HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

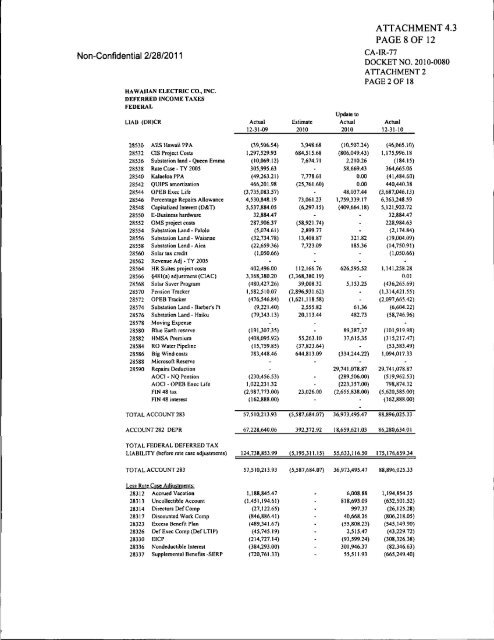

Non-Confidential 2/28/2011ATTACHMENT 4.3PAGE 8 OF 12CA-IR-77DOCKETNO. 2010-0080ATTACHMENT 2PAGE 2 OF 18HAWAIIAN ELECTRIC CO^ INC.DEFERRED INCOME TAXESFEDERALLIAB (DR)CRActual12-31-09Estimate2010Update toActual2010Actual12-31-1028530 AES Hawaii PPA28532 CIS Project Costs28536 Substation land • Queen Emma28538 Rate Case • TY 200528540 Kalaeloa PPA28542 QUIPS amortization28544 OPEB Exec Life28546 Percentage Repairs Allowance28548 Copiializcd Interest (D&T)28550 E-Business hardware28552 OMS project costs28554 Subslalion Land • Palolo28556 Substalion Land - Waianae28558 Substation Land - Aiea28560 Solar tax credit28562 <strong>Revenue</strong> Adj - TY 200528564 HR Suites projecl costs28566 §481(a) adjustmenl (CIAC)28568 Solar Saver Program28570 Pension Tracker28572 OPEB Tracker28574 Substalion Land - Baiter's Pi28576 Substation Land - Haiku28578 Moving Expense28580 Blue Earth reserve28582 HMSA Premium28584 RO Water Pipeline28586 Big Wind costs28588 Microsoft Reserve28590 Repairs DeductionAOCI - NQ PensionAOCI-OPEB Exec LifeFIN 48 laxFIN 48 interest(39,506.54)1,297,529.93(10.069.12)305,995.63(49.263.21)466,201.98(3,735.083.57)4.530,848.195,537,884.0532,884.47287.906.37(5,074.61)(32,734.78)(22,659.36)(1,050.66)402,496.003,368,380.20(480,427.26)1,582,510.07(476,546,84)(9,221.40)(79,343.13)(191.307,35)(408,095,92)(15.759.85)783,448.46-(230,456.53)1,022,231.32(2,987,773.00)(162,888.00)3.948.68684,515.687,674.71-7,778.61(25.761.60)•73,061.23(6,297.15)-(58.921.74)2.899,7713.408.877.723.09-112.166.76(3,368.380.19)39.008,32(2,896,931.62)(1,621,118.58)2,555.8220,113.44.55,263.10(37,823.64)644.813.09--23,026.00-(10,507.24)(806,049.43)2,210.2658,669.430.000.0048,037.441.759,339.17(409,664.18)---321.82185.36-626.595.52-5.153,25•-61.36482.7389,387.3737,615.35-(334.244.22)29,741.078.87(289,506.00)(223,357.00)(2,655,838.00)•(46,065.10)1,175,996,18(184.15)364,665.06(41,484.60)440,440.38(3,687.046.13)6,363.248.595.121,922.7232,884.47228,984.63(2,174.84)(19.004.09)(14,750.91)(1,050.66)1,141,258.280.01(436,265.69)(1,314.421.55)(2,097.665.42)(6.604.22)(58.746.96)(101,919,98)(315.217.47)(53,583.49)1,094,017.3329,741,078,87(519.962.53)798,874.32(5.620.585.00)(162.888.00)TOTAL ACCOUNT 28357,510,213.93(5.587,684.07)36,973,495.4788,896.025.33ACCOUNT 282 DEPR67,228,640.06392,372.9218,659,621.0386,280.634.01TOTAL FEDERAL DEFERRED TAXLIABILITY (before rate case adjustments)124,738.853.99(5,195,311.15)55.633,116.50175,176,659.34TOTAL ACCOUNT 28357,510.213.93 (5.587,684.07) 36,973.495.47 88,896,025.33Less Rale Case Adjustments:283122831328314283172832328326283302833628337Accrued VacationUncollectible AccountDirectors Def CompDiscounted Work CompExcess Benefit PlanDef Exec Comp (Def LTIP)EICPNondeductible InterestSupplemental Benefits -SERP1,188,845.47(1,451,194.61)(27,122.65)(846,886.41)(489,341.67)(45,745.19)(214,727.14)(384,293.00)(720,761.33)6,008,88818,693.09997.3740,668,36(55,808,23)2,515.47(93,599.24)301,946.3755,511.931,194.854.35(632.501.52)(26.125.28)(806,218.05)(545,149.90)(43.229.72)(308.326.38)(82.346.63)(665.249.40)