of the <strong>Group</strong>’s liabilities toemployees for share options, share bonus and long-term incentive plans. All of the shares held by the ESOP and CGET2 are required to be madeavailable in this way.