HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

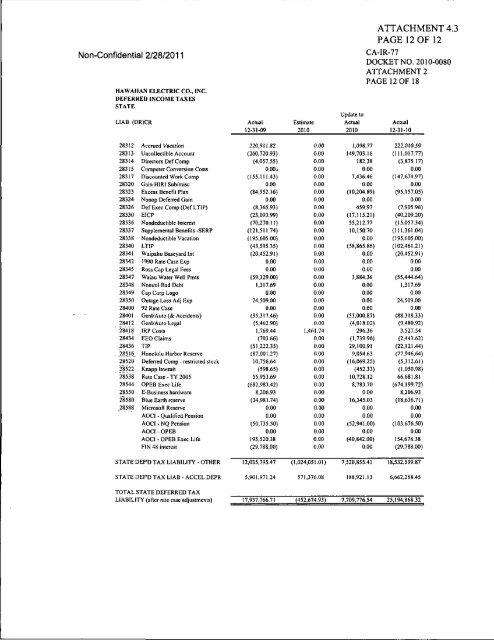

Non-Confidential 2/28/2011ATTACHMENT 4.3PAGE 12 OF 12CA-IR-77DOCKETNO. 2010-0080ATTACHMENT 2PAGE 12 OF 18HAWAIIAN ELECTRIC CO., INC.DEFERRED INCOME TAXESSTATELIAB (DR)CRActual12-31-09Estimate2010Update toActual2010Actual12-31-1028312283132831428315283172832028323283242832628330283362833728338283402834128342283452834728348283492835028400284012841228418'2843428436285,!.6_28520285222853828544285502858028588Accrued VacationUncollectible AccountDirectors Def CompComputer Conversion CostsDiscounted Work CompGain HIRI Sub/miscExcess Benefit PlanNonop Deferred GainDef Exec Comp (Def LTIP)EICPNondeductible InterestSupplemental Benefits -SERPNondeductible VacationLTIPWaipahu Baseyard Int1990 Rate Case ExpRoss Cap Legal i-'eesWaiau Water Well PmtsNonuiil Bad DebtCap Corp LogoOutage Loss Adj Exp92 Rate CaseGen!/Auto (& Accidents)Genl/Aulo Legal^ IRP CostsEEO ClaimsTIPHonolulu Harbor ReserveDeferred Comp - restricted slockKnapp lawsuitRate Case-TY 2005OPEB Exec LifeE-Business hardwareBlue Earth reserveMicrosoft ReserveAOCI-Qualified PensionAOCI - NQ PensionAOCI - OPEBAOCI-OPEB Exec LifeFIN 48 interest220,911.82(260,720.93)(4,057.55)0.00»(155,111.43)0.00(84,952.16)0.00(8,365.93)(23.093.99)(70.270,1!)(121.511.74)(195.605.00)(43.595.35)(20.452.91)0.000,00(59.329.00)1.317.690.0024,509.000.00(35.317.46)(5.462.90)1.769.44(703.66)(51,222.35)(87,001.27)10,756.64(598.65)55,953.69(682,983.42)8,206.93(34,981.74)0.000.00(50,735.50)0.00195,520.38(29,788.00)0.000.000.000.000,000.000.000.000,000.000.000.000.000.000.000.000.000,000.000.000.000,000.000.001,461.740.000.000.000.000.000.000.000.000.000.000.000.000.000.000.001,098.77149,703.16182.380.007,436.460.00(10,204.89)0.00459,97(17,115.21)55,212.7710,150.700.00(58,865.86)0.000.000.003,884.360.000.000.000.00(53,000.87)(4,018.02)296.36(1,739.96)29,100.919,054.63(16,069.25)(452.33)10,728.128,783.700.0016,345.030,000.00(52,941.00)0.00(40,842.00)0.00222,010.59(111.017.77)(3,875.17)0.00(147,674.97)0.00(95,157.05)0.00(7,905.96)(40,209,20)(15,057.34)(111,361.04)(195,605.00)(102,461.21)(20,452.91)0.000.00(55,444.64)1,317.690.0024,509.000.00(88,318.33)(9,480.92)3.527.54(2.443.62)(22.121.44)(77.946.64)(5.312.61)(1.050.98)66,681.81(674,199.72)8.206.93(18.636.71)0.000.00(103,676.50)0.00154,678.38(29.788.00)STATE DEPDTAX LIABILITY -OTHER 12,035,795.47 (1,024,051.01) 7,520,855.41 18.532,599.87STATE DEPD TAX LIAB-ACCEL DEPR 5.901,971.24 571,376.08 188.921,13 6,662,268.45TOTAL STATE DEFERRED TAXLIABILITY (after rate case adjustments) 17.937.766.71 (452.674.93) 7.709.776.54 25.194,868.32