HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

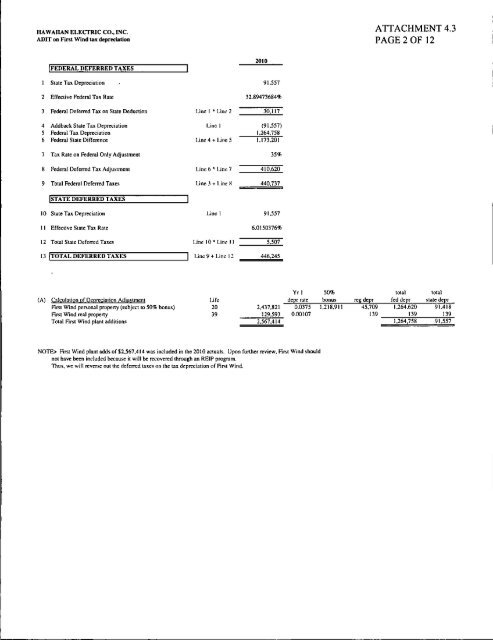

HAWAIIAN ELECTRIC CO., INC.ADIT on <strong>First</strong> Wind tax depreciationATTACHMENT 4.3PAGE 2 OF 12FEDERAL DEFERRED TAXES1 Slate Tax Depreciation2 Effective Federal Tax Rate3 Federal Deferred Tax on State Deduction4 Addback Stale Tax Dcpreciaiion5 Federal Tax Depreciation6 Federal Stale Difference7 Tax Rale on Federal Only Adjustmenl8 Federal Deferred Tax Adju.stmeni9 Total Federal Deferred Taxes[Jnc 1 ' [Jne 2Une ILine 4 +I.Jne5Lincfj' line?Line 3 + Line H201091,55732.89473684%30,117(91.557)1.264,7581.173.20135%410,620440.737{STATE DEFERRED TAXES10 Slate Tax Depreciation11 Effective Slate Tax Rate12 Total State Deferred Taxes13 TOTAL DEFERRED TAXESLine 1Line 10 "Line 11] Lin.; 9 +Line 1291.5576,0150376%5.507446.245(A)Calculation of Depreciation Adjuslmenl<strong>First</strong> Wind personal property (subject to 50% bonu.s)<strong>First</strong> Wind real propertyTotal <strong>First</strong> Wind plant additionsLife20392,437.821129.5932.567.414Yrldepr rate0,03750,0010750%bonus1.218,911res depr45,709139 _totalfed depr1,264.6201391,264,758totalstale depr91.41813991.557NOTE> <strong>First</strong> Wind plant adds of $2,567,414 was included in the 2010 actuals. Upon further review. <strong>First</strong> Wind shouldnol have been included becau.se il will be recovered through an REIP program.Thus, we will reverse oul Ihe deferred taxes on the lax depreciadon of Rrst Wind,