- Page 2 and 3: CURSO: PSICOLOGIA - VARGINHA SEMEST

- Page 4 and 5: the Hawaii Clean Energy Initiative,

- Page 6 and 7: Decision and Order at 42.) In accor

- Page 8 and 9: emainder ofthe test year is set to

- Page 12 and 13: ATTACHMENT IAPAGE 1 OF 3SHEET NO. 9

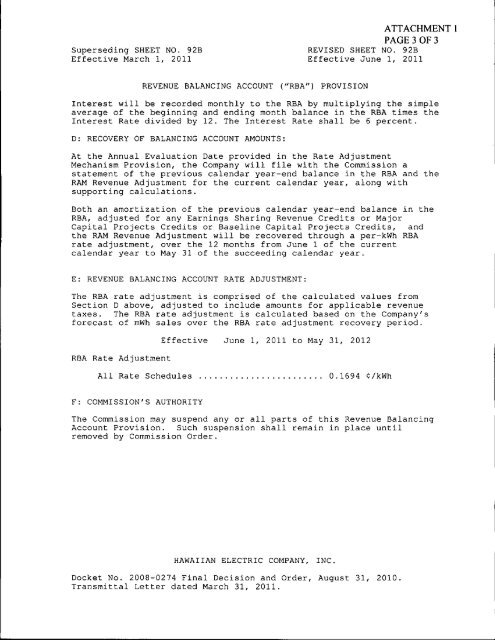

- Page 14 and 15: ATTACHMENT lAPAGE 3 OF 3SHEET NO. 9

- Page 16 and 17: in CT) oo r-. o CO•^ od r^ cd r^

- Page 18 and 19: ATTACHMENT 3PAGE 2 OF 4Hawaiian Ele

- Page 20 and 21: ATTACHMENT 3PAGE 4 OF 4(A) (B) (C)(

- Page 22 and 23: ATTACHMENT 3.2PAGE 1 OF 4Aspen Publ

- Page 24 and 25: ATTACHMENT 3.2T. ,1. , PAGE 3 OF 4A

- Page 26 and 27: ATTACHMENT 3.3PAGE 1 OF 1HAWAIIAN E

- Page 28 and 29: ATTACHMENT 3.5PAGE 1 OF 9BUDGET"HAW

- Page 30 and 31: ATTACHMENT 3.5PAGE 3 OF 9BUDGET"HAW

- Page 32 and 33: ATTACHMENT 3.5PAGE 5 OF 9BUDGET"HAW

- Page 34 and 35: ATTACHMENT 3.5PAGE 7 OF 9HAWAIIAN E

- Page 36 and 37: ATTACHMENT 3.5PAGE 9 OF 9HAWAIIAN E

- Page 38 and 39: ATTACHMENT 3.6PAGE 2 OF 2Hawaiian E

- Page 40 and 41: ATTACHMENTS.?PAGE 2 OF 54o o o 5 oS

- Page 42 and 43: ATTACHMENT 3.?PAGE 4 OF 54a8S388SS8

- Page 44 and 45: ATTACHMENTS.?PAGE 6 OF 54ssa '•"'

- Page 46 and 47: UggSSginSS8R8HH;!HSn3H§8gS3iiSH3is

- Page 48 and 49: ATTACHMENT 3.7PAGE 10 OF 54SS SS SI

- Page 50 and 51: ATTACHMENTS.?PAGE 12 OF 54!S8)3KSSS

- Page 52 and 53: ATTACHMENT3.7PAGE 14 OF 54888888888

- Page 54 and 55: E B B B E E S S S^i^mn*-MnlhnuHhmmm

- Page 56 and 57: S88|S8888S|SSSS|SSS|S||gggggggggggg

- Page 58 and 59: ATTACHMENT 3.7PAGE 20 OF 54SS sssss

- Page 60 and 61:

ATTACHMENT 3.7PAGE 22 OF 54-55 SS B

- Page 62 and 63:

ATTACHMENT 3.7PAGE 24 OF 54§§g88g

- Page 64 and 65:

ATTACHMENT 3.7PAGE 26 OF 54g§8§g

- Page 66 and 67:

1iss.i§|ggy.M.8sg.ggssiissj.i.§.i

- Page 68 and 69:

i§;.!.5.5.5.s.5.s.s.f.??5si.ifiin.

