HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

HECO's First Annual Revenue Decoupling Mechanism Filing, March ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

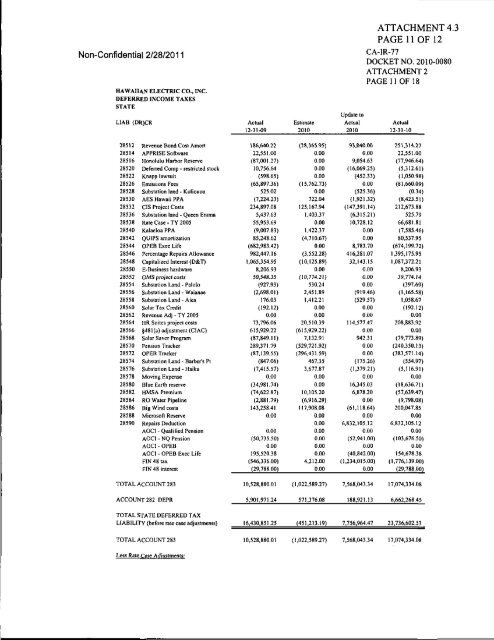

Non-Confidential 2/28/2011ATTACHMENT 4.3PAGE 11 OF 12CA-IR-77DOCKETNO. 2010-0080ATTACHMENT 2PAGE 11 OF 18HAWAIIAN ELECTRIC CO., INC.DEFERRED INCOME TAXESSTATELIAB (DR)CRActual12-31-09Estimate2010Update toActual2010Actual12-31-1028512285142851628520285222852628528285302853228536285382854028542285442854628548285502855228554285562855828560285622856428566285682857028572285742857628578285802858228584285862858828590<strong>Revenue</strong> Bond Cost AmoriAPPRISE SoftwareHonolulu Harbor ReserveDeferred Comp - restricted slockKnapp lawsuitEmissions FeesSubstation land - KuliououAES Hawaii PPACIS Project CostsSubstalion land - Queen EmmaRate Case - TY 2005Kalaeloa PPAQUIPS amortizationOPEB Exec LifePercentage Repairs AllowanceCapitalized Interest (D&T)E-Business hardwareOMS projecl cosisSubstalion Land - PaloloSubstalion Land - WaianaeSubstation Land - AieaSolar Tax Credit<strong>Revenue</strong> Adj • TY 2005HR Suites projecl costsg481(a) adjustment (CIAC)Solar Saver ProgramPension TrackerOPEB TrackerSubstalion Land - Barber's PtSubstation Land - HaikuMoving ExpenseBlue Earth reserveHMSA PremiumRO Water PipelineBig Wind costsMicrosoft ReserveRepairs DeductionAOCI - Qualified PensionAOCI - NQ PensionAOCI - OPEBAOCI - OPEB Exec LifeFIN 48 taxFIN 48 interest186,640.2222.551.00(87,001.27)10.756.64(598.65)(65.897.36)525.02(7.224.23)234.897.085,437.6355,953.69(9,007.83)85,248.62(682,983.42)982,447.161,065,354.958.206.9350,548.35(927.93)(2,698,01)176.03(192.12)0.0073.796,06615,929.22(87,849,11)289,371.79(87,139,55)(847.06)(7.415.57)0.00(34,981.74)(74,622.87)(2,881.79)143,258.410.000.00(50,735.50)0.00195,520.38(546.336.00)(29,788.00)(28,365.95)0.000.000.000.00(15,762.73)0.00722.04125,167.941,403.370.001.422.37(4,710.67)0.00(3,552.28)(10,125,89)0.00(10,774.2))530.242.451.891.412.210.000.0020,510.39(615.929.22)7.132.91(529,721.92)(296,431.59)467.353,677.870.000.0010,105.20(6,916.29)117.908.080.000.000.000,000.000.004,212.000.0093.040.000.009.054.63(16,069.25)(452.33)0.00(525.36)(1.921.32)(147,391.14)(6,315.21)10,728.120.000.008,783.70416,281.0732,143.150.000.000.00(919,46)(529,57)0.000.00114,577,470.00942,310.000.00(175.26)(1.379.21)0,0016.345,036,878.200.00(61,118.64)0.006,832.105.120.00(52,941.00)0.00(40,842.00)(1.234,015.00)0.00251.314.2722,551.00(77,946,64)(5.312.61)(1,050.98)(81,660.09)(0.34)(8,423.51)212,673.88525.7966,681.81(7,585.46)80,537.95(674,199.72)1,395,175.951,087,372.218,206,9339,774.14(397.69)(1.165.58)1.058.67(192.12)0.00208,883.920.00(79,773.89)(240,350.13)(383.571.14)(554.97)(5,116.91)0.00(18,636.71)(57.639.47)(9,798.08)200.047.850.006,832,105.120.00(103,676,50)0.00154,678,38(1,776,139.00)(29.788.00)TOTAL ACCOUNT 283 10,528,880.01 (1,022.589.27)7,568.043.3417.074,334.08ACCOUNT 282 DEPR 5,901,971.24 571,376.08188.921.136,662,268.45TOTAL STATE DEFERRED TAXLIABILITY (before rate case adjustments) 16,430,851.25 (451,213.19)7,756,964.47 23.736,602.53TOTAL ACCOUNT 283 10,528,880.01 (1,022,589.27)7,568,043.34 17,074,334.08Less Rale Case Adfustments;