2568.11 kb - Compass Group

2568.11 kb - Compass Group

2568.11 kb - Compass Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

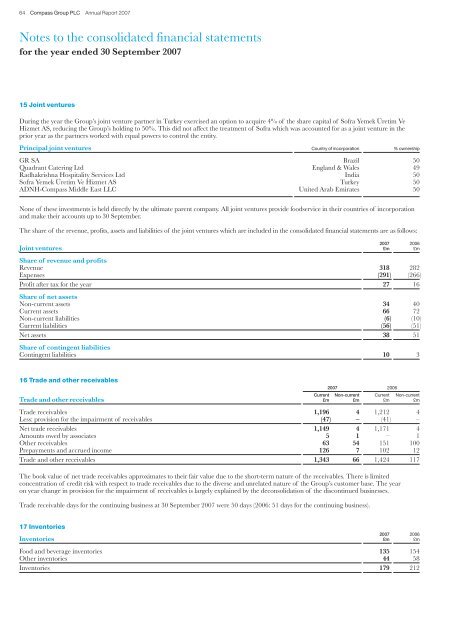

64 <strong>Compass</strong> <strong>Group</strong> PLC Annual Report 2007Notes to the consolidated financial statementsfor the year ended 30 September 200715 Joint venturesDuring the year the <strong>Group</strong>’s joint venture partner in Turkey exercised an option to acquire 4% of the share capital of Sofra Yemek Üretim VeHizmet AS, reducing the <strong>Group</strong>’s holding to 50%. This did not affect the treatment of Sofra which was accounted for as a joint venture in theprior year as the partners worked with equal powers to control the entity.Principal joint ventures Country of incorporation % ownershipGR SA Brazil 50Quadrant Catering Ltd England & Wales 49Radhakrishna Hospitality Services Ltd India 50Sofra Yemek Üretim Ve Hizmet AS Turkey 50ADNH-<strong>Compass</strong> Middle East LLC United Arab Emirates 50None of these investments is held directly by the ultimate parent company. All joint ventures provide foodservice in their countries of incorporationand make their accounts up to 30 September.The share of the revenue, profits, assets and liabilities of the joint ventures which are included in the consolidated financial statements are as follows:2007 2006Joint ventures £m £mShare of revenue and profitsRevenue 318 282Expenses (291) (266)Profit after tax for the year 27 16Share of net assetsNon-current assets 34 40Current assets 66 72Non-current liabilities (6) (10)Current liabilities (56) (51)Net assets 38 51Share of contingent liabilitiesContingent liabilities 10 316 Trade and other receivables2007 2006Current Non-current Current Non-currentTrade and other receivables £m £m £m £mTrade receivables 1,196 4 1,212 4Less: provision for the impairment of receivables (47) – (41) –Net trade receivables 1,149 4 1,171 4Amounts owed by associates 5 1 – 1Other receivables 63 54 151 100Prepayments and accrued income 126 7 102 12Trade and other receivables 1,343 66 1,424 117The book value of net trade receivables approximates to their fair value due to the short-term nature of the receivables. There is limitedconcentration of credit risk with respect to trade receivables due to the diverse and unrelated nature of the <strong>Group</strong>’s customer base. The yearon year change in provision for the impairment of receivables is largely explained by the deconsolidation of the discontinued businesses.Trade receivable days for the continuing business at 30 September 2007 were 50 days (2006: 51 days for the continuing business).17 Inventories2007 2006Inventories £m £mFood and beverage inventories 135 154Other inventories 44 58Inventories 179 212