- Page 70 and 71:

ATTACHMENT 3.7PAGE 32 OF 54n§§§^

- Page 72 and 73:

ATTACHMENT 3.7PAGE 34 OF 543HSSSS39

- Page 74 and 75:

ATTACHMENT 3.7PAGE 36 OF 54iS S S S

- Page 76 and 77:

J!JS?^U?^S.IM^§l?5.M.n.§.H5.5.5.H

- Page 78 and 79:

&S5SSSSiS st t t I I > III Issssss

- Page 80 and 81:

ATTACHMENT 3.7PAGE 42 OF 54||ssss5n

- Page 82 and 83:

?3||||^a.|5.?3.S.||||8.||.||||S,|||

- Page 84 and 85:

ATTACHMENT 3.7PAGE 46 OF 54HEn^^^^S

- Page 86 and 87:

ATTACHMENTS.?PAGE 48 OF 54SS* •0

- Page 88 and 89:

SH!!»SggiS|S!SS^S3§gS3^3^HIH3igB3

- Page 90 and 91:

ATTACHMENT 3.7PAGE 52 OF 54tttt tt

- Page 92 and 93:

Pillar1 KPPMNT1 PPENGRLPPPLANl_PPSP

- Page 94 and 95:

Hawaiian Electric Company, inc.2011

- Page 96 and 97:

ATTACHMENT 4.1PAGE 1 OF 11Hawaiian

- Page 98 and 99:

ATTACHMENT 4.1PAGE 3 OF 11Hawaiian

- Page 100 and 101:

ATTACHMENT 4.1PAGE 5 OF 1130-Mar-11

- Page 102 and 103:

ATTACHMENT 4.1PAGE 7 OF 11gUf-[rs

- Page 104 and 105:

ATTACHMENT 4.1PAGE 9 OF 11^p p o o

- Page 106 and 107:

ATTACHMENT 4.1PAGE 11 OF 11HECO-CIA

- Page 108 and 109:

Hawaiian Electric Company, Inc.Reve

- Page 110 and 111:

HAWAIIAN ELECTRIC CO., INC.ADIT on

- Page 112 and 113:

"si' SS "S-. t "^"1" --ATTACHMENT4.

- Page 114 and 115:

ATTACHMENT 4.3PAGE 6 OF 12Non-Confi

- Page 116 and 117:

Non-Confidential 2/28/2011ATTACHMEN

- Page 118 and 119:

Non-Confidential 2/28/2011ATTACHMEN

- Page 120 and 121:

Non-Confidential 2/28/2011ATTACHMEN

- Page 122 and 123:

ATTACHMENT 4.4PAGE 2 OF 10CO tc o<

- Page 124 and 125:

HAWAIIAN ELECTRIC CO., INC.REPAIRS

- Page 126 and 127:

ATTACHMENT 4.4PAGE 6 OF 10Hawaiian

- Page 128 and 129:

ATTACHMENT 4.4PAGE 8 OF 10Hawaiian

- Page 130 and 131:

ATTACHMENT 4.4PAGE 10 OF 10Hawaiian

- Page 132 and 133:

ATTACHMENT 4.5PAGE 2 OF 36The Honor

- Page 134 and 135:

ATTACHMENT4.5PAGE 4 OF 36EXHIBIT lA

- Page 136 and 137:

ATTACHMENT4.5PAGE 6 OF 36Hawaiian E

- Page 138 and 139:

ATTACHMENT4.5PAGE 8 OF 36EXHIBIT lA

- Page 140 and 141:

ATTACHMENT 4.5PAGE 10 OF 36The Hono

- Page 142 and 143:

ATTACHMENT 4.5PAGE 12 OF 36Hawaiian

- Page 144 and 145:

ATTACHMENT 4.5PAGE 14 OF 36iifj " i

- Page 146 and 147:

ATTACHMENT 4.5PAGE 16 OF 36INTEROFF

- Page 148 and 149:

ATTACHMENT 4.5PAGE 18 OF 36HAWAIIAN

- Page 150 and 151:

2010 General Order No. 7 (GO 7) Rep

- Page 152 and 153:

ATTACHMENT 4.5PAGE 22 OF 36Hawaiian

- Page 154 and 155:

ATTACHMENT 4.5PAGE 24 OF 36Hawaiian

- Page 156 and 157:

ATTACHMENT 4.5PAGE 26 OF 36Hawaiian

- Page 158 and 159:

ATTACHMENT 4.5PAGE 28 OF 36Hawaiian

- Page 160 and 161:

cCOST ESTIMATEATTACHMENT 4.5PAGE 30

- Page 162 and 163:

ATTACHMENT 4.5PAGE 32 OF 36HEGO-R-9

- Page 164 and 165:

ATTACHMENT 4.5PAGE 34 OF 36Att. ^ I

- Page 166 and 167:

ATTACHMENT 4.5PAGE 36 OF 36BEFORE T

- Page 168 and 169:

ATTACHMENT 5PAGE 2 OF 4date ofthe R

- Page 170 and 171:

ATTACHMENT 5PAGE 4 OF 4HAWAIIAN ELE

- Page 172:

BEFORE THE PUBLIC UTILITIES COMMISS