Private Loans and Choice in Financing Higher Education - College ...

Private Loans and Choice in Financing Higher Education - College ...

Private Loans and Choice in Financing Higher Education - College ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

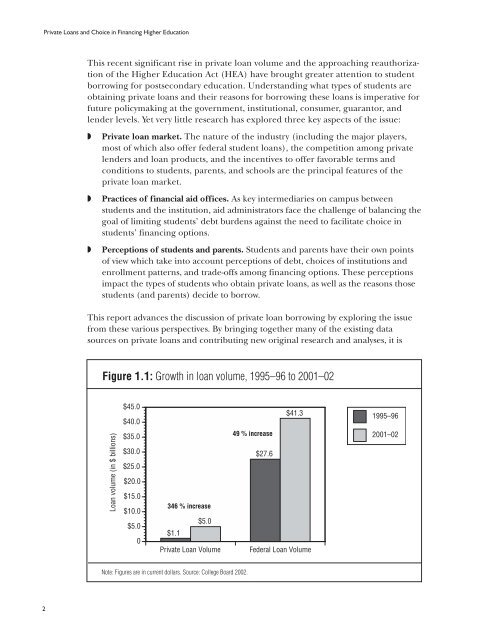

<strong>Private</strong> <strong>Loans</strong> <strong>and</strong> <strong>Choice</strong> <strong>in</strong> F<strong>in</strong>anc<strong>in</strong>g <strong>Higher</strong> <strong>Education</strong>This recent significant rise <strong>in</strong> private loan volume <strong>and</strong> the approach<strong>in</strong>g reauthorizationof the <strong>Higher</strong> <strong>Education</strong> Act (HEA) have brought greater attention to studentborrow<strong>in</strong>g for postsecondary education. Underst<strong>and</strong><strong>in</strong>g what types of students areobta<strong>in</strong><strong>in</strong>g private loans <strong>and</strong> their reasons for borrow<strong>in</strong>g these loans is imperative forfuture policymak<strong>in</strong>g at the government, <strong>in</strong>stitutional, consumer, guarantor, <strong>and</strong>lender levels. Yet very little research has explored three key aspects of the issue:◗◗◗<strong>Private</strong> loan market. The nature of the <strong>in</strong>dustry (<strong>in</strong>clud<strong>in</strong>g the major players,most of which also offer federal student loans), the competition among privatelenders <strong>and</strong> loan products, <strong>and</strong> the <strong>in</strong>centives to offer favorable terms <strong>and</strong>conditions to students, parents, <strong>and</strong> schools are the pr<strong>in</strong>cipal features of theprivate loan market.Practices of f<strong>in</strong>ancial aid offices. As key <strong>in</strong>termediaries on campus betweenstudents <strong>and</strong> the <strong>in</strong>stitution, aid adm<strong>in</strong>istrators face the challenge of balanc<strong>in</strong>g thegoal of limit<strong>in</strong>g students’ debt burdens aga<strong>in</strong>st the need to facilitate choice <strong>in</strong>students’ f<strong>in</strong>anc<strong>in</strong>g options.Perceptions of students <strong>and</strong> parents. Students <strong>and</strong> parents have their own po<strong>in</strong>tsof view which take <strong>in</strong>to account perceptions of debt, choices of <strong>in</strong>stitutions <strong>and</strong>enrollment patterns, <strong>and</strong> trade-offs among f<strong>in</strong>anc<strong>in</strong>g options. These perceptionsimpact the types of students who obta<strong>in</strong> private loans, as well as the reasons thosestudents (<strong>and</strong> parents) decide to borrow.This report advances the discussion of private loan borrow<strong>in</strong>g by explor<strong>in</strong>g the issuefrom these various perspectives. By br<strong>in</strong>g<strong>in</strong>g together many of the exist<strong>in</strong>g datasources on private loans <strong>and</strong> contribut<strong>in</strong>g new orig<strong>in</strong>al research <strong>and</strong> analyses, it isFigure 1.1: Growth <strong>in</strong> loan volume, 1995–96 to 2001–02$45.0$40.0$41.31995–96Loan volume (<strong>in</strong> $ billions)$35.0$30.0$25.0$20.0$15.0$10.0$5.00346 % <strong>in</strong>crease$5.0$1.1<strong>Private</strong> Loan Volume49 % <strong>in</strong>crease$27.6Federal Loan Volume2001–02Note: Figures are <strong>in</strong> current dollars. Source: <strong>College</strong> Board 2002.2